From This Is Money:

Property in the priciest area of England and Wales cost a huge 25 times as much as in the cheapest spot, according to a new interactive map from the Office for National Statistics. It shows that one square meter of floor space, an area about the size of a red telephone box, costs £19,439 in the salubrious London borough of Kensington and Chelsea.

However, in the valley region of Blaenau Gwent, South Wales, the same amount of space costs just £777. Use the interactive map below to see how much a square meter of property costs in your local area and how it compares

I'm not clever enough to embed the interactive map, but it seems accurate enough to me. It's too coarse grained for proper LVT or Council Tax revaluations, because it's at local authority level and in many local authorities there is too much of a difference between the most expensive and cheapest areas, but where I live it's pretty much equally expensive all over the council area, so I can use that to illustrate the point.

It says just under £5,000 per sq meter. On that basis, our house should be worth about £650,000, a tad more than we paid for it three years ago. Seeing as typical build costs for a new build are £1,000 per sq metre, that means that the value of my house is 80% location value and 20% bricks and mortar, a percentage we can apply to the rental value to arrive at the location element/site premium.

All of which puts paid to the KLN that working out the site premium is difficult.

-------------------------

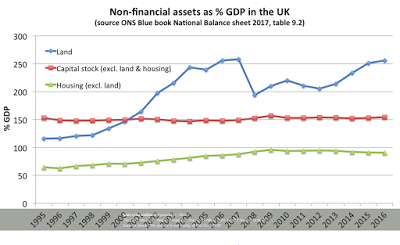

Via Josh Ryan-Collins:

Which sort of illustrates the point that as land and buildings are such a huge proportion of national wealth, there is no point having a general wealth tax, you might as well just tax land (secured on the land and the buildings thereon). Seeing as you can apply a much higher rate to immobile land than 'mobile' (or easily hidden 'wealth'), that means overall you can raise more money more efficiently by exempting all other forms of wealth. There's also the point that most other wealth is used to generate income, and that income is taxed, so most other wealth is already taxed, albeit indirectly.

Which neatly deals with another KLN, and the squealing from the lefties for a general 'wealth tax'.