%%bloglink%%

It seems every day I’m being warned by newspapers, magazines and websites of “financial bogeymen” waiting under my investment bed ready to jump out and turn my dream portfolio into a nightmare. One of these “bogeymen” I hear people are afraid of is rising interest rates.

I, for one, am not afraid of rising interest rates and in fact, I’m looking forward to them and here’s why:

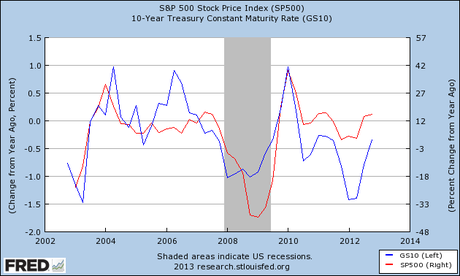

This chart shows the year over year percentage change in the S&P 500 Stock Index versus the year over year percentage change in 10-Year Treasury Bonds. As you can see there is a very strong correlation between rising interest rates and rising stock prices.

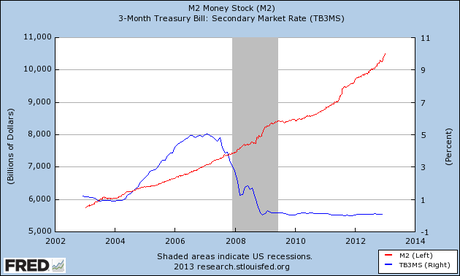

This chart shows the amount of money, as measured by M2, people are holding in the various types of bank accounts versus the interest rate these types of accounts pay, as measured by the 3-Month T Bill which is currently 0.25%.

Despite the fact that these accounts pay almost nothing in interest, the public has added almost $3 trillion in these account in the last four years.

Imagine how much extra income would be generated by if interest rates went up and banks started paying more than essentially zero on approximately $10.5 trillion in deposits.

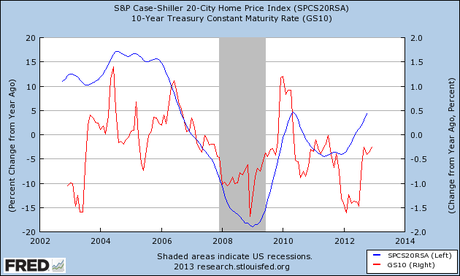

This chart shows the year over year percentage change in the S&P Case-Shiller 20 City Home Price Index versus the year over year change in 10-Year Treasury Bonds. One might expect as rates went down, home prices would increase as buyers would be able to borrow at lower prices allowing them to afford to more for a house yet the trend is the opposite: rising interest rates coincided with increasing home prices.

Credit Cards

I pay my credit cards balances off every month but in reviewing my most recent statements, the interest rates I would have been charged ranged from a low of 8.90% to a high of 21.99%.

According CreditCards.com, the national average credit card interest rate for 2012 was 14.93%.

Conclusion

Rising interest rates have a strong positive correlation to rising home prices and rising stock prices.

Low interest rates are essentially a “Tax on Savers”.

Credit card borrowers (and this represents a vast majority of Americans) are not seeing any benefit to today’s near zero interest rates has the national average credit card interest rate has been and continues to remain in double digit territory.

note: this article was originally written as a guest post at www.learnbonds.com