If you're an aspiring real estate investor, or if you're looking to grow your rental portfolio and buy more properties, you'll need a great real estate investment calculator to help you analyze potential properties and your projected returns.

When it comes to property analysis tools, is one of the most popular options, with over 100,000 active users in the United States, Canada, Australia, and the United Kingdom.

It's a feature-rich cloud platform that offers a one-stop solution for real estate investors and agents looking to calculate cash flow, look up sales and rental comps, create marketing reports and put together smart offers to sellers.

DealCheck.io Review 2019: Real Estate Analysis Software (Worth It ??)

Detailed DealCheck Review

DealCheck was founded in 2015 by Anton Ivanov, a successful real estate investor and entrepreneur when he saw the need for an app to quickly analyze and compare potential investment properties.

What started as a side-project, quickly grew in popularity due to DealCheck's outstanding customer service and frequent feature releases.

It's been covered by Forbes, BiggerPockets, RE Tipster, Jason Hartman and other leading real estate publications and is one of the highest-rated real estate apps on the market.

Property Analysis Calculations

The core feature of DealCheck is its property analysis tools. You can use DealCheck to analyze a variety of investment properties:

Analysis Metrics

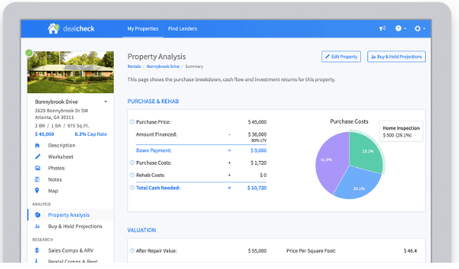

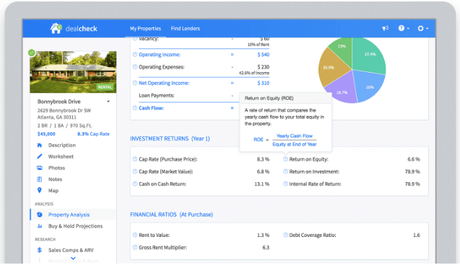

After adding a property and customizing your acquisition strategy though its intuitive worksheets (things like purchase price, financing, closing costs, rehab costs, etc.), you'll be able to view a complete analysis of that deal with all of the relevant metrics on one page.

Buy & Hold and Profit Projections

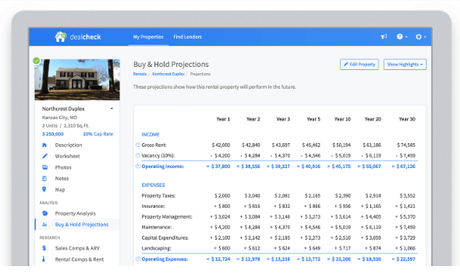

In addition to the main deal analysis breakdown, DealCheck can help you look at several types of financial projections.

For rental properties, DealCheck includes a buy and hold projections page that shows the cash flow, tax deductions, equity accumulation, sale analysis and your investment returns from year 1 to year 35. You can analyze these projections to determine your cumulative future returns, as well as potential, exit strategies.

For flips and rehab deals, you can view holding projections and see how your profit and ROI will change depending on the length of the rehab period. You can see how much extra money you'll make if the rehab is completed ahead of schedule, and how much less profit you'll make if it goes over.

DealCheck's Top Features

DealCheck offers a full suite of property analysis tools geared toward buying and holds investors, flippers, rehabbers, wholesalers and real estate agents. Here are its most popular features:

Property Data Import

Most other property analysis calculators (or if you're using an Excel spreadsheet) require you to tediously enter all property data yourself.

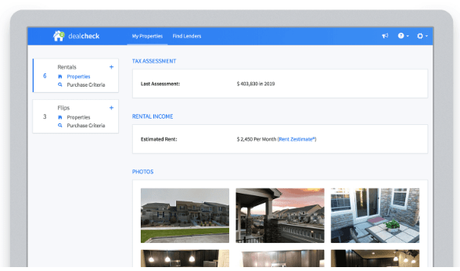

DealCheck comes with a property database integration, so you can quickly import basic home facts, price estimates, rent estimates, photos and descriptions with a click of a button. Property data is available for most US properties.

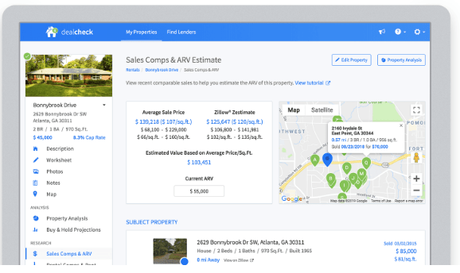

Sales and Rental Comps

As part of analyzing rental properties and flips, you'll often run into the issue of estimating the after-repair value (ARV) and gross rent of potential investment properties.

To help you estimate the ARV of your properties, DealCheck comes with a built-in sales comps tool. It will pull up to 20 recent comparable sales for any property in the US, show them on a list or a map, and provide several automated and adjustable estimates for the ARV of the property you're analyzing.

Specifically for rental properties, DealCheck can also pull up to 20 recent comparable rental listings and calculate their average listed rent and the potential rent of the subject property based on its living area.

Screening Properties with Custom Criteria

Let's say you're only focused on flips that pass the "70% Rule", that will return at least $35k in profit and that will require less than $50k of capital up-front.

With DealCheck's purchase criteria tool, you can set up custom criteria that will match these investment goals and instantly see which properties will pass them and which ones will not.

This is great for quickly screening deals and only focusing on those that show some promise to be profitable.

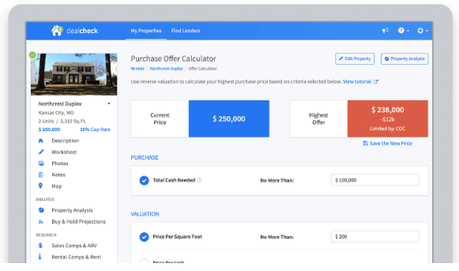

Purchase Offer Calculator

Once you've identified a potential property that you're interested in and ready to reach out to the seller, DealCheck can help you put together an intelligent offer price on that property.

There is usually some level of negotiation involved in all real estate transactions and you can use DealCheck's purchase offer calculator to figure out the highest price you can pay that will still meet your cash flow, the investment return and profit goals.

DealCheck's offer calculator uses reverse valuation analysis to suggest an offer price and comes with over a dozen criteria you can choose from.

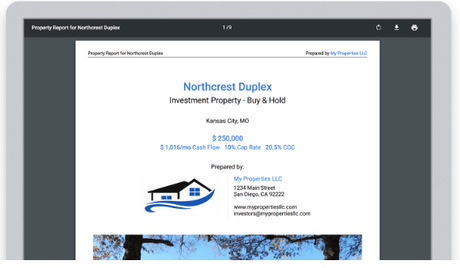

Property Reports (PDF)

Another great feature is the ability to export all of the information, analysis, projections, comps, photos, and notes for any property into one complete, professional PDF report.

You can customize the report sections and even add your custom branding (like a company name, contact information, and logo) to personalize it.

These reports are great to send to your potential clients, investors, partners or business associates and give them a complete picture about a specific investment property.

Real-Time Property Records and Listings

Property data and for-sale listings often change, as sellers update the list price, change the description or upload more property photos.

DealCheck's property records and listing feature provides access to the latest property record and listing information, so you can monitor what's changed in real-time.

For example, while you may pass on a property now because its list price is too high, you can use this feature to watch for price changes and be the first to put in an offer when the seller lowers it.

Side-By-Side Property Comparison

A common need when looking for investment properties to buy is comparing potential properties with one another, as well as comparing different acquisition strategies and scenarios for the same property.

To help with this, DealCheck comes with a side-by-side property comparison tool, which allows you to view the purchase information, cash flow projections and returns for two or more properties right next to each other.

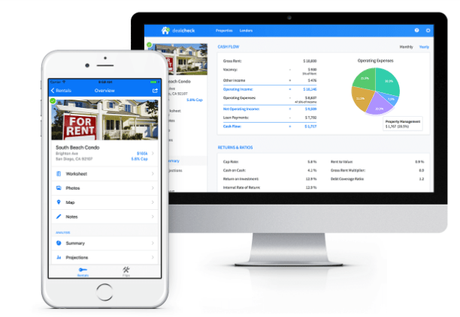

Using DealCheck on Any Device

One of the things that makes DealCheck unique is that you can use it to analyze investment properties online , but you can also download their or app and analyze properties on the go.

DealCheck's mobile app has the exact same features as the online version and is perfect to take with you while traveling, to open houses or simply if you're away from your office and need to make a quick decision on a potential property.

Both the online and the mobile apps instantly sync your data and properties to the cloud, so you can start analyzing a property on one device, then seamlessly continue on another. Your data is also securely stored and backed-up daily.

There are hundreds of 5-star reviews on both iOS and Android, so you can see that the DealCheck mobile app is quite popular among real estate investors, agents, and entrepreneurs

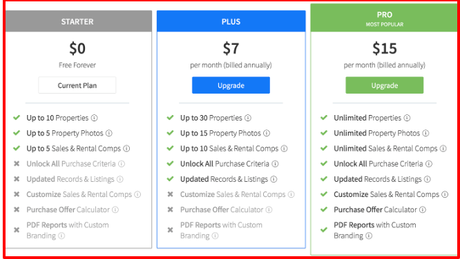

Pricing and Plans

DealCheck offers a variety of 14-day free trial to cater to both novice and professional real estate investors:

One thing that's unique about DealCheck is that they offer a free-forever tier. This means that if you're just starting with real estate and don't need some of the more advanced features, you can use the platform online and on your mobile device for free, without entering any payment information.

As your real estate investing business grows, you can naturally progress to one of the paid tiers as needed.

All paid plans include a 14-day free trial and you can switch between tiers or cancel your subscription at any time.

Help and Support Resources

DealCheck is the perfect real estate analysis tool for both experienced investors and those just starting out.

Based on hundreds of 5-star reviews, DealCheck has an outstanding customer support team and a variety of resources to help its users learn how to use all of its features, as well as learn about real estate investing in general

Built-In Real Estate Glossary

To be 100% transparent with its analysis calculations, DealCheck lists every formula and definition used for its property analysis metric calculations.

You can hover over the help icons located next to every analysis metric or real estate term to see its exact formula and a detailed explanation of what it is:

7 Days a Week Live Chat

If you need help while using the application or have any questions, DealCheck support staff is available 7 days a week, from 9am to 5pm Pacific Standard Time via live chat. Their response time is listed at less than 10 minutes.

Online Help Portal with Step-By-Step Guides

DealCheck's online help portal is a great place to learn how to use it to analyze investment properties, as well as how to become proficient in every feature offered by the application.

It has dozens of step-by-step guides with detailed tutorials, tips and how-to's to help you get the most out of this software and become a real pro.

Real Estate Course Directory with Discounts

If you're looking for more in-depth introductory courses into real estate investing, property management, lead generation, syndication, and financial modeling, check out DealCheck's online course directory.

DealCheck partnered with some of the most well-respected online real estate authors to offer its users up to 94% off on over 20 in-depth online courses.

Reliability and Speed

Both DealCheck's online application and its mobile apps are quite fast and suffer minimal downtime, so you can be sure that its property analysis tools are available when you need them.

DealCheck uses Google's cloud architecture to host its platform, which is known for its worldwide reliability and speed.

One thing to note is that you can use DealCheck's mobile app offline in case you don't have internet access. As long as you signed in to the app at least once, you can analyze investment properties without interruption if your phone has poor reception or is in airplane mode.

Quick Links:

Final Verdict: DealCheck.io Review 2019 | Should You Go For It?? Best Real Estate Analysis Software

With real estate investing growing in popularity and becoming more competitive, it's more important than ever to have the best tools of the trade to get an edge over your competition.

DealCheck property analysis platform is a clear winner when it comes to quickly analyze investment properties, looking up sales and rental comps, generating professional marketing reports and screening properties to find the best deals.

Hurry! Start Your DealCheck 14 Days Free Trial [/button-red ]

Offering a complete property evaluation and analysis solution, it's your one-stop-shop for analyzing real estate online, or on the go with its mobile apps.