World liquid fuels and global inventory net withdrawals charts. (Source:

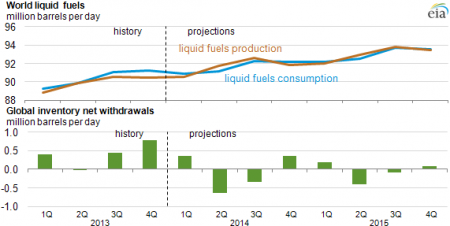

World liquid fuels and global inventory net withdrawals charts. (Source: U.S. Energy Information Administration, Short-Term Energy Outlook February 2014)

The U.S. Energy Information Administration (EIA) released a Short-Term Energy Outlook (STEO) supplement that assesses some of the major uncertainties in EIA’s 2014-15 global petroleum and other liquids (or liquid fuels) supply outlook. EIA forecasts that the supply of global liquid fuels will grow year-over-year by 1.7 million barrels per day (bbl/d) in 2014 and 1.4 million bbl/d in 2015. Projected world supply growth is driven by countries outside of the Organization of the Petroleum Exporting Countries (OPEC).

With any forecast, there are uncertainties that will result in global liquid fuels supply being higher or lower than expected. The uncertainties in the short-term global supply outlook include:

Unplanned global supply disruptions. EIA estimates that unplanned global supply disruptions averaged 2.6 million bbl/d in 2013, about one-third higher than the previous year. OPEC crude oil supply disruptions averaged 1.8 million bbl/d in 2013, reaching 2.6 million bbl/d by the end of the year because of increased disruptions in Libya. The issues underpinning the outages in many countries are unresolved, resulting in uncertain oil production outlooks for those countries.

U.S. oil production growth. Uncertainty in onshore production forecasts for the United States comes primarily from upside supply risks. Technological innovation may result in a faster rise in drilling productivity than currently forecast. Should this occur, EIA’s current forecast for onshore Lower 48 states oil production, which shows a rise from 5.7 million bbl/d in 2013 to 7.1 million bbl/d in 2015, could understate actual production growth.

Oil production in the federal Gulf of Mexico (GOM) is forecast to grow from an average of 1.3 million bbl/d in 2013 to 1.6 million bbl/d in 2015. While the GOM forecast is based on current and planned drilling projects, there is considerable uncertainty because of potential project delays and hurricane or maintenance outages.

Kazakhstan’s Kashagan oil field. EIA forecasts that the Kashagan field (located in the Caspian Sea), which first started production in September 2013 but suspended it to address pipeline leaks in the following month, will restart production in the second half of 2014. The Kashagan Field is expected to ramp up in 2015 but remain below the field’s phase one target of 370,000 bbl/d because technical challenges and high development costs may limit its expansion.

North Sea maintenance. The main uncertainties surrounding North Sea maintenance are the duration of the maintenance period, the production volume offline because of maintenance, and unexpected outages that may occur during maintenance.