If you are running an online store with WooCommerce, you might be wondering how to handle sales tax. Sales tax is a complex and dynamic topic that varies depending on your location, products, and customers. In this blog post, I will explain how WooCommerce can help you collect sales tax data, but not collect or remit sales tax on your behalf. I will also show you how to set up sales tax in WooCommerce and how to use third-party services to automate your sales tax compliance.

WooCommerce Does Not Collect or Remit Sales Tax

WooCommerce is a powerful and flexible plugin for WordPress that allows you to create and manage an online store. One of the features of WooCommerce that many users appreciate is the ability to collect sales tax data. This means that WooCommerce can calculate the correct tax rate for each transaction based on the customer’s location, product type, and other factors. WooCommerce can also display the tax amount on the checkout page and the order confirmation email, and store the tax data in your order history.

However, WooCommerce does not collect or remit sales tax on behalf of businesses. It is the responsibility of the business owner to comply with their local sales tax laws and regulations. Failure to do so can result in penalties and interest from the relevant tax authorities.

Sales tax laws and regulations vary depending on the country and region in which your business is located, as well as the countries and regions where you sell your products. For example, in the United States, you may need to collect and remit sales tax in states where you have a physical presence (such as an office, warehouse, or employee) or an economic nexus (such as a certain amount of sales or transactions). In the European Union, you may need to collect and remit value-added tax (VAT) in countries where you have customers, unless you are below a certain threshold or use a special scheme.

Therefore, it is important to research and understand your sales tax obligations before setting up your online store with WooCommerce. You can consult with a tax professional or an accountant for specific advice on what or when to charge tax.

How to Set Up Sales Tax in WooCommerce

To set up sales tax in WooCommerce, you need to follow these steps:

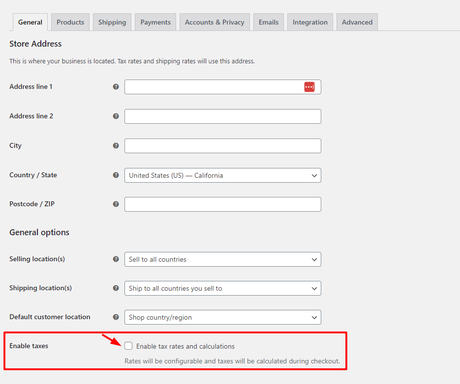

- Enable sales tax by going to WooCommerce > Settings in your WordPress dashboard and selecting the General settings tab. Activate the sales tax option.

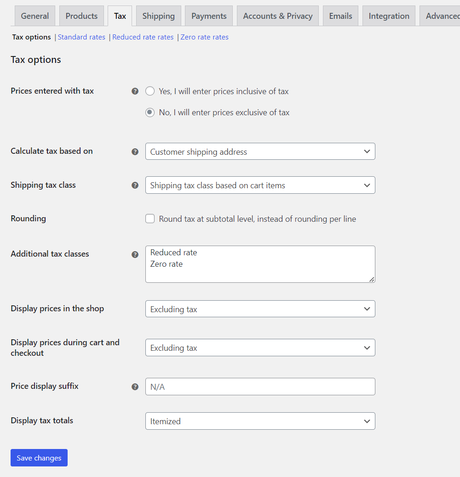

- Navigate to the Tax tab in WooCommerce > Settings.

- Set the tax rates. WooCommerce offers multiple options for your site such as if you want to add taxes with your price, shipping class, additional classes, and much more.

You can set up different tax rates for different regions and products by using standard rates or reduced rates. You can also set up zero rates for tax-exempt products or customers.

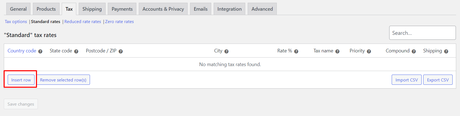

To add a new tax rate, click on the Insert row button at the bottom of the table. You can enter the country code, state code, zip code, city name, rate percentage, name, priority, compound option, and shipping option for each tax rate.

You can also import or export tax rates using CSV files by clicking on the Import CSV or Export CSV buttons at the top of the table.

- Save changes.

Once you have set up your tax rates, WooCommerce will automatically apply them to your transactions based on the customer’s location, product type, and other factors. You can see the tax amount on the checkout page and the order confirmation email, and store the tax data in your order history.

How to Automate Your Sales Tax Compliance

If you want to automate your sales tax calculation and filing, you can use a third-party service like TaxJar or Avalara that integrates with WooCommerce. These services can help you determine the correct tax rates for each transaction, collect and remit taxes to the appropriate jurisdictions, and generate reports and filings for your convenience.

To use these services, you need to sign up for an account with them and install their plugins on your WordPress site. Then, you need to connect your WooCommerce store with their service by entering your API key or credentials. You can also configure some settings such as enabling real-time rates, selecting nexus states or countries, choosing filing frequency, etc.

Once you have connected your WooCommerce store with their service, they will take care of your sales tax compliance for you. They will calculate the correct tax rate for each transaction using their database of updated tax rules and rates. They will also collect and remit taxes to the appropriate jurisdictions on your behalf using their automated filing system. They will also generate reports and filings for your records and audits.

Using these services can save you time and hassle from dealing with sales tax manually. However, they may charge a fee based on your transaction volume or subscription plan.

Conclusion

Sales tax is a crucial part of any ecommerce business, and it’s important to ensure that it is calculated and charged correctly. WooCommerce can help you collect sales tax data, but not collect or remit sales tax on your behalf. You need to comply with your local sales tax laws and regulations, and consult with a tax professional or an accountant for specific advice. You can also use third-party services to automate your sales tax compliance and make your life easier.

I hope this blog post helps you understand how sales tax works with WooCommerce. If you have any questions, please leave a comment below.

Interesting Reads:

How to Add Shipping Charges in WooCommerce

How to Sell Your Art on Fiverr

BuddyBoss Platform Review: All You Need to Know