Ideology determines which economic indicators we’re told to pay attention to.

So the great recession, depression or slump is apparently over, GDP having returned to the level from which it crashed in 2008. That’s enough to satisfy most commentators, even if there are a few curmudgeons like me who point out that GDP per head remains well down on 2008. On average, we’re still more than 5% worse off and 5% less productive than before the crash – there are just more of us than there were six years ago.

Most economists, of course, have long been satisfied. It only takes a single quarter of minuscule growth (0.1% will do, although two quarters of negative growth are required before economists will admit a recession has started) for them to declare a recession over and move on to proselytising about the sunlit uplands which are always just around the corner. It doesn’t matter how many people lost their jobs or how many are still on the dole. It doesn’t matter how much people’s incomes and standards of living have fallen. It doesn’t matter how many firms have gone bust or how much production has been lost. One little tiny uptick in this GDP thingy and everything’s tickety-boo.

This is like a doctor declaring a seriously ill patient completely recovered just because they wake up one morning not feeling any worse.

At first, this just looks like another startling disconnect between the economics profession and the real world the rest of us live and work in. But this is so blatant, it feels more like deliberate manipulation.

Mainstream economists can’t deny that recessions sometimes happen, but want to make them seem as short and as rare as possible. That way they can preserve the illusion that recessions are just blips. The fact that the real-world effects of a recession – basically hardship in various forms – persists long after economists have declared the recession over (and in some cases might never go away) doesn’t matter to them. The recession is over because they say it is and anyone who says different, as usual, is tarred with the “economically illiterate” brush.

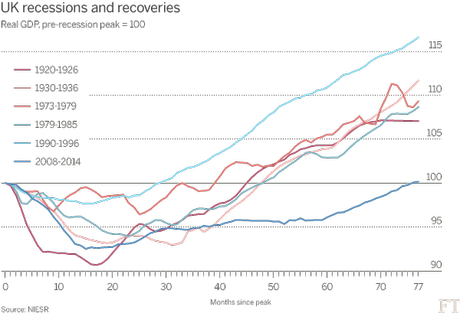

As the graph below shows, since the free-marketeers regained control of policy in the UK in 1979, we’ve actually spent quite a long time in recession – at least 13 out of 35 years. That’s quite a big blip.

Economic concepts and the indicators we’re told are important are ideologically determined. Saying that the recession ended in the fourth quarter of 2009 (or even that it’s all over now, when most people are still feeling its effects) isn’t a statement of scientific fact, it’s a piece of propaganda.

Most mainstream economists are free-market ideologues and will define concepts and choose indicators that make free-market capitalism look better than it really is, however meaningless and remote from reality they are. They are our equivalent to the Soviet officials of yesteryear, solemnly intoning over the factory tannoy endless series of meaningless statistics about the production of tractors or brown shoes.

This is why there is no economic definition of a depression. Mainstream economics just cannot admit that such a thing is possible. The free-market economy is supposed to be self-correcting, quickly adjusting to the blip of recession and returning to growth without any intervention from governments. To admit that Keynes was right all along and the economy can get stuck in a rut, would bring the whole façade crashing down. So the long periods of slow growth or no growth we all know are possible (and have just experienced) are just defined out of existence.

Of course, politicians often connive in this manipulation, because it tends to make their stewardship of economy look better than it really is. This is probably why we use an inflation measure that with every revision (inevitably downward) gets further and further away from measuring anything like the “cost of living” (the CPI is called the government’s “preferred” measure, so what do you expect it to do?). And why we have employment statistics that count being stuck at home on a zero-hours contract waiting for the phone to ring as being just as much “employment” as a real (full-time, permanent) job.

But GDP has become the Daddy of all economic indicators, a sort of catch-all barometer for economic health and a yardstick for comparing economic performance between governments and countries. But it’s a lousy measure of our economic welfare, even in purely material terms.

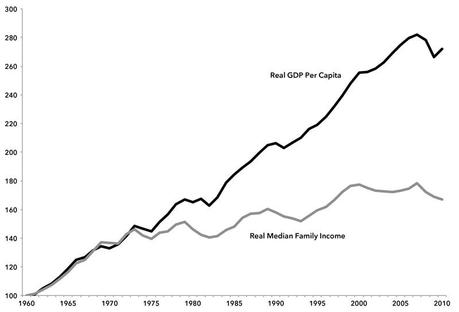

GDP – or Gross Domestic Product – is an accounting estimate (nothing more) of the market value of all goods and services produced in the country. The fact that GDP is about to be revised significantly to include drug dealing and prostitution (hardly new industries) shows just how arbitrary and abstract a measure it is. It takes no account of population growth, sustainability, debt or how income is distributed among the population. So GDP can be rising quite fast while most people’s standards of living are falling – which is more or less what’s happening now. If we want a simple measure of material welfare as experienced by most people, we’d be better off focusing on median household incomes or even better, median household disposable income (i.e after taxes). That would tell an entirely different story, as the graph below for the US for the last fifty years clearly shows.

GDP per head and median family incomes in the US 1960-2010 (1960=100)

But it would also mean economists having to focus on policies and ideas that address the welfare and lives of ordinary people instead of providing ideological cover for a plutocratic elite whose experience of economic life is completely detached from that of their fellow citizens. Mainstream economists seem to have little or no interest in doing that.