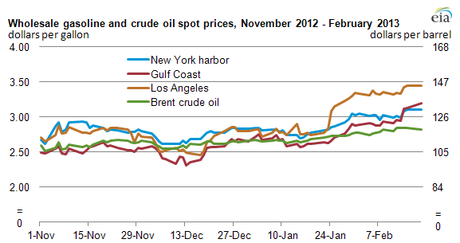

Wholesale gasoline and crude oil spot prices, November 2012—February 2013 (Credit: EIA, Data source: Bloomberg)

Gasoline prices are going up—since the start of this year an average price for a gallon of regular gas have risen by 45 cents, reaching $3.75 per gallon on February 18. U.S. Energy Information Administration explains that the reason for this is in part the higher crude oil prices. The most of the price growth is, however, due to increased differential between the price of crude oil and petroleum products extracted from it (so-called crack spread).

Between January 1 and February 19, the price of Brent crude oil—the waterborne light sweet crude grade that drives the wholesale price of gasoline sold in most U.S. regions—rose about $6 per barrel, or about 15 cents per gallon. A simple calculation, which modestly understates the role of higher crude prices to the extent that crude price increases during December 2012 were still not fully passed through in retail gasoline prices at the start of 2013, suggests that about two-thirds of the rise in gasoline prices since the start of the year reflects higher gasoline crack spreads.

Some of the factors contributing to rising crack spreads (or margins) for gasoline, and therefore to rising retail gasoline prices, include:

• Refinery outages. There have been multiple refinery outages, both planned and unplanned, that reduced U.S. capacity to manufacture gasoline.

• Global demand for petroleum products. Year-over-year global product demand is up, and further rises are expected. That rise in demand affects domestic refinery utilization rates, maintenance needs, and product balances.

• Prior low crack spreads. Throughout much of November and December 2012, gasoline crack spreads were very low, and in some cases negative (a barrel of gasoline was worth less than a barrel of Brent crude oil).

While these factors have played an important role, other factors, such as preparations for the seasonal switch to summer grade gasoline, may also have contributed to recent short-term movements in wholesale gasoline prices that are reflected in crack spreads.

Despite the recent increases in wholesale and retail gasoline prices, there are indications that gasoline crack spreads are beginning to ease. However, the short-term outlook for gasoline prices remains volatile. It is possible that a part of the rise in wholesale prices has not yet been fully reflected in pump prices.

A more in-depth analysis of this trend is discussed in the U.S. Energy Information Administration’s February 21 edition of This Week in Petroleum.