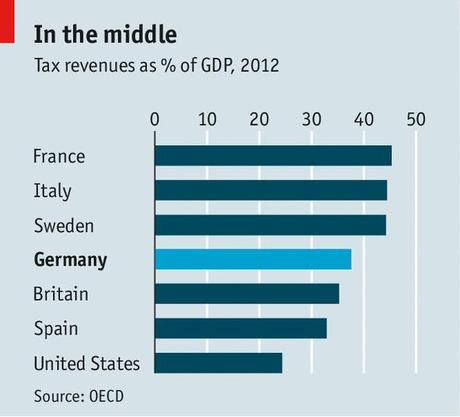

THANKS mainly to low unemployment, Germany keeps exceeding tax forecasts, with receipts that other European countries must envy. Last year state revenues totalled €620 billion ($ 860 billion); by 2017 they will pass €700 billion. This bounty is letting Germany balance its federal budget in 2015 for the first time in 46 years. But wouldn’t it make sense, if not to cut taxes, at least to end underhand tax rises?Bracket creep, or what the Germans call “cold progression”, results when pay rises only compensate for inflation but still push their recipients into a higher tax bracket. The effect is that taxpayers can buy less with their net income. Given steeply progressive tax rates, even middle-income Germans face such opaque and automatic tax rises every year.In her previous term, Chancellor Angela Merkel tried to fix bracket creep but failed in the upper-house Bundesrat, where the centre-left Social Democrats (SPD) had a majority. But now Mrs Merkel is in a “grand coalition” with the same Social Democrats. Sigmar Gabriel, the SPD’s boss as well as minister of energy and the economy, said this week that he could imagine indexing tax thresholds even…