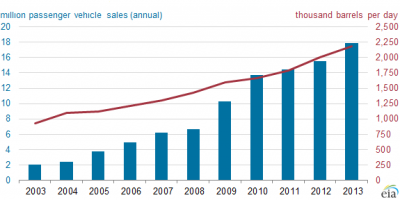

Chinese vehicle sales and gasoline consumption, 2003-2013. (Source:

Chinese vehicle sales and gasoline consumption, 2003-2013. (Source: U.S. Energy Information Administration)

Unprecedented motorization in China has led to significant increases in oil demand and oil imports. In response to growing oil imports, the Chinese government is adopting a broad range of policies, including improvements in the fuel economy of new vehicles and the promotion of alternative-fuel vehicles.

Consumption of gasoline in China grew from 0.9 million barrels per day (bbl/d) in 2003 to more than 2 million bbl/d in 2013. This continues a trend of significant growth in China’s transportation sector since the 1990s. Increasing oil demand requires China to import more petroleum from other countries, and since 2009, China has been importing more than half of its petroleum needs. Under the Energy Saving and New Energy Vehicle Plan for 2012 to 2020 released in 2012, average passenger car fuel economy is targeted to increase to 34 miles per gallon by 2015 and 47 miles per gallon by 2020.

In its 12th, and current, Five-Year Plan, the Chinese government also launched a new strategy to promote new energy vehicles (NEV; vehicles that are partially or fully powered by electricity) and to support its domestic automobile industry to mass-produce NEVs. The government plans to invest an estimated $15 billion in alternative-fuel vehicles during the next 10 years. The national target for cumulative production and sales of electric and plug-in hybrid vehicles is 500,000 units by 2015. The NEV target for 2020, originally set at 5 million vehicles, was recently scaled back to 1 million vehicles.

To meet NEV penetration targets, to boost consumer demand, and to make alternative-fuel vehicles more affordable, the Chinese government has been offering many financial incentives, including some $4 billion allocated for energy-saving products, primarily NEV and household appliances. Additionally, in 2012 the Chinese Ministry of Finance announced it would provide annual subsidies up to two billion yuan ($323.6 million) to support NEV manufacturing. In September 2013, the government announced additional subsidies that will support the growth of NEV ownership through 2015.

For electric vehicles, subsidies from the central government are often matched by local subsidies. For example, in Beijing, the central government subsidy of 60,000 yuan ($9,700) is matched by a subsidy of equal amount from the city of Beijing. Many other cities also offer considerable subsidies. For example, the Shenzhen government offers one of the highest subsidies for electric vehicles in the country—120,000 yuan ($19,400) per passenger vehicle—reducing the price of such vehicles by more than half. In addition to financial incentives, some cities offer other incentives, including free license plates for NEVs and exemptions from vehicle license plate quota systems. For example, Shanghai (where a license plate can cost as much or more than an entry-level domestically manufactured car) offered free license plates for 20,000 electric vehicles purchased before the end of 2013. Guangzhou offers 12,000 free plates allocated by lottery, and Beijing offers electric vehicles an exemption from the vehicle license lottery, which prospective owners of gasoline-fueled automobiles are required to enter.

Despite many incentives, electric vehicles sales to date have been minimal. NEV sales account for less than 1% of total vehicle sales in China, which in 2013 remained the world’s largest vehicle sales market for the fifth year in a row. According to China Daily, as of March 2013, an estimated 39,800 electric vehicles were on the road, approximately 80% of which are used for public transport.

Some of the reasons behind low sales of NEVs to date are high vehicle costs despite government subsidies, inadequate charging infrastructure, limited driving range when compared to conventional internal combustion engine vehicles, lack of a national industry standard for charging connectors, consumer education and acceptance of the new technology, and vehicle safety issues, among others.