Gold has enjoyed steady gains over the last 5 days, rescuing XAU from yearlong lows. The XAU/USD price was briefly buoyed this week following poor non-farm payroll numbers which were released on Friday showing, the forecast missing its target by some ground. Despite this, there weren’t huge tremors seen in markets. The lack of diversion highlighting the confidence and security that the US economy currently offers, despite the very real possibility of two superpowers beginning a trade and currency war.

US non-farms propel gold prices

Gold was lifted following the release of this month’s non- farm payroll numbers. Markets had anticipated 191,000 jobs to have been added to the US economy. Regrettably, the number fell short of the target, showing just 157,000 new positions were created in July.

Although the number may have surprised investors who had recently seen ADP non-farm payroll numbers reach 219,000 just a few days before, no shocks were seen in the markets. Other elements of the US job markets showed the economies consistency. The US unemployment claims shading target reaching 218,000 v the predicted 220,000. Average earnings data also remained on target showing wage increases of 0.3% in July as forecast. Annually this equates to a 2.7% rise in US average earnings.

Elsewhere in the US jobs reports were July’s unemployment rate which fell below the 4.0% marker, returning to 3.9% unemployment.

Although elements of the jobs report could be interpreted negatively, overall it bodes well for the US economy. Job creation would appear to be supporting the economy and vice versa the economy will aid job creation. There will naturally be concerns about the protectionism route President Trump has elected to take, however, the stimulus that will be provided by his US tax cuts should far outweigh the tax implications of higher tariffs.

China fires back as trade war intensifies

Whilst China has been far from the protagonist during the war of words between the US and China it has finally fired back. In the last few days, The Chinese state council announced that it will apply new tariffs to more than 5,200 US goods if the White House actions its latest tariff threats.

The tariffs range from 5%-25% and will be applied to $60 billion’s worth of US goods and products. The US has blamed unfair trade deals as one of the primary causes of the US trade deficit, which amounts to a $46.3billion as of June.

Last year China equated to 16% of America’s traded goods last year. Exporting about $500 billion to the US and importing $130 billions of US products and goods.

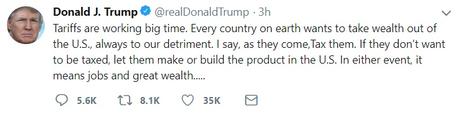

The heightened tensions according to President Trump remarkably have been interpreted positively. Trump insinuated recently that his strategy of imposing tariffs on China was having the desired effect. The president claimed that tariffs were “working far better than anyone ever anticipated”.

Trump acknowledged that the recent weakening in the Chinese stock market could bode well for renegotiating with Beijing.

Dollar performance and economic data

Whilst the dollar index has remained steady despite the slight imperfections in the July’s jobs data the Dollar has remained steadfast closing trading on Friday at 95.16.

The key trading EUR/USD has also followed trend this week with the USD dollar continuing to strengthen despite the economic data hiccup seen this week. The pair closing Friday’s session at 1.1568.

Volatility was seen in the XAU/USD pricing with Gold finding good support from the weak data numbers. Incredibly gold to USD spot prices were at an all-time low just before the Non-farms announcement but spiked from $1,204.86 to $1219.43. The sharp recovery some believe is a sign that gold has hit bottom. Experts now believe that if the precious metal spot price is able to break $1220 that markets may see a run on spot prices, with estimates believe resistance to be between the $1225-$1229 marker.

Gold prices have suffered due to the strength of the US Dollar. Prices have weakened due to positive US economic data, the prospect of further US interest rate rises and an overall risk on attitude towards markets. This weeks XAU/USD spike should only be treated as a blip in the general trend unless Gold spot prices find support at the aforementioned levels.