DoorDash Has Pulled Ahead of GrubHub, Uber Eats in the On-Demand Food Delivery Race

DoorDash began with a simple mission: to enable every merchant to deliver.

It has come a long way from keeping students at Stanford well fed. A year ago, DoorDash looked like just another meal delivery app maker on its way out. The company was burning cash as it struggled to stand apart from that of Uber Eats, GrubHub Inc. It had recently sold shares that valued the company at less than its previous funding.

Then something strange happened: Saudi-backed SoftBank Group Corp swooped in to lead a fresh round of investment totaling $535 million. It will likely value the company at about $13 billion. DoorDash has started turning a profit.

DoorDash used the money to expand from 600 cities to 3,000, and another round of venture funding tripled its value, to $4 billion.

DoorDash is now the fastest-growing business in its field. The delivery company tripled annual sales in 2018 and recorded net revenue of $107 million in November.

Core Concept Of DoorDash

Core Concept Of DoorDash

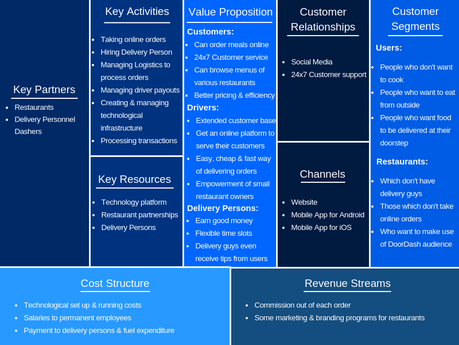

DoorDash is an On-Demand logistics based startup, that acts as an intermediary between merchants & prospective buyers who wish to get products from local merchants delivered at their doorstep.

The delivery startup currently delivers on-demand food from partner restaurants but is modeling itself to be a generalized logistics startup in the long run.

Its business model is designed to enable users to find a restaurant & order food. It gives restaurants access to extended customer base. Over and above it offers people employment for delivering food.

DoorDash Basic Facts

DoorDash Basic Facts

DoorDash Business Model Outline

DoorDash Business Model Outline

Smartly puts together the three stakeholders

Partner Restaurants, Drivers aka "Dashers" and Users.

Powerful technology - to optimize experience and cash flow of the three stakeholders - Extremely well-written, complicated software in the back-end.

The model is easy.

Doordash Revenue Model

Doordash Revenue Model

Its focus is prime on quality, and "the food almost always arrived hot."

Delivery Fees

Delivery Fees

Commission

Commission

This indicates that DoorDash that it has a decent amount of sway over restaurants.

Restaurants Pay for Advertising

Restaurants Pay for Advertising

Everybody Wins With DoorDash

Everybody Wins With DoorDash

Drivers - Dashers

It's not just about assigning orders. Getting drivers who deliver consistently well in all its 50+ markets in the US and Canada is not easy.

DoorDash provides 3rd party insurance to Dashers that covers up to $1,000,000 in bodily injury and property damage. They also keep 100% of the tips they earn. Finally, it recommends Dashers hang out in busy areas with lots of restaurants around so they can quickly swing into action!

Regarding payment to its drivers. The pay varies with cities and depends upon distances, the complexity of the order and so on. For instance, in Los Angeles, DoorDash pay rate is calculated as $1 + pay boost.

Partner Restaurants

DoorDash allows restaurants to sell more food without changing their seating facilities. Whether a restaurant has its delivery service or not, partnering with DoorDash gives them access to markets they probably wouldn't have access to.

Restaurants also get an opportunity to promote their businesses to a targeted audience at a relatively affordable cost, when they choose to advertise on the DoorDash platform.

A typical advantage to Dashers and partnering eateries is the access to the massive technology and analytics that DoorDash has built.

And The Winner Is...

And The Winner Is...

DoorDash is now the top on-demand food delivery service after knocking off legacy leader GrubHub in consumer spending market share, according to March data released by 3rd-party research firm Edison Trends.

It is also valued higher than Dominos Pizza, and worth nearly half as much as KFC, Taco bell and Pizza Hut owner Yum Brands.

When it comes to dollars spent, DoorDash owns 27.6% of the market. GrubHub, which has steadily lost ground accounts for 26.7%. Uber Eats has flat lined over the last 11 months, takes the 3rd spot claiming 25.2% of the market.