Enter something in the Google search bar for loans, student debt, or finances, and you'll find many sites offering expert advice. After some research, you will soon discover that not all of these sites are the same.

Regardless of whether it is predatory business tactics or valuable information, it seems impossible to distinguish between good and bad.

Credible is undoubtedly the "right" page of search results. It's important to understand that Credible does not sell you anything directly. Instead, they offer personalized loan options from multiple lenders.

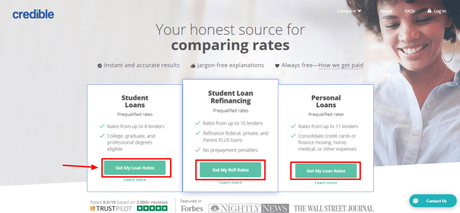

That is, they are similar to the student loan and personal finance options available at Credible.com. These loan recommendations began with the refinancing of student loans, but have become several funding options that students or graduates need, such as: For example, credit cards or personal loans. Read full detailed about Credible Review in below section.

Let's started.

Credible Review 2019: Is Credible Reliable ?? (Read Pros & Cons)

Detailed About Credible Review

Credible is a website that helps you find hotels, flights and rental cars but does not sell them yourself.

Likewise, Credible is a market for various types of loans, ranging from student loan refinancing to credit card consolidation. They look for loan options and make personalized recommendations in real-time based on their current credit rating. Then these options will be displayed side by side so you can easily compare them.

You're probably wondering if this is all free. What an incredibly altruistic company, right? Not quite; After all, they have to stay in business in one way or another. When Credible creates a list of suppliers and makes recommendations, the process is based on several factors.

If you select a particular provider, Credible will receive a commission on that sale. Imagine these as well-meaning intermediaries between you and potential lenders.

This does not mean that Credible will push you to the loan where you get the highest commission. Stephen Dash, CEO of Credible and a former investment banker at JPMorgan, believes that "the student loan market needs more transparency."

He also says Credibility is "designed to enable students and alumni to take responsibility for their financial future." This philosophy seems to permeate the business and people are beginning to understand.

How can Credible help me? (Read full instruction about Credible review)

Credible.com is primarily a market for students and graduates who refinance their student loans. In an interview with NBC Nightly News, Stephen Dash said that for $ 3 in student loans, $ 1 can be refinanced at a lower interest rate.

He claims that the average credible user can lower his interest payments by 37%. The average student with a student debt of $ 35,000 is a graduate, so the savings can be significant, especially given that the loan term can be a decade or more. Credible does not just focus on the refinancing of student loans.

They can also help you find a student loan first. So, if you're trying to close the gap between your grant program and your tuition, you can definitely consider applying for a credible loan.

In addition, the lender offers recommendations on personal loans and credit cards as soon as he determines that students have debts outside of student loans. They understand that in the current environment it is a necessary evil to bring debt to school and try to help you make the most of those times and reduce your overall costs.

It is important to understand that although the refinancing of federal and private education loans is accepted by Credible partner lenders, all new lending is private. Although refinancing can cut your interest rate significantly, you lose some protection if you switch from a federal loan.

It's not necessarily a bad thing, but it's definitely something to consider before you refinance. This is especially true if you wish to receive an income-related refund or a student loan exemption program.

Credible with all this information is very honest and seems to stick to its founding principle, which is "to give borrowers the level of transparency they deserve".

How credible Work

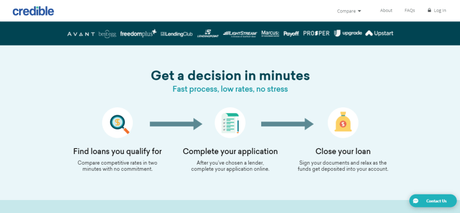

Credible is one of the simplest platforms we have used. It is very easy and it takes about 2 minutes to find your fare.

First, click on "Search for my plan" and fill in the short form. The input of your data takes about 2 minutes.

You must provide details of your education and finances, as well as the amount of debt you wish to refinance.

The best part is that it does not affect your credit score.

Credible starts the entire process with a flexible credit check, so you do not have to worry about the consequences of your creditworthiness. So you can see whether refinancing is worthwhile without any problems.

After you enter your details, a checkbox will appear with the various offers that you may be eligible for. I say "maybe" because none of this information is 100% guaranteed because none of your information has been verified and your credit has not been verified.

2. Compare your optionsSubject to change. Note: Although not guaranteed, these are your actual pre-qualified rates.

Provided that your credit profile does not change, market rates have not changed, and you can review the information provided in your profile, these interest rates are generally accurate.

However, if you have made a precise statement during the process and your details can be verified, you will receive excellent prices. The best thing is that you can see your options in advance and whether it makes sense to refinance your student loan or not.

Once you've chosen a lender, it's time to apply. During the application process, you will be asked much more detailed questions about your credit history, your financial history, and the lender will conduct a true credit check. Note: All of this happens on a Credible website.

3. Apply for your student loanOnce this process is completed, the lender will work directly with you to complete all the details.

If you need a co-debtor for your student loan, you can also apply to the Credible website, which can be simplified together.

If you refinance your student loan through our link, you will receive a bonus of up to $ 750! We are affiliated with Credible and are happy to send you this bonus offer. View our full list of the best student loan bonus offers here.

4. Collect your bonusWhich qualifications are required? (See Full credible review)

It is important to remember that Credible does not lend money itself. Instead, they are a comparison platform. But they announce on their platform that there is NO minimum qualification for using Credible. However, you must be at least 18 years old and have at least $ 5,000 in student loans that you would like to refinance.

In fact, we have found that you need good credit and a stable income to get the best prices and terms. In using the platform, we also found that most lenders need a credit score in the middle of the sixteenth century.

Many cases, you can qualify with a co-debtor if you still do not have good credit or stable income.

THE APPLICATION PROCESS

It's easy to get a (not pre-approved) pre-qualification for refinancing a student loan with Credible. It only takes a few minutes. Start using your e-mail address as a login and set a strong password.

Then enter the following information:

When you have answered these questions, enter your personal credentials. After submitting the form, you will receive offers from lenders who are interested in refinancing your loans according to the criteria you have entered.

When does it make sense to refinance a student loan?

- Refinancing target (payment reduction, savings maximization or faster deleveraging)

- Type of student loan (own student loan or PLUS loan for parents)

- Name of your university

- The highest degree received

- Doctoral School: yes or no

- Annual income

- Other income (part-time, capital income, etc.)

- Income from another household member (as a parent or spouse)

- Amount of your rent or mortgage (indicate your share only if you share the rent)

- The amount you want to refinance (can be adjusted later)

- Your address

There are situations where it makes sense to refinance a student loan. And if that happens, you can save a lot of money!

A service like Credible can be useful if:

- You have private student loans at a higher interest rate than you can get when refinancing

- You have federal student loans, make payments according to the standard payment plan, and want to pay your student loans faster

- Most people do not realize that they can often refinance their student loans. So if you already have private loans and can save interest, you can refinance yourself. If you find a lower rate, you can do it again.

If you have federal loans, you can lose some protection. However, if you want to pay faster and can afford it, you can save a lot of money by refinancing!

Credible Review | What is a credible refinancing of a student loan?

Refinancing can save you money by lowering interest rates on student loans. When you refinance, you are taking out a new low-interest loan to repay your existing higher-interest loan.

However, this is not the right choice for everyone. For example, by refinancing federal loans, you lose the protection of federal borrowers, including access to debt-based repayment and repayment plans.

If you fill out a Credible, clear form, you will receive prizes from various lenders that refinance student loans, including Citizens Bank, College Ave Student Loans, iHelp, the Massachusetts Educational Financing Authority, and the Rhode Island Student Loan Authority.

There are no minimum requirements for using Credible. But most lenders on the platform are looking for a credit score in the mid-600s and having sufficient income to repay their student loans in addition to their other financial obligations.

If you have a credit score or a relatively low income, applying with a solvent co-debtor increases your chances of qualifying and maintaining a competitive rate. That's how it works.

This step takes about two minutes and does not affect your credit rating. You fill in a short form about your education and financial background, including the total amount you wish to refinance. You do not have to refinance all your loans.

For example, it may be appropriate to only refinance your personal loans. You will then be asked to create a credible account.

Then you'll see a board with the refinancing rates you're likely to claim. You will probably see multiple options for each lender as most lenders offer multiple maturities as well as fixed and variable interest rates. Customize the filters in your dashboard to refine your selection to your liking.

1. Receive personalized offersTake your time to search for your options before you decide. For more information about a lender, read NerdWallet's Student Loan Refinancing Reviews available through Credible:

If you choose a lender to help you develop, you will be prompted to import information about your loan. The lender conducts a credit check before making a concrete offer. Once you have completed this process through Credible, the lender will contact you directly to complete your new loan.

2. Compare prices and lendersCredible private student loan

Make sure you have completed the Free Student Financial Assistance Request (FAFSA) before considering private student loans. Borrow all the student loan money from students before using private loans, as federal loans generally offer lower interest rates for undergraduate students and more favorable repayment terms for all borrowers.

3. Choose a lender and applyIf you need a private student loan, compare the interest rates of multiple lenders before you decide on one.

Markets can facilitate the comparison of lending rates. You can get interested rate estimates from several private lenders, including Citizens Bank, College Ave Student Loans, iHelp, Rhode Island Student Loan Authority, and Sallie Mae.

Anyone can use credit to get interested rate estimates for private student loans. However, to qualify for a lender on the platform, you will generally need to have a minimum credit rating of 600 and earn enough to cover the payments for your student loans and other debts. If you do not have a full credit rating, you may need to file an application with a co-debtor.

it declined to share data on the average credit rating and income levels of its private borrowers.

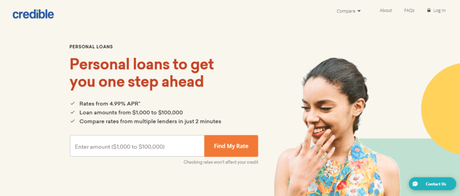

Credible personal loans | Credible Review

It also offers personal loans on its platform using the same system for student loans. You can enter your data and compare multiple personal lenders in just 2 minutes. Find out why we recommend that you find the best personal loans.

Personal loans are not useful for everyone (especially those paying for college), but maybe useful for people who want to consolidate their credit card debt, etc. They are also an excellent alternative to pre-financing for credit taxes as you borrow more for longer.

Credible offers personal loans in the range of $ 1,000 to $ 50,000 with an annual percentage of just 5.99%, which is excellent (interest rates vary depending on the purpose of the loan, maturities vary between 2 and 8 years). This can save you a lot of money if you want to consolidate a credit card debt or other high-interest debt.

Other products

In addition, Credible offers mortgages and credit card comparisons on its platform.

We have a credible, detailed mortgage review here. See how they compare and consider whether you want to use them to refinance or buy your next home.

You can also compare credit card offers on your website.

REASON WE LOVE TO BUILD THE CREDIBLE LOAN FOR STUDENTS

REASONS YOU CAN LOOK MUCH

READ ALSOConclusion: Credible Review | Is it worth or not?

We're big fans of Credible because it makes it easier to buy student loans by comparing multiple lenders in minutes.

You have also recently started a mortgage service. See our Credible mortgage check here.

- Get offers in minutes. The application is fully online and it only takes a few minutes to complete your details. Then you can get pre-qualified budgets in minutes.

- Receive multiple offers at the same time. Instead of asking individual lenders, you can get rates from 8 lenders at the same time. You can even receive multiple offers (different rates and terms) from the same lender. This gives you more options.

- No obligation If you do not like one of the offers, there is no obligation to continue. You can ignore the offers and look for other options or keep the loans you have. There is no registration fee or penalty for doing nothing.

- Take your time to decide. You do not have to decide where you want to go with the lender. Please note, however, that prices and conditions may change at any time. The lender bases the prequalification on the prices/conditions that were available at the time of the request. If you wait too long, the situation may change.

- It's free Credible service is completely free. The credit will be paid when you return a loan to a linked lender. However, this has no influence on the rates or conditions offered by the lenders.

- Possibility to add a co-debtor. You can add a co-debtor before you select the lenders on your platform. Credible will tell you if it is approved without a co-debtor or if you need to add one. This can also improve your admission chances and/or your conditions.

- Choose how much to refinance. You can choose the number of student loans you want to refinance. For example, you can only refinance private loans with the highest interest rates.

- Several ways to contact. You do not have to accept free advice from credible experts. If you have questions or concerns, you can contact Credible by phone, online chat or email.

If you want to refinance your student loan or even take out new private student loans, you should look around. We also compare all lenders who refinance student loans. Do not hesitate to investigate this as well. And remember, if you use Credible to refinance your student loan, you will receive a $ 750 gift card bonus!

- All lenders do not participate. You will not see offers from major lenders that refinance student loans like Earnest or CommonBond.

- They have student loans from the federal government. Use all options provided by the Department of Education instead of refinancing your federal student loans into private loans. If you refinance your federal loans like a personal loan, you will lose any special assistance or special program that you can access with the Federal Government.

- The balance of their student loans is less than $ 5,000. Credit partners of several credible partners have minimum credit requirements. The required minimum loan is $ 5,000. However, many lenders require $ 10,000 in credit.

- Your balance is low. If you have low credit, if you have a lot of debt, and your income is low, you may not get a cheap deal. In this case, a co-debtor could help you.