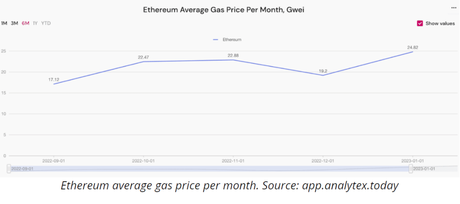

As user activity rises, the price of Ethereum gas rises 29% in January.

Ethereum block data show that while the average daily block production stayed largely unchanged, the average block size increased by 7% monthly.

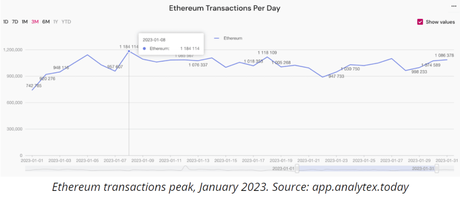

As 2023 began, the bitcoin sector seemed to have moved past the year-long darkness of 2022. Investors responded strongly to the long-awaited price changes, as seen by on-chain activity on the Ethereum blockchain.

Analytex’s analysis indicates that the average gas cost for Ethereum (calculated using the smallest $1,674 increment) is $1,674.

In January 2023, the gwei denomination grew by 29.27%. The study looks at gas prices from January to December 2022 and attributes the monthly increase in the average gas price from 19.2 gwei to 24.82 gwei to an increase in user activity.

According to the study, the average number of unique active Ethereum wallets each day fell by about 10% to 387,475, which is the lowest amount in the previous six months. The average percentage of separate active smart contracts increased by 6.74 percent throughout this time.

Ethereum block data show that while the average daily block production stayed largely unchanged, the average block size increased by 7% monthly. The monthly average of daily block data has stayed consistent at about 0.01% since the Merge. The overall monthly Ethereum block size in January increased from December’s 16.1 GB to 17.24 GB, a 7.08% increase.

The report shows inconsistent data indicators throughout. The quantity of transactions and distinct active wallets has fallen since December. The average price of gas and the quantity of active smart contracts were both up, according to the Ethereum activity index.

Increasing interest from both current blockchain users and smart contract developers, says Analytex, is implied by this.

Decentralized finance (DeFi) protocols showed an increase in the total value locked in January, according to a survey by DappRadar. A 26% increase from December 2022 brought the market’s staked assets to $74.6 billion.

Ethereum’s impending Shanghai upgrade is also increasing staking in DeFi since withdrawals from staking contracts are anticipated to be released. Due to the popularity of liquid staking derivative systems, Lido Finance surpassed Maker DAO as the largest DeFi protocol in January.

Content Source: cointelegraph.com