The non-fungible token (NFT) space is known for many success stories, from NFT projects like Bored Ape Yacht Club to CryptoPunks. However, many NFT projects failed to compete in the market and keep their hype up. Analyses report that, on average, one in three NFT collections have essentially failed with little or no trading activity. One-third is trading below the amount they cost their developers to mint the tokens. Some of these NFT collections were a huge success and widely funded at the time of NFT hype. But what made them fail?

In this article, we will discuss all the important reasons causing an NFT project to fail. We also suggest ways to avoid failed NFT projects as collectors or investors.

What is a Failed NFT Project?

A failed or unsuccessful NFT is a project that loses its floor price of launching by more than %60. A failed NFT project experiences a decrease in trade volume over time, and its floor price usually decreases by %90 within the first 6 months after launch.

The number of holders cannot be a determinant of failed NFT projects since there may be many investors due to the low floor price. Although the number of holders increases, the low floor price shows that there is probably an unsuccessful project.

Unsuccessful NFT projects are also known based on their trading volumes. If a project’s trading volume regularly decreases during a period, it is generally said that the NFT collection is failed. Considering NFT projects such as Azuki and CryptoPunks, their high floor price and trading volume suggest a low possibility of failure for these NFT projects.

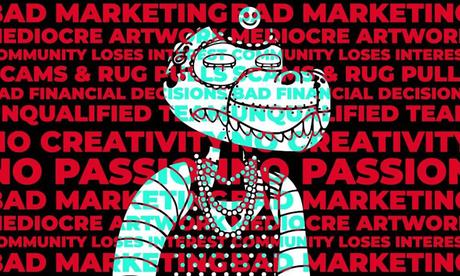

Why Does an NFT Project Fail?

Several factors may contribute to the failure of an NFT project. NFT projects may fail at different stages of their lifetime. Here are some of the most important factors that lead to failed NFT projects.

1. Failure at the launching stage

The most important reason for an NFT project to fail is failing to get the chance to get off the ground at the launch stage. An NFT project that is not innovative enough or has nothing different to offer the market faces many challenges in promoting its collection and increasing trade volume.

NFT projects increase their floor price if they provoke investors’ emotional feelings or offer them a promising roadmap to success. NFT collections must be worth investing in, benefit their holders, and hold investors as a community.

NFT projects that do not provide a sense of community to their holders and have nothing to share with them will lead to failure.

2. Ineffective supporting team

The next important reason for an NFT project to fail is an ineffective team behind the project. NFT projects are mostly a product of teamwork that may include designers, blockchain developers, community managers, content creators, etc. Therefore, their productivity and commitment to the collection directly influences the outcomes.

A successful NFT project, thus, must have an organized, planned, knowledgeable, and dedicated team. Investors must search for the team behind their desired NFT project before purchasing. Dedicated team members with a strong field background suggest the NFT collection’s success.

3. Growing a community and engagement

NFTs will be successful if a dedicated community supports them. NFT projects that fail to grow a community and lack engagement in the project are to lose their popularity in the market and fail.

NFT projects must create their community on social media, including Twitter, DAO, Instagram, etc., and do their best to improve their engagement in the project roadmap. NFT project teams or owners must spend enough time establishing a consistent audience in their work and discussing the bright future of their NFT projects with holders. They can also improve the sense of community by providing access to events or gifts to NFT holders.

4. Marketing failure

Among other reasons, weakness in marketing an NFT project at the beginning of its launch seems to be the most important reason for an NFT project to fail. Marketing is the key point that should have done in the right way to the right audience in any market.

Many NFT projects fail since they are not introduced to investors through proper marketing, and they eventually fail. NFT collections need all potential holders and collectors in the market to give rise to their floor price and become a success. Capturing investment almost always happens through marketing.

5. Rug pull

Rug pull is also a main reason leading to the failure of an NFT project. Rug pull is the case when an NFT project owner pays off all NFTs so that collectors of the NFTs lose their entire invested money at once. Most failed NFT projects are recorded due to abandoning the project creators or artists when they stop producing NFTs for any reason.

Once the owner or CEO of an NFT project take the decision to rug-pull the NFT project, investors lose their money within no time, and this is the worst thing to happen to NFT holders and investors. The NFT owners, on the other hand, have no chance to return to the market since they have lost their reputation in the market, and will be difficult to trust them again.

Top failed NFT projects

Let’s check some of the failed NFT projects. Here is the list:

1. Mekaverse

Mekaverse was one of the most successful NFT projects at its launch. The collection was launched in October 2021 and is a collection of 8,888 algorithmically generated 3D warrior robots with different traits. The NFT collection generated over $60 million during the first 24 hours of sale.

Mekaverse NFTs were traded for as high as 2 ETH in late 2021. However, it was tracked by allegations of data leaks and possible fraudulent activities that compromised the legitimate ownership of certain rare NFTs. The news caused a sharp decrease in the floor price of the project.

Mekaverse floor price reached 0.173 ETH in May 2023, which suggests an almost %85 drop. The number of Mekaverse NFT owners also decreased from 5,100 to 4,422 at the of writing.

2. Pixelmon

Pixelmon is another NFT project that failed in the market after a hyped launch in February 2022. The NFT project raised $70 million by selling 7,750 NFTs from the collection of 22,475 that promised to deliver a Pokémon Chase experience. However, these Pokémon NFTs were far from what investors hoped.

The cost of minting an NFT from the collection was 3 ETH at the launch time. Today, the floor price drastically decreased to 0.57 ETH. One month after the launch, the NFT project had almost 6,000 NFT owners, which decreased to 2624 in May 2023. Pixelmon aimed to be the Pokémon of the blockchain; however, the project had a long list of issues and scandals that disappointed the investors and gamers.

3. The Indifferent Duck

The Indifferent Duck is a 10,000 NFTs collection customized by the collectors and minted on the Ethereum Blockchain. Investors could buy an egg and create their own NFT in the BRAVO MAKER. The floor price started at 0.34 ETH and decreased to 0.003 ETH in May 2023.

The number of NFT holders was 4,686 during the first month of launch. However, there are only 3,105 holders for the collection now.

4. PXN: Ghost Division

PXN: Ghost Division is a collection of 10,000 GHOST NFTs created by the team that created Nanopass. While PXN: Ghost Division is a standalone project, it does share a universe and some IP with Nanopass. Holders can generate utility tokens that are used within the PXN ecosystem.

At the launch, the NFT average price was 4.15 ETH. The floor price reached 0.140 ETH in May 2023. Although the NFT project supported its NFT holders in different ways as a community, it failed to attract more investors for different reasons, such as marketing.

5. Phanta Bear

The Phanta Bears NFT collection is an algorithmically-generated collection of 10,000 colorful bears and was launched on January 1, 2022, on the Ethereum blockchain. Barely a week after its official launch, the collection has already achieved an impressive feat of hitting 1,729 in sales as of January 6, which was mainly pushed by Jay Chou’s star power.

The floor price started at 6.36 ETH and reached 0.158 ETH in May 2023. NFT Holders had the highest amount of owners at 4,886 during their first month, and the number has creased by 49.88% now.

How to Secure Investments in NFTs?

Many projects launch without proper research, and this makes them fail even if they start with hype and at a high floor price. To secure your investment in NFTs and avoid failing NFTs, you must look out for a few factors when considering investing in an NFT project, including exclusivity, the developer team, and the community size and engagement.

The exclusive NFT collections usually come up with a unique idea from a creative developer team. These projects are far from the copy-paste jobs that use other people’s concepts, art styles, utilities, marketing plans, and merchandise. If the NFT wholly or partially plagiarizes other efforts, this should raise a red flag to investment.

If a team behind an NFT project does not have a vision for the future of its collection, it will be at a loss for attracting more investors as well as supporting its NFT holders. The lack of rarity and uniqueness in a project that has thousands of competing NFT projects operating similarly will cause it to fade into the shadows of failing NFTs in the market.

To avoid failed NFT projects, it is a good idea to learn more about blue chip NFT projects; Blue chip NFTs are the best options if you are looking for a secure investment in NFTs. These NFTs, which include Bored Ape Yacht Club and CryptoPunk projects, keep their floor prices high due to the developer team’s good vision of the project’s future and the commitment of their NFT holders to the project. It is advised that investors spend enough time searching various aspects of an NFT project before investing in it.

FAQs

How many NFT projects fail?

On average, one in three NFT collections have failed for different reasons and have little or no trading activities in the market.

Can failed NFT projects make a comeback?

Once the floor price of an NFT project goes down, it is very difficult to return to normal again. However, there might be a chance that it will come back again.