A short while ago, I tweeted that a show entitled “Economists Say the Funniest Things” – where economists opine on issues outside their domain – would make for good watching by those of us who inhabit the real world. Unfortunately, I can’t afford a show, so I’ll settle for a blog post.

I have previously posted on ‘economic imperialism’, but the examples in this post are, to put it bluntly, less serious, often crossing the line into simply silly. Some economists like to transpose their incentive-driven, utility-maximising agents onto complex social problems, and claim that they have discovered the elegant, underlying mechanics underneath all the noise that the other social sciences study. They will also argue that those who object to their framework do it simply because they don’t like or understand maths, or because they can’t stomach the often unpalatable conclusions of the model. In fact, it is these economists who are seemingly unable to comprehend the phenomena they purport to study, preferring instead to solve equations, which they label ‘models’, but which do not actually ‘model’ the world at all, and which often seem to lead the economist to ridiculous conclusions.

I will put a standard disclaimer out there: I’m not so much attacking the entire economics profession as the ‘pop’ economics that you find in books, on the internet and, sadly, sometimes in policy circles. I hope many economists – those who are able to comprehend history, the complexity of human behavior and above all the difference between models and reality – will find these examples equally absurd.

Economists do psychology

Naturally, the sometimes infuriating Freakeconomics craze could warrant an entire post, as their ‘antics’ have angered many, including other economists. However, I am going to focus here on one of their less covered arguments: a story about incentives, which is at the beginning of their first book. It provides a nice introduction to wrongheaded economic imperialism, as this wooden insistence on how, underneath everything, people are essentially driven by clear incentives underlies many of economist’s attempts to try their hand at other disciplines.

The story goes like this: an Israeli day care center found that parents were picking up their children too late, so they introduced a small charge of $3 to try and disincentivise lateness. However, instead of discouraging this behaviour, the payment served to legitimise it and buy the parents piece of mind. The result was that lateness actually increased. Bizarrely, the Freakonomics duo decided that this story is consistent with economist’s way of thinking, and used it as an introduction to the idea that “incentives matter”. They argue that people actually face three different types of incentives: economic, moral and social. The idea is that the charges “substituted an economic incentive for a moral incentive (the guilt)”, with the implication that the daycare center simply didn’t get the amount right. However, if this were true, treating guilt would be as simple as paying somebody that you had wronged.

The way people respond to incentives is in fact highly complex and unpredictable. Incentives that are too big or too small can have perverse effects. What’s more, how people will respond to any incentive depends on the perceived motives of the person offering it, and the implied motives of the person receiving it. Studies show that incentives can easily backfire if these motives are questionable, something that has had an impact on the field of organ donation: when people were offered money for donating, donations decreased. People simply no longer felt that they were helping people, only that they were making a bit of money. The Freakonomics guys do not engage with any of these well established psychological tendencies; they simply select three arbitrary and incommensurable concepts and proceed as if their analysis were obviously true. But it’s clear that, contrary to their mantra, claiming to be able to predict people’s response to incentives with certainty is simply a fool’s game.

Economists Do History

Historians – at least, those who aren’t Niall Ferguson – try to emphasize context, combat euro-centric (and therefore usually capitalism-centric) narratives, and endlessly struggle against ‘Whig’ history, which suggests that history has naturally culminated in contemporary societies. History is therefore a prime stumbling ground for economists, whose models generally take place in a theoretical ‘vacuum’, take capitalist institutions and social relations as a given, and often model the economy as a deterministic time path or as in equilibrium. It seems that economists tend to see the ‘people respond to incentives’ behavior outlined above as underlying history, and therefore believe that events naturally culminated in capitalistic behaviour; of course, the corollary is that deviations from this were caused by bad policy, externally imposed by governments.

This type of thinking is clear in Evsey Domar’s serfdom model, which attempted to explain the end of serfdom through notions of its profitability to the landowner. The model argues that if land is too plentiful relative to labour, this results in competition among landlords for workers, which drives wages up, and subsequently it becomes more profitable for landlords to use the institutions of serfdom and slavery to ‘put down’ labourers, rather than employ them for wages. Conversely, if land is scarce relative to labour, wages will remain low enough for wage labor to be profitable, and serfdom and slavery will disappear. Domar suggested that this explained the end of serfdom in Russia in the late 19th Century.

To be fair to Domar, he was more than ready to acknowledge the limitations of this model. One person who was less so, however, was Paul Krugman, who has used it as an illustration of why he considers economics the superior framework for social science. According to Krugman, models like Domar’s are an indication of how economics is “rigorous” and makes “generally correct predictions”. This latter characterisation is especially bizarre, because Krugman goes on to acknowledge that there are large areas of history the Domar model doesn’t explain, such as why serfdom was not reinstituted in Europe after the Black Death wiped out a large amount of the labor force, pushing up wages. According to Krugman, events such as these are “puzzles”. Surely they are just an indication that economist’s framework isn’t so great?

In fact, the Domar model actually doesn’t do a great job of explaining its prime example of 19th century Russia. The serf agreement was not simply forced onto peasants, but was a three way deal between the state, landlords and peasants: peasants has rights and were in many ways ‘free’, as long as they produced enough for the gentry, who were subsequently available for the military. What’s more, the 1861 ‘emancipation’ from serfdom was not instituted by the landlords based on considerations of profitability; the move was centrally directed by the state, based mostly on imperialist/defensive considerations after the Russian defeat in the Crimean War. Many landlords were resistant to the change, and though the legislation was passed a large number of restrictions remained, some effectively extending serfdom.1 Overall, the incentive-based behavior outlined by Domar is irrelevant to the broader story of social and political change.

The root of the issue is the assumption is one that is not atypical in economics: the idea that the capitalist institution – in this case wage labor – is the ‘natural‘, underlying tendency, upon which artificial institutions like slavery and serfdom are ‘forced’. Indeed, Domar repeatedly refers to the wage labourer as the “free man”. But history shows us there are no natural, underlying institutions: capitalist, feudalist and slave(ist?) institutions are all complex, and their introduction is fragmented. Therefore, at worst, the Domar model is trivial: it suggests that if wage labour, serfdom and slavery are all easily available to landlords, they will choose the one most beneficial to them (in fairness, Domar acknowledges in one place that we might “question the need for [his model]“. However, you don’t need an economist to tell you this, and neither would they be able to tell you how such a situation arose in the first place. A historian would.

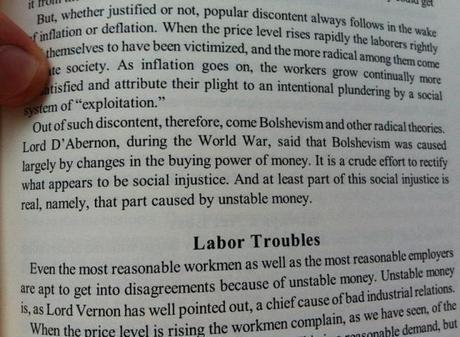

The next example continues our journey through Russian history, though perhaps that is stretching the definition of the word ‘history’. This one reminds me of a story – probably an urban myth – about a student at the University of Chicago, who fell asleep in one of Milton Friedman’s lectures. Friedman was furious, and demanded the student answer whichever question he had just asked. The student responded “I don’t know the question Professor Friedman, but the answer is a change in the money supply”. It’s a funny joke, until you realize that economists (in this case Irving Fisher*) actually write things like this:

There you have it, folks: the Russian Revolution was caused by price instability, itself probably caused by changes in the money supply. This is despite the fact that Russia wasn’t really capitalist at the time, but largely feudalist, and it was the scarcity of land and food, not money, which robbed peasants of their lot. It ignores the undeniable role of World War 1, which devastated large areas of the country and created an armed, disenchanted underclass accustomed to conflict. Contrary to what Fisher implies, I’m pretty sure that an oppressive regime drafting you for a largely pointless war, or taking away what little you have, does not only “appear to be social injustice”, but is social injustice, and is peripheral to “changes in the buying power of money”, themselves symptomatic of broader instability – economic or otherwise.

An economist does sociology (and more)

Perhaps nobody better characterises the term ‘Economic Imperialism’ than University of Chicago economist Gary Becker. Becker has used economist’s toolkit to craft theories for everything from crime to addiction to the family, and in fact he won the Sveridges Riksbank Prize for his efforts (yes, it’s a fake Nobel yada yada). Naturally, Becker’s models were praised because they were rigorous and mathematical (a quick google search will reveal multiple people fawning over him for god knows what reason). While Becker himself is quite modest and seemingly well intentioned, his theories about human behavior are so far from the truth it’s a wonder they have garnered any respect at all.

The first of these, Becker’s theory of ‘Rational Addiction‘ (amusingly parodied in this video), suggests that those who are addicted to drugs are just following a rational long term utility-maximisation plan. This is the sort of thing that a normal person looks at and goes “erm, no”, as it is completely at odds with the internal and external struggles that addicts commonly face. “I’m just maximising my satisfaction” sounds like something an addict will tell you, but analysis of addiction generally has to go beyond that to be of any use.

It almost goes without saying that do not plan their addiction because they think it will maximise their future satisfaction, and that it is well established people in general do not behave this way. Some economists have tried to use vague data points – such as the evidence that smokers adjust their habits due to expected tax increases – to ‘show’ people are rational and forward looking. However, it is obviously a leap from this highly stylised behavior to suggest that smokers are perfectly rational and informed forward looking utility maximisers. In fact, the observed behavior of addicts suggest that addiction is generally involuntary, and people become addicted because they are unaware of, or underestimate, the risks of addiction. Often it is not clear why people are addicted, even (or especially) to themselves.2

On top of this, the actual mechanics of addiction used in the theory are questionable. ‘Rational addiction’ occurs because past consumption of something builds up a ‘stock’ (with typically undefined units), increasing the pleasure you get from consuming it now. However, in the real world addiction is far more complex than this, and is associated with numerous, sometimes conflicting effects. For example, the theory of rational addiction cannot explain the ‘empty compulsion’ addicts feel once the brain has adapted or become satiated, resulting in a disappearance of the ‘high’, but not of the desire to continue, even if the addict’s conscious brain conflicts with this desire. What’s more, different drugs create different reactions inside the brain (not to mention psychological reactions): opiates like heroin tend to mimic certain neurons, whereas alcohol inhibits the brain’s ability to release (and coordinate the release of) neurons. These are disparate processes that cannot be captured by utility. Neurologists, psychologists and social workers, however, have models that can explain such nuances, which are certainly the ones I’d turn to if I wanted to understand and deal with addiction.**

Becker’s second major theory of human behavior is New Home Economics, or the theory of the family, which started with Becker’s 1965 paper on the allocation of time and culminated in his 1981 Treatise on the Family. As would be expected, the theory models families as a collection of rational agents optimising various preferences and operating according to their respective specialisations, and so it can easily be criticised along previously mentioned lines. However, I will not go over these arguments again.

Instead, the critiques I find of interest here are those by feminist economists, who generally take issue with Becker’s almost hilariously stereotypical depiction of the family. The head of the household – implied to be a man – is modeled as an ‘altruistic’, breadwinning agent who coordinates everything and makes sure it is OK, while the rest of the family accept his judgment as in their best interests (in other words, he is a benevolent dictator). Housework is done by the woman (as women have a ‘comparative advantage’ in housework), and is not counted as a contribution to the family pot, implying that said work is not similarly ‘altruistic’. One is forced to wonder whether the theory would be more suited to the 18th or 19th centuries – clearly, it precludes the study of non-traditional families.

The theory has many other conceptual and explanatory problems. It could be viewed as an attempt to deal with the troublesome existence of the family unit by arguing it can be represented by a single optimising agent, similar to the way some perfectly competitive models deal with the firm. Economist Barbara Bergmann noted that the theory seems to lead to the “conclusion that the institutions depicted are benign, and that government intervention would be useless at best and probably harmful.” Yet this depiction is completely at odds with the obvious fact that families often exhibit conflicting or self destructive behavior. Bergmann goes further, arguing that Becker’s theory more generally leads to “preposterous conclusions”, among which is the ‘economic argument’ that women should embrace polygamy, and the idea that the decision to have children is only a function of parent’s ‘altruism’ and of the rate of interest. While the theory may be vaguely consistent with a few stylised facts about how income affects families, these are largely trivial and do not need Becker’s theory to explain them.

The third and final theory is Becker’s theory of crime, which unsurprisingly argues that criminals simply perform crimes because the benefits outweigh the costs. Criminals were said to calculate the ‘expected utility’ of a crime, which multiplies the probability of being caught times the price for being caught. Becker’s cost-saving solution was to increase penalties but reduce enforcement, and also to increase enforcement of more costly crimes (which, in practice, means increasing enforcement in wealthy areas and decreasing it in poor areas).

To be fair, Becker always warned against implementing an extreme version of his view, but as is often the case the caveats were not taken on board and ideas like his seemed to have a substantial (negative) impact on law enforcement (the fact that Becker has a blog with notable judge Richard Posner should be a clue that he has an influence on the legal profession). Over the 1970s and 80s, law enforcement seemed to follow the Chicago-style prescriptions: punishments were increased, with mandatory sentencing introduced and incarceration rates rising. Meanwhile, particularly in cities, the number of police officers was reduced, as was general enforcement and surveillance. The well-documented wave of crime that followed/coincided with this, culminating in the late 1980s, led to the realisation that this approach was flawed, at which point different approaches to law enforcement were taken and crime started to go down. (I’m not going to go over the Freakonomics abortion explanation for this, though this paper has been acknowledged to show that at the very least the effect was smaller than they thought).

Criminologists generally find that real criminals behave the opposite way to those in Becker’s theory: what matters is not the punishment for a crime, but the likelihood of being caught. Most criminals do not even consider the punishment at all when committing a crime, particularly because many of them are under the influence of drugs when they do it. What’s more, punishments that are too severe can backfire, either because they end up being impossible to enforce or because, if a punishment is severe enough, a criminal may as well commit a more heinous crime. I expect an economist like Becker might respond that this just shows that criminals have ‘interesting utility functions’. I would respond that they need to get a grip on reality.

Conclusion

Economists are prone to thinking their framework is neat, useful and even universal, but actually it is just quite a naive and one-dimensional view of human behavior. When economists take their toolkit to other social sciences, they’d like to believe that they ’simplify’ in such a manner that they get to the ‘underlying’ mechanics of issues; but they actually ‘simplify’ in such a manner that they often assume everything relevant away. This may make for compelling mathematics and entertaining books, but when we actually venture out into the real world these theories at best only to touch on the surface of the story; at worst, they simply become absurd.

Footnotes

*This is from Fisher’s book The Money Illusion. The chapter in question is fully available online here, and no, it doesn’t look any better in context.

**A part of me says that someone like Becker probably wouldn’t rely on his theory, either. There is a joke about an academic economist who was offered a position at another university, and was conflicted about the choice. One of his students asked him why he didn’t simply choose the rational option. Puzzled, the professor responded “come on, this is serious”.

References

1. Crime, Cultural Conflict, and Justice in Rural Russia, 1856-1914 by Robert Frank, pp. 7

2. The Theory of Addiction by Robert West, pp. 32-36, 75