The Federal Reserve Bank initiated another interest rate rise this week. The Rise of 0.25% was anticipated by the market but has attracted heavy criticism from President Trump who has once again bucked protocol and commented on the Federal Reserve Banks policies. This is despite being made aware that the bank’s purpose is to work autonomously from political policy.

FED’s word on the latest rise

Speaking on Wednesday last week the FED chairman delivered a positive if not surprising outlook on the US economy. As the FOMC announced the latest expected 0.25% interest rate rise Powell confirmed the possibility of future rate rises.

Touching upon the GDP the FOMC continue to predict growth a stable pace throughout 2019 with GDP forecast to grow at 2.5% next year, slowing in 2020 to 2% and cooling further in 2021 declining to 1.8%. The slowdown is anticipated as the FED believe that the effects of Trump’s tax cuts and infrastructure investments will slowly begin to subside over the coming years.

The latest US interest rate rise is predictably underpinned by strong GDP figures throughout the first half of 2018. Unemployment remains historically low and employment remains buoyant despite fear the jobs market was reaching full capacity. The solid jobs market is also supported in terms of wages with the US seeing an annualised increase of 2.9% year on year as of August.

Wages are also counteracting concerns around future trade as Trump continues to impose tariffs on foreign goods. Talking on trade concerns Powell stated that as of yet the tariff amendments had had little impact on the economy. He did, however, say that he was concerned as to where the tariffs and the potential trade war would end.

Despite all of the above, the US economy remains on track and the possibility of a further rate rise this year seem highly possible. Powell confirmed that the FED would continue to monitor key indicators and weigh up the pros and cons of moving too fast on rate rises; impeding the recovery and moving too slowly and allowing the economy to overheat.

More US rate rises in the pipeline?

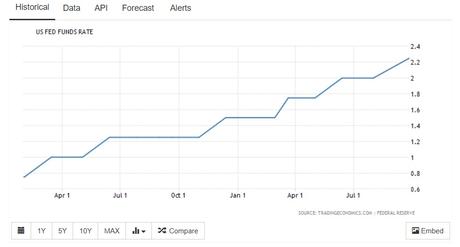

The latest US interest rate hike marked the eighth since 2015 further demonstrating the FED’s slow and gradual approach to interest rate rises. The US economy is predicted to grow by 3.1% this year and therefore arguably has room for more gradual rises. So far, this year has seen 3 rate rises from 1.5% to 2.25% this week and markets fully anticipate a 4th. The most likely time being December.

A similar trend is set to continue in 2019 with 3 rate rises expected in 2019 and a single rate rise in 2020 as interest rate normalise.

Trump’s criticism swaying FED?

Despite warnings about commenting or intervening on monetary policy Trump recently has been unable to resist commenting on FED policy. This month was no exception with the president stating that:

“We are doing great as a country. Unfortunately, they just raised interest rates a little bit because we are doing so well. I am not happy about that.”

When quizzed about previous comments or pressure from President Trump at this weeks FOMC meeting Powell underlined the Banks autonomy, saying

“We don’t consider political factors.” “That’s who we are. That’s what we do. And that’s just the way it’s always going to be for us.”

Although Trump may demonstrate disdain for the FOMC’s rate decisions he doesn’t have the ability to dismiss the governor. Despite this, his comments can be extremely influential on markets and therefore won’t be appreciated by the FED or investors.

Could interest rate rise cool the US economy?

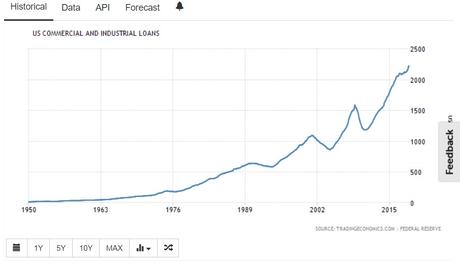

The previous decade of historically low interest rates has created a force-fed boom in the American economy. The borrowing conditions available in turn have fueled business in the US to borrow in order to fund businesses that arguably would be untenable in normalised lending conditions, a place where the US economy will surely find itself in a few years if further rates rises come to fruition. Experts now are becoming concerned that a multitude of bad business investments will no come home to roost in the coming years sparking another banking ‘situation’. This rationale is supported by the acceleration of US commercial loans in the last decade.

The fear now is whether these loans can be supported taking them out especially as interest rates rises are very unlikely to relent at the current trend.

USD currency performance

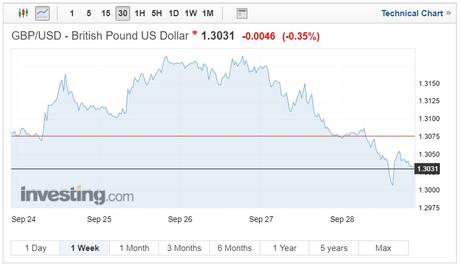

As the latest interest rate rise was far from surprising movement on key USD pairs has been relatively modest. GBP/USD remained comfortably above 1.30 for most of the trading week. The low came just after the Fed rise with the currency pair touching 1.3007, the high of the week 1.3189 with the currency pair closing at 1.3031 on Friday’s session.

USD could make further progression next week following an article published by the Telegraph in which Boris Johnson has set out a better plan for Brexit, attempting to dismantle what is left of Theresa May’s Chequers plan. His timing impeccable and running alongside the Tory party conference which started recently.

Elsewhere USD/JPY has been approaching a year high and closed trading on Friday at 1.1370. The pair were boosted significantly on Friday as investor left the Euro and Italy’s budget issue, seeking refuge in the dollar and lifting the USD/JPY currency by just shy of 0.3%.