The simplistic view is that if we allowed more houses to be built, prices would come down.

One of the fatal flaws in this theory - apart from there being no real life evidence to back it up - is the assumption that demand is fixed. It is not. High prices in e.g. London could be solved by allowing more homes to be built - but only if there were a complete freeze on migration to the capital (whether from elsewhere in the UK or elsewhere in the world).

So supply creates its own demand. There are three million households in London and three million homes. If they built another million homes, another million households would move to London. By and large prices would not change. With agglomeration benefits, they would actually go up slightly, but that is another topic.

The next fatal flaw is the theory assumes that land is uniform and freely interchangeable. For sure, if there was a sudden glut of coffee (and no protectionist intervention, such as price subsidies or deliberate destruction of the excess crop), coffee prices would go down. That is because coffee is freely traded around the world and is homogeneous. A coffee bean in the UK is the same as a coffee bean in New Zealand.

But each and every plot of land is unique and a mini-monopoly in its own right. So each has its own value which cannot be influenced by the owner.

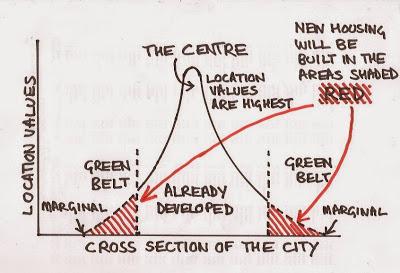

Let's draw a cross section of a typical city; land values are highest in the center and then tail off towards the margin. In the absence of planning restrictions and the Hallowed Green Belt, builders would build all the way out to the margin where land values are virtually zero.

But the Green Belt restricts them; if they were allowed to build a bit further out, they would be building in the areas shaded red, and they would only build them if they know they can sell them; i.e. for every home they build, one new household moves to the city. Supply creates its own demand. The price of these homes (or indeed commercial buildings) would of course be lower than those nearer the centre, but the price of existing homes would not change much (and might go up).

By and large, by allowing more development in the red shaded areas in high value areas (London and South East), it would only be the price of homes in towns from which people emigrate which would fall - there would be the same number of homes but fewer households, so same supply, less demand. The effect of dis-agglomeration would push them down a bit further still, i.e. all the ambitious people have moved elsewhere (compare West with East Germany).