Task:

Question 1

This question relates to material covered ¡n the Topics 1 to 3. This question addresses the 5th and 6th subject learning outcomes. A thorough understanding of financial mathematics forms the basis of all/earning in this subject.

For the following numerical problems, detailed worked answers must be shown. This involves providing a brief description of the problem, formulae used, progressive and final answers. For assignments you are expected to show your workings using the appropriate formula entered using the MS Word formula function.

(a) Your daughter has expressed a wish to attend university when she finishes school in five (5) years. You anticipate the cost will be $60,000 at the time she commences university. If your financial institution is offering you 4% pa (compounded monthly), how much do you need to deposit ¡n your account each month in order to save the required amount before your daughter commences university?

(b) You have been offered the opportunity to purchase a start up company building electric cars for the Australian market called Green Motors P/L. Your initial investment is $22,000,000. The term of the project is 5 years. The project has an expected rate of return of 10% pa. All expected cash flows for the project are below and you have an expected rate of return of 10% pa.

End of year Cash flow ($mil)1

2

3

4

5

1.8

3.0

6.5

8.4

12.3

(i) Based on your required rate of return would you purchase this investment? Present all calculations to support your answer.

(ii) Would you change your opinion from (i) if the expected rate of return rose to 15%? Present all calculations to support your answer.

(c) You have commenced work as a certified Financial Planner. Your supervisor has provided the following financial data for a new client Brant Jerome. The client turned 34 years old today and plans to retire when she turns 67. The client owns a diversified share portfolio which is valued today at $47,000. It is expected that this portfolio will earn (on average) 7% per annum indefinitely. Brant also has a superannuation account with a balance of $78,000 to which he currently contributes $1,000 per month. The superannuation account is expected to continue to earn 8% per annum. At his retirement your client plans to consolidate his financial holdings and purchase a monthly annuity as a pension to fund his planned lifestyle. Brant believes he will need to self-fund his retirement until he reaches the age of 85 at which time he would like to have $120,000 remaining to fund any costs not covered by the age pension. During the pension phase of his retirement Brant will adopt a Balanced investment strategy which will return 5% pa (compounded monthly) on his annuity investment.

(i) What will be the value of Brant's financial assets when he retires at age 67? Present all calculations to support your answer.

(ii) What will be the monthly pension amount that Brant will receive on his retirement? Present all calculations to support your answer.

QuestIon 2

This question relates to material covered in Topic 1 particularly the Australian taxation system and interest rates. This question addresses the 1st, 2nd, 3rd and 4th subject

learning outcomes.

Students are expected to conduct their own research and develop their own opinions about the merits of this topic. There ¡s no single correct answer and students will be marked on the depth of their research, the quality of their arguments (for and against), and their demonstrated understanding of the issues involved in this complex area of financial policy. Please refer to the instructions regarding referencing and the risks of plagiarism in the assignment submission instructions.

(a) James is applying for a new home loan. He wishes to borrow $250.000 and make his repayments monthly. The interest rate the bank has quoted him is 4% per annum.

- Is this the real rate of interest or the notional rate of interest?.

- Explain the difference between the real rate of interest and the notional rate of interest.

- Calculate the real rate of interest and the notional rate of interest for James.

- Is it possible for the real rate of interest to equal the notional rate of interest? Explain.

(b) The Reserve Bank of Australia has announced a 0.25% decrease in the cash rate. What effects does this have on the economy and the financial markets? Provide examples of who might benefit from this decrease and those that do not.

Question 3

(a) Bradley hates taking risk with his money; '1 hate shares and property, I know a lot of people who have lost money in those investments. As a result he will only considerbank guaranteed investments. Bank guaranteed investments are returning 1%. Bradley has a marginal tax rate of 32.5% and pays medicare levy of 2%.

i. Assuming he pays tax at 32.5% plus medicare levy, on the income from his investment, is he preserving the real dollar value of his investment if inflation is 2.5% per annum? Show your workings to justify your answer.

ii. When considering your calculations, how would you explain the benefits of risk to Bradley?

(b) Explain the Australian dividend imputation credit system and how it applies in Australia. Include an analysis of how the receipt of franking credits will result in differing returns for Australian resident and international investors.

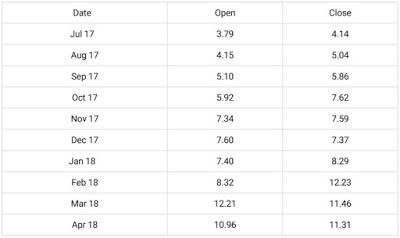

(c) Below is the monthly share price data for A2 Milk Company for the 2018 financial year (source: https://au.finance.yahoo.com/quote/A2M.AX/). Note: no dividends were declared for the 2017-18 FY.

i. Calculate the 2017-2018 monthly holding period returns (in both $ and %) for A2M.

ii. Calculate the average monthly return (%) for A2M.

iii. Using the data provided calculate the annual holding period return (in both $ and % terms) for an international (non-Australian) shareholder of A2M.

(d) The monthly data for the Australian All Ordinaries share price index (Source: https://au.finance.yahoo.com/ is below.

i.Calculate the monthly holding period returns (%) for the Australian share market (MKT) during 2017-2018 FY.

ii. Calculate the average monthly holding period return (%) for the MKT (ALL ORDS).

iii. Calculate the annual holding period return (in % terms) for the Australian share market (MKT) (as proxied by the All Ords index) during 2017-2018 FY.

iv. Using Excel (XL) prepare a line graph comparing the monthly returns for A2M and the return on the Australian (MKT).

v. Calculate the risk for 2018 as measured by standard deviation of both A2M and the MKT.

vi. According to Reuters Finance A2M Ltd has a Beta of 1 .04. In terms of share investment, define what Beta represents. What does A2M's Beta of 1 .04 mean? How risky is it?

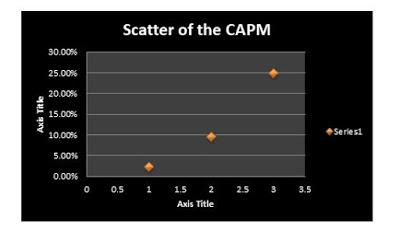

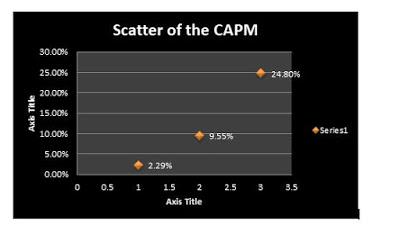

vii. The average return on the market (MKT) in Australia for the past 10 years has been 9.55% (Source: https://www.asx.com.au). The yield on Australian 10 year treasury bonds is currently 2.29%. Using these as proxies for the Return on Market (MKT) and Risk Free Rate (RO, combine them with the A2M Beta (above) and calculate the return expected for A2M using the Capital Asset Pricing Model (CAPM).

viii. Using the CAPM data from the previous question create an XL scatter plot graph to plot the Security Market Line (SML) using the Risk Free Rate, Return on Market, and A2M as data points.

ix. Recreate the graph from (viii) above but this time also include the actual 2018 returns for A2M and the MKT as previously found (using the same beta measures).

x. Based on your CAPM findings construct a portfolio made up of 40% A2M and 60% MKT. Calculate the estimated return and for this portfolio.

The cost of the study (Principal) = $ 60, 000

The time period taken for the study = 5 years or 60 months

The rate of interest is = 4%

Formula for compound interest is,

Amount = Principal (1 + Rate / number of time interest is compounded) ^ number of time * time - Principal

Interest Amount = (60000 (1 + 4% / 12) ^ 12 * 5) - 60000

= (60000 * (1.0033) ^ 60) - 60000

= (60000 * 1.2186) - 60000

Total amount to be paid after five years = $ 60000 + $ 13116

Hence, the amount to be paid monthly for five years = $ 73116 / 60

Thus, the amount that is necessary to be saved monthly is $ 1218.60

(i) Based on your required rate of return would you purchase this investment.

From the above calculations present in the finance assignment help, it can be commented that basis the present scenario of the required rate of return, the investment can be done. The reason behind this is that the organization will have decent internal rate of return and the payback period is also just 1 year and two months. The Net present value is also very high. Thus, no other options will be as fruitful as the investment to earn the maximum amount of money.

(ii) Would you change your opinion from ( i ) if the expected rate of return rose to15%?

From the above calculation, it can be stated that the investment will not be fruitful as the interest will be more if the amount of money is invested in other areas. This is important to check the interest rates and calculate accordingly so that the maximum amount of money is received from the money that will be invested. But it can be stated that with the increase in the rate of interest, the investment in new business will not be fruitful and need not be executed by the person.

(c) Name of Client is Brant Jerome. The current age is 34 years. The client will retire on 67 years. List of items present:

ParticularsAmount ($)Share Portfolio

$47,000

Rate of Interest

7%

Superannuation

$78,000

Contribution for Superannuation

$1000 per month

Rate of Interest

8%

(i) What will be the value of Brant's financial assets when he retires at age 67

Amount of money in shares = $ 47000

Rate of interest to be received = 7%

Total amount of money that will be received at the time of retirement is

= (Principal * Rate * Time) / 100

= (47000 * 7% * 33) / 100

Therefore, total amount of money that will be received from share portfolio is $ 47000 + $ 1085.70 = $ 48085.70.

Superannuation amount = $ 78000

Amount of money that is contributed every month = $ 1000

Total months to be paid = 396 months

Amount that will be added = $ 1000 * 396

Total amount of money excluding interest = $ 78000 + $ 396000

Interest to be received is 8%

Amount of interest = (474000 * 8% * 33) / 100

Total amount of money from superannuation = $ 474000 + $ 12513.60

Total amount of money that will be present with him = $ 486513.60 + $ 48085.70

Brant Jerome will have total of $ 534599.30 during the time of retirement at the age of 67.

(ii) What will be the monthly pension amount that Brant will receive on his retirement?

The total amount of money he will have at his retirement = $ 534599.30

The total amount of months necessary = 216 months

Therefore, the amount of money he will receive monthly = $ 534599.30 / 216

Hence, he will receive an amount of $ 2475 per month till 85 years of age.

Information provided in the sum are as follows:

James is applying for a new home loan.

He wants to borrow $ 250000 from the bank and will return the amount monthly

The rate of interest to be paid = 4%

1. Is this the real rate of interest or the notional rate of interest?

The interest that is to be paid by James is real rate of interest. The rate is derived after allowing the inflation of 1.90%.

2. Explain the difference between the real rate of interest and the notional rate of interest.

Notional rate of interest

Takes the cost of opportunity into the consideration

Takes the value of money into the consideration

This kind of rate includes the prices of the market which shows the changes as well

Presents the value of money that is currently present

Real value is that rate that is received after the adjustment of the inflation

Notional Value is that rate that is received from the money that is received from the commodity value

3. Calculate the real rate of interest and the notional rate of interest for James.

Step by step calculation to provide the finance assignment help for real rate of interest

Real interest rate = Nominal Rate of interest - Actual rate of inflation = (4 - 1.90) % = 2.1 %

4. Is it possible for the real rate of interest to equal the notional rate of interest?

The real rate of interest described in this finance assignment help cannot match the notional rate of interest at any point of time. The data for the two rates are different and they differ from each other. This is the main reason for which the rates do not match each other at any point of time. These are essential for the government of Australia to have proper rates and they should control these rates in such a way that do not go out of reach for the business. These are beneficial for the Government as the bank rate and the inflation rate determines the rate of interest for the real and notional rates. Thus, it can be stated that these rates are necessary for them to control in order to have good structure in the country of Australia so that the work is done properly and the people get interested to take home loans.

The Reserve Bank of Australia has announced a 0.25 % decrease in the cash rate. What effects does this have on the economy and the financial markets? Provide examples of who might benefit from this decrease and those that do not.

There are various effects that are present for the reduction in the cash rate by the Reserve Bank of Australia. These will be explained beneath:

1. Due to the reduction in the cash rate, there will be a reduction in other interest rates as well, which will give good feedback to the people who wish to take different types of loans from t eh banks. They can take different loans at a much lower rate of interest from before due to the reduction of the cash rate.

2. There will be more money in the hands of the people as they will be able to take different types of loans from the bank and non-banking financial corporations. This will increase the rate of inflation in order to control the flow of money in the country.

3. The fall in the cash rate will allow the business organisations to prosper as they will get different types of business loans at a lower rate of interest which they will take easily so that there will be no issues in the business. These are essential for the business in order to perform well in the market.

From the decrease in the cash rate, the people and the business organisations will get the benefits as they will need to pay a less amount of interest for any type of loans they will take. The people who will not benefit from the decrease are the banks as they will need to reduce the interest rates of different types of loans that are present.

i. Assuming he pays tax at 32.5% plus Medicare levy, on the income from his investment, is he preserving the real dollar value of his investment if inflation is 2.5%per annum? Show your workings to justify your answer in the present finance assignment help.

Tax rate = 0.325 Medicare levy = 0.02 Inflation = 2.5% After tax return of Bradley = 0.01 * (1 - (0.02 + 0.325)) = 0.00655 = 0.6% After tax real return of Bradley = (0.00655 / 0.25) = 0.262 = 26%

From the above information, it can be seen that Bradley will get 26% return after paying the tax and Medicare levy. Bradley should take this investment plan as the return is positive from the plan. Total return from the investment 26% and the amount of return is moderate but chance of loss is low in this.

ii. When considering your calculations, how would you explain the benefits of risk to Bradley?

In this investment the risk is low as the bank has guaranteed to give 1% return to Bradley and this investment should be taken by him as he has low appetite for risk. The investment will help him to get positive return. Chance of losing money is very low and as Bradley wants the investment pattern is same like his preference.

Dividend ascription was presented in Australia in 1987. In spite of many hypothetical and observational thinks about, there's small agreement on its impacts on the fetched of value capital, share costs, or speculation - due essentially to diverse sees on the results of universal integration on value estimating. In differentiate, there shows up to be a common understanding of the impacts on corporate use and profit arrangement, and resource allotment procedures of financial specialists, indeed even though numerous of these impacts pivot upon how universal integration influences the taken a toll of value capital. The objective of this paper is to layout these impacts, drawing on and fundamentally investigating the existing writing to evaluate what conclusions can be drawn, and causes of contradiction, on imputation's impacts on the Australian Monetary Framework.

It can be summarised that ascription has given critical profitability to the economy of the country through results on conduct, especially through actuating lower use and higher profit pay out rates, with positive suggestions for money related steadiness and advertise teach of companies. Whether it has invigorated household physical venture is hazy - this depends upon what counterfactual assess framework and rates are expected and upon whether universal integration has anticipated any decrease within the taken a toll of value capital to Australian companies.

i. Calculate the 2017-2018 monthly holding period returns (in both $ and %) for A2M.

Table 1: Holding period return of A2 Milk companies

(Source: Created by the learner)

ii. Calculate the average monthly return (%) for A2M.

Table 2: Average monthly return of A2Milk

(Source: Created by the learner)

i. Calculate the monthly holding period returns (%) for the Australian share market (MKT) during 2017-2018 in this finance assignment help.

ii. Calculate the average monthly holding period return (%) for the MKT(ALLORDS).

iii. Calculate the annual holding period return (in % terms) for the Australian share market (MKT) (as peroxide by the All Ords index) during 2017-2018 FY.

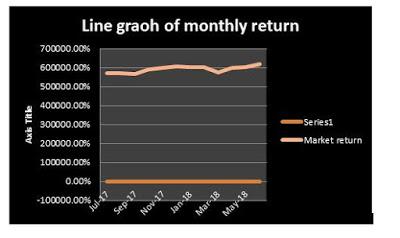

iv. Using Excel (XL) prepare a line graph comparing the monthly returns for A2M and their turn on the Australian (MKT).

Calculate the risk for 2018 as measured by standard deviation of both A2M and the MKT.

Standard deviation of A2M is 0.02.

Standard deviation of the market is 164.8

According to Reuters FinanceA2M Ltd has a Beta of 1.04. In terms of share investment, define what Beta represents. What does A2M's Beta of 1.04 mean? How risky is it?

1.04 is quite a high risk beta as the value of beta should always be below 1. This share has a chance to give high profit and high loss as well. The risk if this investment will be high.

CAPM return : Kc = Rf + beta (Km - Rf) = 2.29% + 1.04 (9.55 - 2.29) = 9.84%

Risk adjusted market return = 24.8% Risk adjusted A2M return = 9.84% Portfolio = (24.8% * 0.40) + (9.84% * 0.60) = 0.0992 + 0.5904 = 0.6896 = 68.9 % Portfolio return = 68.9% Beta = 0.6

Abdel-Kader, M. G., Dugdale, D., & Taylor, P. (2018). Investment decisions in advanced manufacturing technology: A fuzzy set theory approach. Routledge.

Bodenstein, M., Erceg, C. J., & Guerrieri, L. (2017). The effects of foreign shocks when interest rates are at zero. Canadian Journal of Economics/Revue canadienne d'économique, 50(3), 660-684.

Gust, C., Herbst, E., López-Salido, D., & Smith, M. E. (2017). The empirical implications of the interest-rate lower bound. American Economic Review, 107(7), 1971-2006.

Harris, E. (2017). Strategic project risk appraisal and management. Routledge.

Holston, K., Laubach, T., & Williams, J. C. (2017). Measuring the natural rate of interest: International trends and determinants. Journal of International Economics, 108, S59-S75.

Hughson, H., La Cava, G., Ryan, P., & Smith, P. (2016). The Household Cash Flow Channel of Monetary Policy. RBA Bulletin, September, 21-29.

James, D. (2018). Compound interest is the root of banks' evil. Eureka Street, 28(24), 83.

Laubach, T., & Williams, J. C. (2016). Measuring the natural rate of interest redux. Business Economics, 51(2), 57-67.

Manalo, J., Perera, D., & Rees, D. M. (2015). Exchange rate movements and the Australian economy. Economic Modelling, 47, 53-62.

Song, C. (2015). Financial illiteracy and pension contributions: A field experiment on compound interest in China. Available at SSRN 2580856.