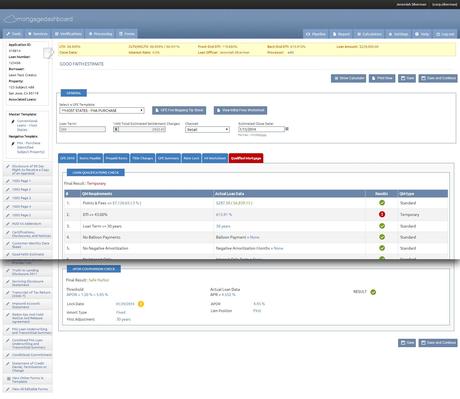

Answering Qualified Mortgage

Three weeks ago, MortgageDashboard responded to the Consumer Financial Protection Bureau’s new Qualified Mortgage & Ability to Repay rules by installing additional compliance alerts, an Ability to Repay-related worksheet, and a new tab that tests whether your loans are qualified mortgages. In today’s blog, Jeremiah Silverman from MortgageDashboard’s Support Team discusses some of the frequently asked questions concerning the new Qualified Mortgage rule. Three weeks later, it is clear that QM has caused more news, commentary, and debate than almost all previous mortgage rules in history. Demystifying the discussion, we have spelled out exactly how QM affects lenders.

To see MortgageDashboard’s new QM features, take a tour:

Start Here

What is a Qualified Mortgage?

Qualified Mortgage (QM) is a series of regulations by the CFPB that set various mortgage lending requirements from non-allowable toxic loan terms, determining how to establish borrower’s ability to repay a loan, housing counseling services, and appraisal evaluation delivery requirements. The goal of these changes was to insure that lenders were treating borrowers fairly in their costs and loan terms, and properly documenting their ability to pay for the mortgages they applied for. According to the Consumer Financial Protection Bureau, “any loan that meets the product feature requirements with a debt-to-income ratio of 43% or less is a QM”.

What does QM change for borrowers & lenders?

For borrower’s the new ability to repay (ATR) requirements will mean they may need to provide larger amounts of documentation to prove that they have sufficient ability to repay the new mortgage. Also most high risk programs such as balloon terms, prepay penalties, and interest only are no longer allowed.Lenders will need to make sure that they have technology, polices, and procedures in place to meet all of the 2014 QM guidelines including documenting ability to repay, checking their maximum points and fees charged, and staying in compliance with the disclosure and appraisal delivery requirements.

What are the consequences of being non-compliant to QM?

Originating a non-QM loan as a banker lender can result in the loan being rejected from investors or government lending such as FHA and VA not insuring the loan for the lender. For brokers this will result in the lender rejecting their submission unless it is possible to correct the non-QM status such as by lowering points and fees. Lenders that do not follow the disclosure and appraisal delivery requirements can also be considered out of compliance and may be subject to corrective action.

Can I originate a non-QM loan?

According to the CFPB, lenders can originate any mortgage, even Non-QM ones, as long as the lender has made a good-faith determination that the consumer is able to repay based on “common underwriting factors”. The key, perhaps, is extensively documenting the information you consider while using the underwriting guidelines that have worked in the past.

How does it affect my compensation?

QM regulations have a strict guideline on the maximum points and fees that can be charged on any transaction. Exceeding those maximums means a lender credit must be issued or fees and broker compensation reduced, otherwise the loan will be considered non-QM. The CFPB has also issued guidance on the definition of a loan originator. This can mean that some processors or loan officer assistant type roles could be considered an originator under the new regulations which could affect how they must or can be compensated or paid.

What are the mandatory requirements of QM?

Points and fees must be less than or equal to 3% of the loan amount (for loans less than $100,000, higher percentage thresholds are allowed); there cannot be any risk features like negative amortization, interest-only, or balloon loans; the maximum loan term is less than or equal to 30 years.

How MortgageDashboard Responded

MortgageDashboard has released several new features in their flagship loan origination software to help lenders remain compliant in QM.

If you’d like to see these features yourself, contact our support team:

Start Here