If you owned shares of BSC (the former NYSE ticker symbol for Bear Stearns common stock) when Bear's share price was falling through during 2007 and early 2008, you may be somewhat pissed off by an admission that Bear made to the SEC.

If I had owned shares of BSC, I am pretty sure I would freak. I am positive that, if I was a Bear Stearns shareholder back then, I would have sold every single hare I owned immediately upon learning what Bear told the SEC in a letter dated January 31, 2008. The January 2008 letter, signed on behalf of Bear Stearns by SAM MOLINARO - at the time Bear's CFO and COO - says, among other interesting things, this:

We believe that based on the Company's level of involvement in subprime lending and the broader impact on global credit markets, a material adverse impact on the Company's financial condition, results of operations or liquidity is reasonably possible.

Translation: There is a real possibility that Bear Stearns' subprime exposure could cause the company to suffer severe financial damage.

Wait. I know what you are thinking. You were going to say something like this: So What? Everyone on Earth knows that Bear's mortgage exposure was a pretty big factor in the collapse of the investment bank.

True. But not everyone knew that on January 31, 2008. Certainly, there was a great deal of concern about Bear. And if you were a stockholder of the Bear Stearns Companies Inc. in 2007 and 2008, you were concerned about the value of your investment. After all, Bear was widely known as the king of mortgage securitization at a time when it clearly was definitely not (in the words of Mel Brooks playing Louis XIV in Brooks' classic History of The World, Part 1) "good to be the king." -BUT-Bear Stearns executives repeatedly addressed all that. They repeatedly denied that there was anything other than temporary problems based on difficult market conditions that were the natural result of an inevitable turn in the business cycle. Top executives devoted themselves to damage control. And the story they told did not vary. The short version of the fairy tale went like this- TOUGH MARKETS; REAL BUT TEMPORARY PROBLEMS; HEALTH BALANCE SHEET; AMPLE LIQUIDITY; BRIGHT FUTURE...* * *-THE REST OF THE STORYAfter shares of BSC peaked at a price north of $150 in January 2007, the stock began a long bumpy slide toward the abyss. Stockholders outside the small cloistered circle of truly informed insiders, were in a tough spot. The issue, of course, was whether to sell while the price headed south, or hang in there, ride out the storm and hope Bear's problems were temporary.

Senior management at Bear Stearns understood that they had a ton of influence over whether the market saw the Bear Stearns glass as half empty or half full.

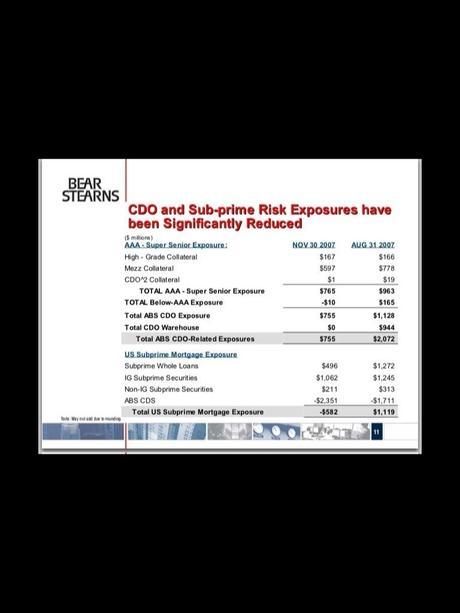

Bear's top executives pushed the half full angle. In other words, they decided to be extremely optimistic about the situation. For example, management claimed that, in formulating Bear's growth strategy, the executive committee had expected and accounted for trouble in the mortgage markets. Yes, they acknowledged market conditions were probably worse than anticipated. But Bear's unique expertise with distressed mortgages, they said, meant great things for Bear Stearns in the not too distant future. Management even portrayed the drop in the Bear Stearns stock price in a positive light. What could be good about the price slide? Management took the position that the market had overreacted to temporary market conditions and oversold the stock. Speaking at Bear's October 3, 2007 investor day, then CEO Jimmy Cayne called the stock a "compelling value."In his investor day speech later that morning, CFO Sam Molinaro expnded on Cayne's compelling value comment. Molinaro gave a detailed presentation to investors and analysts to show them why the price decline created an investing opportunity. Molinaro's argument was based on a comparison of Bear's then current price to book value ratio and Bear's similar price-to book calculations during a series of prior market crises.In each prior instance, the stock had quickly rebounded and investors who bought shares during other crises realized substantial gains. The problem with Molinaro's explanation was that Bear's true book value was really much lower than reported.

In any event, Bear Stearns' executives kept pushing silver lining scenarios through 2007 and early '08. This strategy was rational from their personal perpectives on because these guys owned a lot of stock. They had a vested interest in propping up the share price up for as long as they could.

--MISREPRESENTING EXPOSURE TO MORTGAGE RISK

In light of the admission in the SEC letter about a week earlier, there is a term for the message conveyed by this slide. That term is material misrepresentation. Another one is securities fraud.By Brett ShermanThe Sherman Law Firm

In light of the admission in the SEC letter about a week earlier, there is a term for the message conveyed by this slide. That term is material misrepresentation. Another one is securities fraud.By Brett ShermanThe Sherman Law Firm