The price of oil, is the price of a commodity different from the petrol that you require to drive your car – it in fact is crude oil. Crude oil is the base product that gets processed into gasoline at oil refineries. So, if the price of oil goes up, the price of gas goes up. The price of crude is not simply determined by ‘law of demand and supply’ but Internationally by many more factors. USA consumes much more oil than it produces, so if some major oil producing countries unexpectedly withdraw their oil from the market as happened during the 1973 oil crisis, the economies of the USA and the developed world can suffer long-term damage. For this reason, the wily Federal government has created a vast oil storage facility called the Strategic Petroleum Reserve, or SPR.

The unit of reference is ‘barrel’ - Oil refineries buy their crude oil by the barrel. Let's say a refinery buys 1,000 barrels of oil for delivery and a set of trucks filled up with oil drums starts rolling in its direction. Unsurprisingly the trucks will not be carrying 1,000 drums of oil because the volume of a (standard) oil drum differs from the volume of an oil barrel: A barrel of oil (bbl) is the equivalent of 42 gallons, or 159 litres.

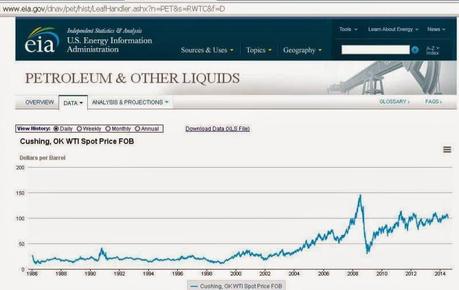

U.S. oil prices fell to the lowest level in almost two months on Friday as signs of abundant supplies spurred investors to resume selling. Light, sweet crude for August delivery fell $2.10, or 2%, to $100.83 a barrel, the lowest closing price since May 12 on the New York Mercantile Exchange. Friday's drop in the Nymex crude contract was the largest since April 22. The price of petroleum as quoted in news in North America generally refers to the WTI Cushing Crude Oil Spot Price West Texas Intermediate (WTI), also known as Texas Light Sweet, a type of crude oil used as a benchmark in oil pricing and the underlying commodity of New York Mercantile Exchange's oil futures contracts.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Groupof Chicago. In finance, a futures contract (more colloquially, futures) is a standardized contract between two parties to buy or sell a specified asset of standardized quantity and quality for a price agreed upon today (the futures price) with delivery and payment occurring at a specified future date, the delivery date. A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts. These types of contracts fall into the category of ‘derivatives’ because the value of these instruments are derived from another asset class

Heady it may sound …… here is some interesting news too… reports state that the man behind the record rise in oil prices to $100 a barrel was a lone trader, seeking bragging rights and a minute of fame, market watchers say. A single trader bid up the price by buying a modest lot and then sold it immediately at a loss, they claim. The New York Mercantile Exchange said that US crude oil futures traded just once in triple figures on Wednesday. On Wednesday, one floor trader bought 1,000 barrels, the smallest amount permitted, and sold it immediately for $99.40 at a $600 loss, said Stephen Schork, a former floor trader on the New York Mercantile Exchange (Nymex) and the editor of an oil market newsletter. "They absolutely overpaid," he told Radio Four's Today Programme. "He paid $600 for the right to tell his grandchildren that he was the first in the world to buy $100 oil."

One barrel of crude oil, when refined, produces about 19 gallons of finished motor gasoline, and 10 gallons of diesel, as well as other petroleum products. In US, people use propane to heat their homes. The other products include : ink, crayons, dishwashing liquids, deodorants, CDs & DVDs, tires, ammonia, heart valves and other medical equipment.

With regards – S. Sampathkumar 17th July 2014.

Thanks recorded to : http://www.eia.gov/ - for most inputs and charts.