The following is a small part of an excellent article in the Economic Policy Institute:

The following is a small part of an excellent article in the Economic Policy Institute:Keeping taxes low for the richest households and corporations is the clearest legislative priority of the Trump administration and the Republican congressional majority. Many provisions of the 2017 tax law (often called the Tax Cuts and Jobs Act or the TCJA) are expiring this year. Extending these provisions would provide hugely disproportionate benefits to the richest households.

To illustrate the difference in benefits depending on household income, the range would extend between less than $0.35 per day for the poorest households to $860 per day for the top 0.1%. For the bottom 20% of U.S. households, extending these provisions would give them an average of less than $0.35 per day. For households in the second income fifth, the benefits would be $1.20 per day, and for the middle 20% of the income distribution, the benefits would be $1.80 per day. Yet for the richest 1% of households, the benefits would jump to $165 per day, while the top 0.1% would see benefits of $860 per day.

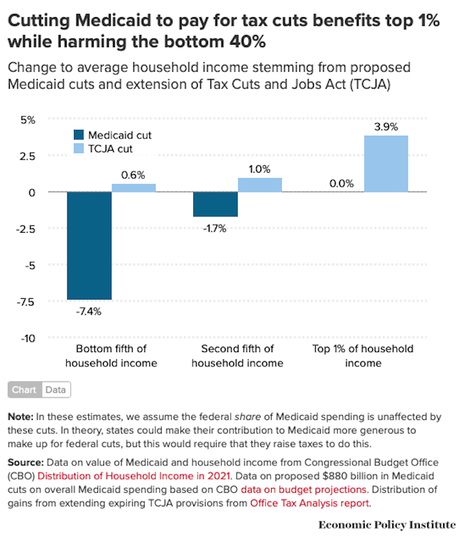

Besides being unfairly distributed, the cost of the overall tax cut is large enough to put huge stress on other parts of the economy, no matter how it’s paid for. The most damaging way to pay for this would be to enact large cuts in spending programs that provide benefits to economically vulnerable families. Last week, House Republicans approved a budget resolution calling exactly for these types of cuts, including $880 billion in cuts that will inevitably fall on Medicaid, the program that provides health insurance for low-income Americans who cannot otherwise afford it.

Medicaid is, by far, the largest program in the federal government aimed predominantly at alleviating poverty. In 2024 it provided health insurance coverage for over 80 million people each month. The juxtaposition of prioritizing lower taxes for the richest families while proposing steep cuts to the nation’s largest program aimed at alleviating poverty could not be more clarifying for the economic debate in front of us.

The benefits of extending expiring provisions to the TCJA are easy to summarize. They will boost incomes trivially for the large majority of families but significantly for the richest households, leading to greater income inequality. The costs of Medicaid cuts are a bit harder to summarize because they are so broad and will cascade far into the future. The summary of what these cuts will do is clear. They will greatly increase hardship and misery for already struggling families, they will reduce opportunities in the future for kids who will grow up less healthy and poorer because their families lack access to Medicaid, and they will put enough strain on the nation’s overall economy that they will make a future recession far more likely.

Conclusion

Low taxes for the rich and for corporations is the highest legislative priority of the Trump administration and congressional Republicans. To get there, they are willing to cut federal programs that are utterly vital to the incomes and security of vulnerable families. These cuts will not just cause harm to individual families, they will cascade, leading to hospital closures in rural counties, higher medical debt, lower earnings from future workers who will suffer from poorer health decades from now, and could even put upward pressure on federal budget deficits in the long run. In the very near term, these cuts will make the United States economy far more vulnerable to any recessionary shock. Nothing about this policy package—tax cuts mostly for the rich and benefit cuts for the vulnerable—is good for the vast majority of families in this country.