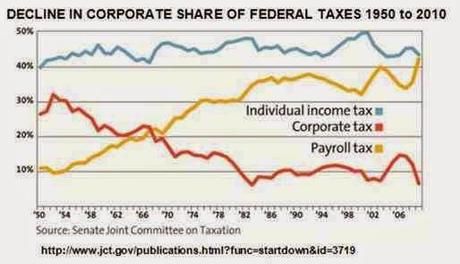

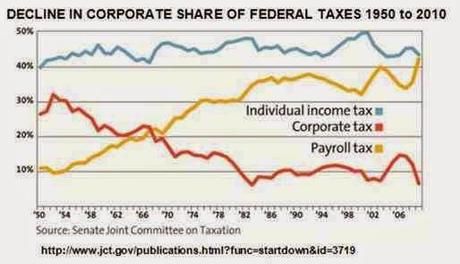

Republicans would like for us to believe that corporations have to pay too much in taxes in the United States -- and they would like to significantly reduce the corporate tax rate. They are lying. The truth is United States corporations pay an actual tax rate that is the lowest of nearly all developed nations. And as you can see from the chart above, the share of U.S. government revenue that comes from corporations is lower than ever. Note that the corporate share in the early 1950's was slightly over 30%. Now it is well below 10%.

The corporations are not really paying their fair share of taxes in this country -- and that is due to the Republican's "Trickle-Down" economic policy -- a policy that gives corporations huge subsidies to offset taxes, gives them tax breaks for exporting U.S. jobs, and allows them to avoid taxes by keeping profits in overseas bank accounts. It has gotten so bad that about one-quarter of all corporations pay no taxes at all, even though they make huge profits -- and most others pay a far smaller rate than they should be paying.

Here are some of the

most egregious examples of corporate tax-dodgers:

Bank of America runs its business through more than 300 offshore tax-haven subsidiaries. It reported $17.2 billion in accumulated offshore profits in 2012. It would owe $4.3 billion in US taxes if these funds were brought back to the US.

Bank of America runs its business through more than 300 offshore tax-haven subsidiaries. It reported $17.2 billion in accumulated offshore profits in 2012. It would owe $4.3 billion in US taxes if these funds were brought back to the US.

Citigroup had $42.6 billion in foreign profits parked offshore in 2012 on which it paid no US taxes. It reported that it would owe $11.5 billion if it brings these funds back to the US. A significant chunk is being held in tax-haven countries.

ExxonMobil had a three-year federal income tax rate of just 15 percent. This gave the company a tax subsidy worth $6.2 billion from 2010-2012. It had $43 billion in offshore profits at the end of 2012, on which it paid no US taxes.

FedEx made $6 billion over the last three years and didn’t pay a dime in federal income taxes, in part because the tax code subsidized its purchase of new planes. This gave FedEx a huge tax subsidy worth $2.1 billion.

General Electric received a tax subsidy of nearly $29 billion over the last 11 years. While dodging paying its fair share of federal income taxes, GE pocketed $21.8 billion in taxpayer-funded contracts from Uncle Sam between 2006 and 2012.

Honeywell had profits of $5 billion from 2009 to 2012. Yet it paid only $50 million in federal income taxes for the period. Its tax rate was just 1 percent over the last four years. This gave it a huge tax subsidy worth $1.7 billion.

Merck had profits of $13.6 billion and paid $2.5 billion in federal income taxes from 2009 to 2012. While dodging its fair share of federal income taxes, it pocketed $8.7 billion in taxpayer-funded contracts from Uncle Sam between 2006 and 2012.

Microsoft saved $4.5 billion in federal income taxes from 2009 to 2011 by transferring profits to a subsidiary in the tax haven of Puerto Rico. It had $60.8 billion in profits stashed offshore in 2012 on which it paid no US taxes.

Pfizer paid no US income taxes from 2010 to 2012 while earning $43 billion worldwide. It did this in part by performing accounting acrobatics to shift its US profits offshore. It received $2.2 billion in federal tax refunds.

Verizon made $19.3 billion in US pretax profits from 2008 to 2012, yet didn’t pay any federal income taxes during the period. Instead, it got $535 million in tax rebates. Verizon’s effective federal income tax rate was negative 2.8 percent from 2008 to 2012.

This is inexcusable. Any corporation or other business that makes billions in profit (or even just millions) should be paying their fair share of taxes. It is just not right that they should get the benefits of the tax-payer funded government without paying any of the taxes (or without paying the full share of taxes the law says they owe). Why should corporations get a free ride when workers must pay their taxes?

The Republicans say our economic woes come from too much government spending, and they want to deeply cut government programs (especially those programs that help hurting Americans. They are wrong. Our economic problems don't come from too much spending -- but from too little revenues, especially from the corporate sector.

Bank of America runs its business through more than 300 offshore tax-haven subsidiaries. It reported $17.2 billion in accumulated offshore profits in 2012. It would owe $4.3 billion in US taxes if these funds were brought back to the US.

Bank of America runs its business through more than 300 offshore tax-haven subsidiaries. It reported $17.2 billion in accumulated offshore profits in 2012. It would owe $4.3 billion in US taxes if these funds were brought back to the US.