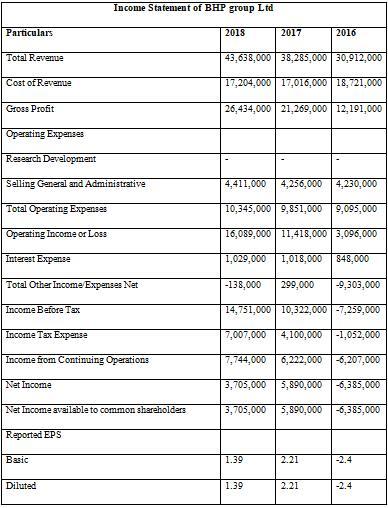

BHP Group Ltd selected in this Financial Analysis assignment is an Anglo-Australian Company that is into multinational mining. The headquarters of the company is situated in Victoria, Australia. This is traded in the Australian Stock Exchange by the name of BHP. The company was founded in the year of 1885. The revenue of the company is US$43.638 billion. The net income of the company is US$4.823 billion (BHP, 2019). The employees working under the company worldwide is sixty two thousand. The report will provide people information that will help them to analyse the work done by the company and the position of the finance in the market. This will also help them to check whether they can invest their money in the company or not.

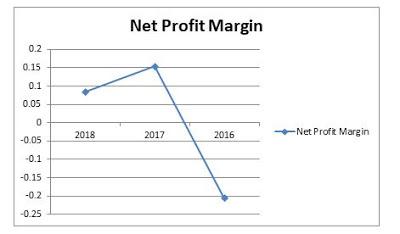

The graph provided above gives information about the net profit margin of BHP Group Ltd. It has been observed that there is a very high fluctuation in the net profit margin as the company is not able to control the expenses properly (BHP, 2016). The margin was -0.21 in the year of 2016, which then rose to 0.15 in the year of 2017, which then finally fell to 0.08 in the year of 2018.

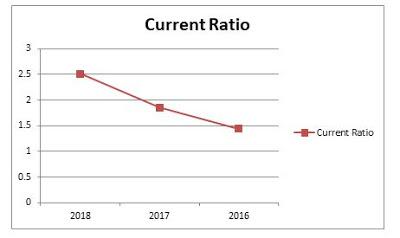

The graph provided above provides information about the current ratio of the company BHP Group Ltd. It has been observed that the position of the company is improving as the current assets are increasing at a greater speed than that of the current liabilities (Bhp.com, 2017). The current ratio was 1.44 in the year of 2016, which rose to 1.85 in the year of 2017, which then finally rose to 2.51 in the year of 2018.

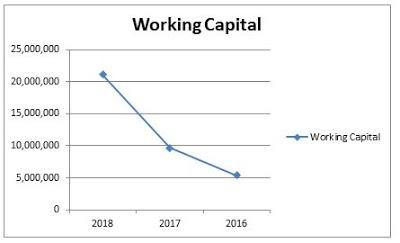

The graph provided above provides information about the working capital of BHP Group Ltd. It can be observed that there has been an increase in the working capital of the organisation. This suggests that the company is using the working capital properly.

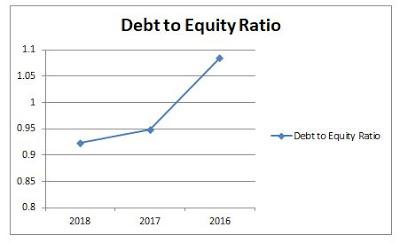

The graph provided above provides information related to the Debt to Equity Ratio of BHP Group Ltd. It has been observed that there is a fall in the debt to equity ratio. It suggests that there is a positivity in the organisation as the investment is done mainly by the shareholders and not by creditors. The Debt to Equity Ratio was 1.08 in the year of 2016, which fell to 0.94 in the year of 2017, which then finally fell to 0.92 in the year of 2018.

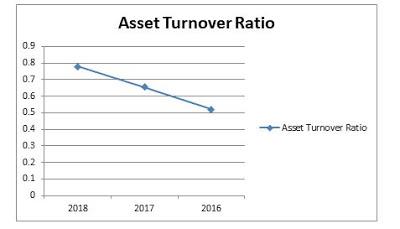

The graph provided above in this Financial Analysis assignment provides information related to the Asset Turnover Ratio for BHP Group Ltd. There is a rise in the rate of asset turnover, which is a positive thing for the organisation. This suggests that the organisation can use their assets properly in order to increase the profit of the business (Bhp.com, 2018). The ratio was 0.52 in the year of 2016, which then rose to 0.65 in the year of 2017, which then finally rose to 0.78 in the year of 2018.

The organisation BHP Group Ltd has an incentive plan named Long Term Incentive Plan for their employees. This brings in competitive performance based remuneration for the business. A committee for remuneration is produced for the eligible employees. The structure of incentives changes from time to time. These are essential for the business in order to motivate the employees properly. These are essential for the organisation as these methods help in protecting the interest of the employees. This structure will increase the performance of the employees, as they will be interested to perform well due to the incentives provided by the company. These are essential for the business in order to perform well in the market.

BHP group Ltd is a leading global company in the field of resources. They provide the best values to their customers. Their sustainability puts the safety and health in the first place. They are very much responsible for the environment. They do what is right for the society, which helps them to keep their integrity as well. They respect all the stakeholders that they have, which is another important part of the company.

There are various calculations presented in the Financial Analysis assignment that suggests few things to the shareholders. These are termed as recommendations that will be provided below:

- The company is in a better position for the shareholders to invest their money as the ratios provide a position for investment.

- The working capital of the company is also rising, which shows that they are able to perform their activities properly.

- The part of concern for the company is to control the expenses in a proper manner so that there is a rise in the net profit margin as well.

These are essential for the organisation to perform well and these ratios suggest that the investors and shareholders can invest their money in the company without any fear of getting a loss.

The calculations that are provided above shows different kind of ratios that are calculated that are used to analyse the statement of finance of BHP Group Ltd. It is observed that they are unable to control their expenses properly. Other than this, they are in a very good position in order to back their business properly. This will attract all the stakeholders to invest their parts in the business. These are essential for the organisation to perform.

BHP. (2016). BHP | 2016 Annual Reporting suite. Retrieved 1 October 2019, from https://www.bhp.com/media-and-insights/reports-and-presentations/2016/09/2016-annual-reporting-suite

BHP. (2019). BHP | A leading global resources company. Retrieved 1 October 2019, from https://www.bhp.com/

Bhp.com. (2017). Retrieved 1 October 2019, from https://www.bhp.com/-/media/documents/investors/annual-reports/2017/bhpannualreport2017.pdf

Bhp.com. (2018). Retrieved 1 October 2019, from https://www.bhp.com/-/media/documents/investors/annual-reports/2018/bhpannualreport2018.pdf