More end-of-week tidbits: I'll leave it to you to spot the common theme of this batch.

Nick Hanauer at the Moyers & Company blog:

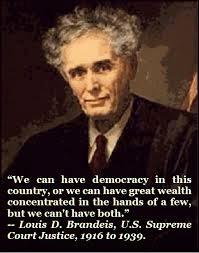

Inclusive economies always outperform and outlast plutocracies. That’s why investments in the middle class work, and tax breaks for the rich don’t. The oldest and most important conflict in human societies is the battle over the concentration of wealth and power. Those at the top will forever tell those at the bottom that our respective positions are righteous and good for all. Historically we called that divine right. Today we have trickle-down economics.

Deirdre Fulton at Common Dreams:

Nearly half (48 percent) of Americans believe that the American Dream once held true but does not anymore, while 7 percent say the American Dream was always an illusion. Most Americans (55 percent) believe that one of the biggest problems in the country is that not everyone is given an equal chance to succeed in life.

Heather Digby Parton at Salon:

Oddly, that same poll shows that far more Republicans than Democrats believe the American dream is still operative, 55 percent to 32 percent. If you wonder why that is, perhaps it’s because many Republicans have a completely different definition of the American dream. They don’t see it as a middle-class goal at all, much of it made possible by the promise of a decent education and secure retirement, guaranteed by the full faith and credit of the U.S. government. No, they believe that the American dream is getting filthy rich.

Dave Gilson at Mother Jones:

Today, another look at how middle-class incomes have been stuck in neutral while the rest of the economy has grown. In 2012, the median household income (adjusted for inflation) was the same as it was in 1996.

Paul Krugman in New York Times:

Extreme income inequality and low taxes at the top are back. For example, in 1955 the 400 highest-earning Americans paid more than half their incomes in federal taxes, but these days that figure is less than a fifth.

David Gilson for Moyers & Company:

A stunning 95 percent of income growth since the recovery started has gone to the super wealthy. The top one percent has captured almost all post-recession income growth.