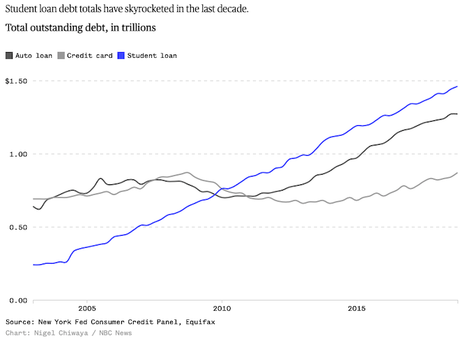

Student debt has ballooned in the last decade, and now surpasses both auto loan and credit card debt (see the chart above). This is because college costs have risen and many students cannot attend college now without going into debt. The problem is that this enormous debt is holding many graduates back from starting families or buying homes -- and that is hurting the U.S. economy.

Some Democratic presidential candidates (especially Elizabeth Warren and Bernie Sanders) have proposed forgiving part or all of this debt. It's not a bad idea. Doing so could be a big boost for the U.S. economy, and benefit all citizens.

Here is what Chris Arnold has to say about forgiving student debt at NPR.org:

Presidential hopefuls Elizabeth Warren and Bernie Sanders want to tear up your student loans and set you financially free. That's popular among voters – especially those struggling to pay off this debt. Other Democratic candidates have more modest plans. But economists say the dramatic proposals from Sanders and Warren to free millions of Americans from the burden of student debt could boost the economy in significant ways and help combat income inequality. Warren would forgive up to $50,000 for most people. Sanders would go further with total loan forgiveness. But with these plans having a price tag north of $1 trillion, such legislation would come with plenty of risks. The reason debt forgiveness could have a big impact on the overall economy is that a generation of Americans is making major life decisions differently because of student loans. "Children, it's not about if you want them," says Laura Greenwood in Montpelier, Vt. "It's about can you afford them?" Greenwood works for the state education agency. She's 30 years old and makes $63,000 a year. "I make probably a better salary than a lot of my peers." But after paying for college and grad school, Greenwood owes $96,000 in student loans. And she says that's got her and her partner feeling frozen. "Yeah. It's always, we're interested in having kids, but just cost of living and all our other bills and then the student loans, it's just like the final straw." She says it makes starting a family feel impossible. So if people like Greenwood suddenly had this millstone of debt lifted from their necks, it stands to reason that would unleash pent-up desires and spending that would be good for the economy. A lot more people would have kids, or start businesses, or buy houses. "In the short term, it would be very positive for the housing market," says Lawrence Yun, the National Association of Realtors chief economist. He says his group's surveys show that student debt has people delaying homeownership by five to seven years. He's not endorsing any particular plan, but he estimates that broad loan forgiveness would push up the number of home sales quite a bit. "Home sales could be, say, 300,000 higher annually if people were not saddled with large student debt." Yun says that would be "a boost to the housing sector as well as the economy." The effects would go beyond the housing market. William Foster is a vice president with Moody's, which just did a report on student debt forgiveness. "There've been some estimates that U.S. real GDP could be boosted on average by $86 billion to $108 billion per year," which is "quite a bit," he says. "That's if you had total loan forgiveness." Foster says it wouldn't have to be total forgiveness to see significant results. And he says it could also help address rising income inequality.