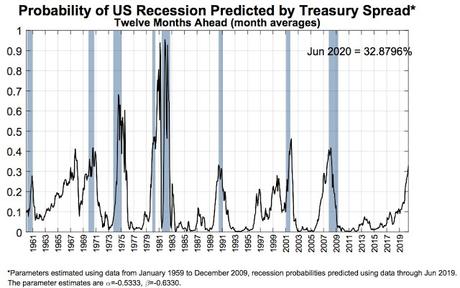

In his bid for re-election, Donald Trump has only one thing in his favor -- the economy seems to be doing well (at least for the rich). But if the Federal Reserve is right, that could disappear before the 2020 election. The most reliable indicator of a coming recession the Fed has is predicting a recession within the next 12 months.

Here's part of how Carmen Reinicke at Business Insider reports it:

A key recession tracker just hit its highest level since 2009, sending a signal that an economic downturn may be looming on the horizon. The New York Federal Reserve's probability model, which predicts the probability of a US recession in the next 12 months, delivered a reading of 32.9% for June. That's could mean tough times ahead, considering the measure has breached the 30% threshold before every recession since 1960. It sat at a precarious 28% in May. This development comes on the heels of the US's 10-year economic expansion recently becoming the longest on record. While duration is not what ends expansions, lengthy ones can make investors nervous. Recession watch has been on high alert, especially since the yield curve between the 10-year and 3-month Treasurys inverted in March, and then again in May. To calculate recession probability, the New York Fed's tracker uses treasury spreads, specifically the difference between the 10-year and 3-month Treasury rates. A negative spread between the two has preceded all post-war downturns, and it's been negative since May.