Automation is the application of techniques that reduce human labor and maximize production with fewer costs. We can apply automation on every process that we wish to get done fast. On finance, the automation are on the algorithms that we see keeping and retrieving data, report summarizing, data-mining, etc. There´s no doubt that the need of automation is very large. That are so much things that we wish to be done in milliseconds, many simulations, analysis or data processing that we have to prioritize, since that the workforce is limited against the demands.On finance we can automate everything, since we know what we want. The automation process is blind, in other words, it´s systematic and repetitious, doesn´t look to the response. On control process we see a fundamental difference: On controlled process we have a feedback of the variables. Some of the results can be inputted on the system changing the system response.Some bioreactors (for a comparison) have control process to balance the temperature or pressure of the cells culture. If pressure get high, a automatic process equipped with sensors can outflow some gas until the desired pressure.Many trading systems have control process, like the stoploss. A simple trading system could only give buy/sell orders based on the actual data input, an automatic process, for example the MACD strategy alone. The dynamic results or variables of the system (accumulate return of the open trade, for example) could be inputted on a stoploss logic, resulting on a binary response (true/false) that indicate the exit of the trade. This process, known by many, is a simple example of a control process.

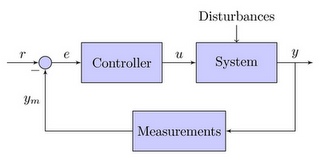

Automation is the application of techniques that reduce human labor and maximize production with fewer costs. We can apply automation on every process that we wish to get done fast. On finance, the automation are on the algorithms that we see keeping and retrieving data, report summarizing, data-mining, etc. There´s no doubt that the need of automation is very large. That are so much things that we wish to be done in milliseconds, many simulations, analysis or data processing that we have to prioritize, since that the workforce is limited against the demands.On finance we can automate everything, since we know what we want. The automation process is blind, in other words, it´s systematic and repetitious, doesn´t look to the response. On control process we see a fundamental difference: On controlled process we have a feedback of the variables. Some of the results can be inputted on the system changing the system response.Some bioreactors (for a comparison) have control process to balance the temperature or pressure of the cells culture. If pressure get high, a automatic process equipped with sensors can outflow some gas until the desired pressure.Many trading systems have control process, like the stoploss. A simple trading system could only give buy/sell orders based on the actual data input, an automatic process, for example the MACD strategy alone. The dynamic results or variables of the system (accumulate return of the open trade, for example) could be inputted on a stoploss logic, resulting on a binary response (true/false) that indicate the exit of the trade. This process, known by many, is a simple example of a control process. A control process can be seen as an automated process with feedback. This property change drastically all the automation process because the system can be all monitored.

A control process can be seen as an automated process with feedback. This property change drastically all the automation process because the system can be all monitored.