Republicans would like for you to believe that corporations need more tax relief, and cannot afford to pay workers a higher salary. Neither is true. Corporate profits are at a 72 year high. They have not been this high since 1950. And in 1950, the top tax rate was 90%, and the minimum wage was worth significantly more in buying power than it currently is.

From Bloomberg News:

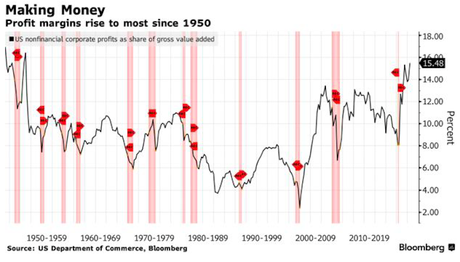

A measure of US profit margins has reached its widest since 1950, suggesting that the prices charged by businesses are outpacing their increased costs for production and labor.

After-tax profits as a share of gross value added for non-financial corporations, a measure of aggregate profit margins, improved in the second quarter to 15.5% -- the most since 1950 -- from 14% in the first quarter, according to Commerce Department figures published Thursday

The data show that companies overall have comfortably been able to pass on their rising cost of materials and labor to consumers. With household budgets squeezed by the rising cost of living, some firms have been able to offset any slip in demand by charging more to the customers they’ve retained -- though others like Target Corp. saw their inventories swell and were forced to discount prices in order to clear them.

The surge in profits during the pandemic era has fueled a debate about whether price-gouging companies carry a share of the blame for high inflation -- an argument pushed by President Joe Biden’s Democrats. Most economists have been skeptical about the idea.

US inflation has surged this year and stood at 8.5% in July, not far short of the previous month’s four-decade high. Federal Reserve officials have pointed to rising wages as one of the big risks that could keep inflation entrenched. But some economists say that historically elevated profit margins mean there’s room for businesses to accommodate worker demands for better pay without setting off a wage-price spiral.

Across the economy, adjusted pretax corporate profits increased 6.1% in the April-to-June period from the prior quarter -- the fastest pace in a year -- after falling 2.2% in the first three months of the year. Profits are up 8.1% from a year earlier.

While companies report individual profits based on historical costs, the government adjusts the figures to reflect the current cost of replacing capital stock such as equipment and structures. Due to surging inflation, the current replacement costs are much higher.

Excluding that adjustment, as well as one for inventory valuation, after-tax profits climbed 10.4% in the second quarter.