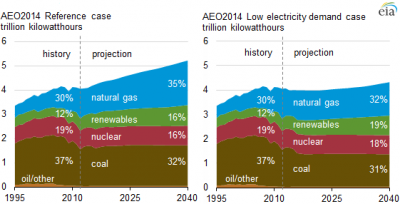

U.S. electricity generation by fuel. (Source: U.S. Energy

U.S. electricity generation by fuel. (Source: U.S. Energy Information Administration, Monthly Energy Review and Annual Energy Outlook 2014)

In EIA’s Annual Energy Outlook 2014 Reference case, electricity generation is expected to increase by 29% between 2012 and 2040, at an average annual rate of 0.9%, to meet steadily increasing demand. In the recently released Low Electricity Demand case, total electricity use in 2040 is just 7% higher than 2012 levels. Under lower electricity demand growth, the share of generation from coal and natural gas declines compared with the Reference case, while the shares of generation from nuclear and renewables increase.

Total electricity sales declined in four of the five years between 2008 and 2012, driven by declining sales in the industrial sector and flat sales in the residential and commercial building sectors. Although industrial sales have shown some recovery since the 2009 recession, there are a number of factors that could contribute to slower demand growth in the future across all sectors, including changing customer behavior, increased use of distributed generation, and additional efficiency standards. The Low Electricity Demand case projects lower demand in 2040 across all sectors compared with the Reference case, through assumptions related to efficiency improvements and costs of new technologies, specifically:

- More efficient technology choices in the residential and commercial sectors

- Efficiency improvements in building shells

- Energy savings in industrial motor technology

- Lower costs for new distributed generation technologies such as solar photovoltaic (PV) installations on residential and commercial buildings

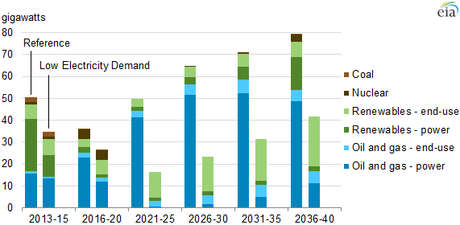

Elelcric generation capacity additions by fuel. (Source: U.S. Energy Information Administration, Annual Energy Outlook 2014)

In the Low Electricity Demand case, little new generating capacity is added in the power sector after planned capacity additions are completed. There are no new additions of coal or nuclear capacity after 2020, and only 22 gigawatts (GW) of new natural gas capacity is added in the power sector after 2020. Significant amounts of new renewable capacity are added throughout the projection, with more than 80% of these additions in the end-use sectors as a result of the lower cost assumptions for distributed solar PV. The lower levels of demand and lower electricity prices drive additional retirements of both coal-fired and oil and natural gas-fired capacity in the power sector, while nuclear retirements are unchanged from the Reference case. These changes in capacity additions and retirements directly affect projected generation by fuel:

- Natural gas generation grows by 11% between 2012 and 2040 in the Low Electricity Demand case to 1,368 billion kilowatthours, compared to 50% growth in the Reference case.

- By 2040, generation from coal declines by 12% from 2012 levels to 1,332 billion kilowatthours, 20% below the 2040 Reference case generation.

- Nuclear generation remains relatively stable, growing just 1% between 2012 and 2040 to 779 billion kilowatthours.

- Generation from renewable technologies grows significantly in this case, by 60% in 2040 relative to 2012 levels to 803 billion kilowatthours, with half of the increase attributed to solar PV generation in the end-use sector. This increase in the end-use sector renewable generation is much greater than in the Reference case, due to the lower-cost assumptions specific to the Low Electricity Demand case. Power sector renewable generation, however, is 18% below the level in the Reference case in 2040.

Because the lower future electricity demand results in large reductions in both coal- and natural gas-fired generation, total carbon dioxide (CO2) emissions in the power sector decline from 2012 levels by 13% by 2018, and remain 13%-14% below 2012 levels throughout the projection period. In contrast, CO2 emissions in the power sector increase by 11% between 2012 and 2040 in the Reference case.