Pandemic forced us to remain inside ! … .. Online transactions grew in a big way – now, vegetables, groceries and every such purchases – orders are placed online and deliveries made at door step ! .. .. this is no post on how e-commerce has grown ! – how many online transactions you make or the value of such transactions !

I am reasonably tech-savvy and indulge in Online transactions - following an advertisement in Facebook – I placed online order for shirts @ shirtzblack.myshopify.com – and in a couple of days realized that this is a fake site and lost money worth Rs.800/- (I have purchased many items on Amazon / Flipkart/ Snapdeal !

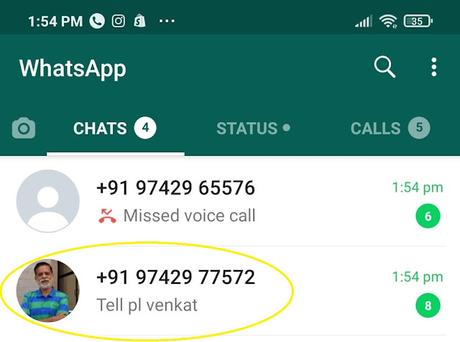

Yesterday a good friend of mine received a message on Whatsapp (though the no. was new to him 9742977572 – it had my photo as profile pic. The fraudster sent message enquiring about his family – then sent message that I am struck in UAE and require money very urgently for an immediate surgery of my sister-in-law in Mumbai. The person identifying himself as my cousin, made voice calls to my friends, begging him to transfer Rs.50000/- immediately dishing out a heart-rending story. Fortunately, my friend realizing something eerie, checked with couple of my friends and then myself – to confirm that I am very much at my residence and had not sought money. Fortunately no money was sent but people could be gullible and be easily cheated when emotional chords are struck.

An unknown no. using my face !!

Upon hearing this, I sent out message to my contacts (through WA & FB) detailing such attempt and informing my friends not to react when they receive such messages ! .. .. I lodged an Online complaint too with Cyber Police and today an official called me to confirm and record the incident. The telephone no. used – the bank details provided for receiving bank transfer have all been lodged with Police.

There have been frauds of much bigger size. Sadly the movies and media often paint a picture that people can easily make money by false insurance claim !

Insurance is protection .. .. Insurers indemnify loss or damage arising out of an insured peril – financial protection for a loss arising out of a fortuity – sudden and accidental loss, during the policy period. Every industry needs it – upon consideration, i.e., payment of a small premium, the Insurer offers to protect the subject matter and effect payment when loss or damage occurs. Insurance industry is centuries old and there is something that ails it almost since its origin ~ the insurance frauds. Policy holders seeking unholy and fraudulent means to derive benefit under the policy which includes exaggerating values, manipulating losses, inventing cause of losses and more – all arising out of greed, dishonesty and infidelity of people !

In an old movie, Goundamani and Senthil would plan – Senthil to fake his death – and the duo would claim fat money of 2 lakh ! from the life insurer. There was a similar incident in 2005, in what is known as John Darwin case, it was faking one’s own death – the first trouble is in the lack of a body. That was tackled in a creative way by Texans Clayton and Molly Daniels in 2005 who proceeded to dig up a corpse from a local cemetery and place it in their burning car. Clayton would then disappear, Molly would collect $110,000 and he would somehow re-appear as her new boyfriend. In truth, their endeavours were very elaborate as she researched into how to burn a body effectively and sought tips on defrauding insurers. There was one gaping flaw in their plan however - the body was that of an 81 year old woman and DNA testing was only action really necessary to confirm what the police already knew.

The Wex Legal dictionary defines insurance fraud as “any duplicitous act performed with the intent to obtain an improper payment from an insurer” and can include any deliberate deception performed by or against an insurer for the purpose of financial gain.

Insurers have experienced innumerable and growing newer ways in fraudulent insurance claims that include : stolen car; false accident; hiding pre-existing damage and claiming later; Billing frauds in Health claims; wrong/ no / name-board hospitals; false bills; claiming for somebody else’s treatment; faked death; claiming compensation for natural death under fake accidents; MACT claims of wrong petitioners; claiming for orphan death; drowning claims; in Property insurance – intentional / set-up fire; manipulating stock records to show higher magnitude of stocks; claiming for stocks not lost and more !

John Darwin is one of the most infamous cases of recorded insurance fraud, even inspiring an entire BBC documentary chronicling his elaborate hoax. In 2002, UK resident John Darwin faked his death, staging a canoeing accident to collect on his £25,000 life insurance policy. His wife, Anne, used the death benefit payout to pay the couple’s £135,000 mortgage. An extensive police search for Darwin’s body in Seaton Carew, UK, yielded only the wreckage of his canoe and a broken oar. For five years, Anne corroborated the insurance hoax to police and even to the couple’s children. Darwin secretly lived between his home and a neighboring property the entire time, even taking a 2004 trip to Cyprus with his wife.

The couple planned to escape to Panama in 2007 and were nearly successful. Anne sold the couple’s home but a change in Panamanian visa laws required their assumed identities to be verified by UK authorities. Realizing the jig was up, Darwin turned himself into police in 2007. He claimed he suffered from amnesia and could not recall the past five years of his disappearance. Darwin was arrested on the spot and charged with insurance fraud and falsification of official documents. Anne was arrested the next day. The couple were convicted of fraud in 2008 and sentenced to more than six years in prison.

In 2000, Sholam Weiss was sentenced to 845 years in prison for racketeering, wire fraud, money laundering, and other charges in connection to the collapse of the National Heritage Life Insurance Company. He and other defendants engaged in an immense scheme that siphoned off $450 million from the company, resulting in what was believed to be the largest insurance company failure ever caused by criminal acts. His sentence was believed to be the longest prison term ever imposed in a U.S. federal court. and the longest ever for white-collar crime. Weiss fled the country during jury deliberations in October 1999, and was extradited from Austria in 2002. His sentence was commuted by President Donald Trump on January 19, 2021.

While these are policy holder crimes against Insurance companies, one would be aghast to read that there have been instances of Insurance company’s employees committing frauds on their employers too !!!

Mumbai Police recently registered a case of conspiracy and criminal breach of trust against one Assistant Manager of United India Insurance Company Limited for allegedly stealing money from the company’s account. The police said the accused had allegedly siphoned off Rs 8.09 crore. A case was registered with the Marine Drive police station after officials of the company learnt about the fraud. An investigation by the specialised Economic Offence Wing (EOW) of the Mumbai Crime branch is on.

UIIC officially lodged a complaint upon a tip-off from Bankers that scam had been committed since November 2020 and they were unaware of it until their Chennai office received a call from a private bank, complaining about some irregular transfer of funds from the company’s account. “The company then conducted an internal inquiry and realised that Rs 8.09 crore has been siphoned off its current account,” said an officer. The company officials during their inquiry also learnt that Kushal Singh, who was working in the account’s department in Churchgate, had made the illegal transactions. He had transferred the sum between November 13, 2020, and April 23, 2021, to seven accounts in Mumbai and Jaipur. The amount was transferred in 21 transactions. Accordingly, officials from the insurance company approached the EOW of the Mumbai Crime Branch.

That is not all – now comes the shocking news that Economic Offences Wing (EOW) of the Mumbai Police have arrested an assistant manager of the United India Insurance company for allegedly siphoning off at least Rs 129 crore from the company's accounts to other accounts, thereby causing wrongful gain. The police have also arrested the wife of the accused for her alleged role in the said crime. Those arrested have been identified as Khushal and Neelam Singh. The couple was staying in the office quarters at Bhulabhai Desai Road.

According to the police, Khushal was working as an Assistant manager in the accounts department of the United India Insurance company. The company has an account with a leading private bank and Singh was the signatory authority for this account. "The company came across some suspicious transactions and found that money was being siphoned from the company's accounts to his personal accounts and from there the money was again diverted to various other accounts. Further enquiry by the company revealed the role of Khushal in the said crime," said an EOW officer. The police claimed that Singh and his wife had gone into hiding ever since the case was registered.

"Initially the siphoned amount known was Rs 8 crore and further scrutiny of the suspicious transaction made by the company revealed that the total siphoning was of Rs129 crores. Singh has properties in NCR, we are probing if the misappropriated money was used in the purchase of these properties. Investigation also revealed the role of Neelam in the crime," the officer said. After the case was registered, a team was formed under the guidance of Joint Commissioner of Police (EOW), Niket Kaushik and on receipt of specific information the couple was traced in Pune and were apprehended on Monday. They were produced before a court which remanded them to EOW custody till July 05.

The couple has been arrested under section 409 (criminal breach of trust by a public servant, or by banker, merchant or agent) and section 120B (punishment of criminal conspiracy) of the Indian Penal Code. https://www.freepressjournal.in/mumbai/united-india-insurance-fraud-eow-arrests-assistant-manager-khushal-singh-and-his-wife-neelam-for-siphoning-rs-129-crore

The photo at the start is of ‘Mr. Fraud’ a Malayalam movie released in 2014 written and directed by B. Unnikrishnan and starring Mohanlal. The story was about a conman whose task is to plunder the treasure from a royal household.

With regards – S. Sampathkumar

3rd July 2021.