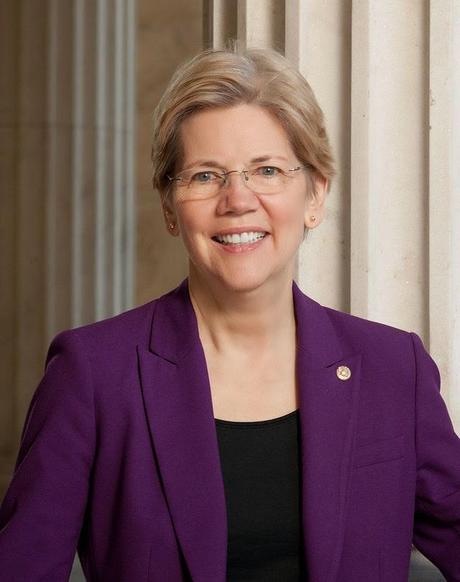

Yesterday was the third anniversary of the date the Consumer Financial Protection Bureau (CFPB) became an independent agency, and began working to protect Americans from the shenanigans of Wall Street and the giant banks. One of the chief architects of that bureaus creation was Elizabeth Warren, and she was originally destined to be its first agency head.

Yesterday was the third anniversary of the date the Consumer Financial Protection Bureau (CFPB) became an independent agency, and began working to protect Americans from the shenanigans of Wall Street and the giant banks. One of the chief architects of that bureaus creation was Elizabeth Warren, and she was originally destined to be its first agency head.But the Republicans decided they couldn't allow the president to have his first choice leading the agency -- so they blocked the nomination of Warren. It turned out to be a huge mistake for them, because she then ran for the Senate in Massachusetts and got elected. She is now a constant thorn in the side of Wall Street and the giant banks, and is in a good position to protect the CFPD from Republican attempts to destroy or weaken it.

Yesterday, Senator Warren send the following e-mail to her supporters, celebrating the anniversary of the CFPB. I thought it was excellent, so I reprint it here in case you haven't seen it.

Not long ago, I was at a McDonald's when a man came over, held out his hand and said he had been having trouble with a fee his bank had charged. It wasn't huge, but he said the bank should not have charged him. He called and argued, talked with customer relations, asked to speak to a manager -- and he got a big, fat zero.

Then he said he remembered about the new Consumer Financial Protection Bureau and told the bank he would file a complaint. They put him on hold and then came back and said they would reverse the fee. The agency worked.

Today is the fourth anniversary of Dodd-Frank, the law that established the Consumer Financial Protection Bureau -- and the third anniversary of the date the CFPB became an independent agency. And in those three years, the agency has done a lot to help level the playing field.

- The CFPB has forced big financial companies to return more than $4 billion dollars to consumers they cheated.

- The CFPB has put in place rules to protect consumers from a whole host of dangerous financial products and to make sure that companies can't issue the kinds of deceptive mortgages that contributed to millions of foreclosures.

- The CFPB has helped tens of thousands of consumers resolve complaints against financial institutions that cheated them.

The big banks spent more than a million dollars a day lobbying against financial reforms, and top lobbyists said that killing off the consumer agency was their number one priority. Even now, the Republicans continue the attack, introducing bills that would take the legs out from under the agency.

We didn't have the lobbying muscle or the money that the big banks had. But we got that agency because we fought for it. We joined forces online and through groups, and we made our voices heard. And now, after three years, it's starting to work.

I smiled at the guy who said he got his money back. I smiled because I love to hear how the CFPB works. But mostly I smiled because it reminded me of what we can do when we fight.

Happy anniversary! Elizabeth