Those of you out there who have the first book of The SmallIvy Book of Investing series, Investing to Grow Wealthy, know that the first book covers most everything about how to use investing to grow wealth except for one critical area: How to pick the right stocks. That is going to be covered in a second book devoted specifically to stock picking since that is an expansive topic on its own. You probably also know that I’ve been promising that book for some time now.

You’ll be happy to know that I have been working on it and have the first couple of chapters done. What I generally try to do is to use parts of the books I’m writing as blog entries since it is difficult to both write a book and keep the blog going (along with perform my day job and take part in family activities). Of course, this means that you can get a lot of the material in the book for free just my reading the blog. Hopefully, though, having it all in one place with the supplementary material that is only in the blog will be worth the $11 you spend on the book (or $5 for the e-book). Realize also that it gives me an incentive to keep writing the blog if I have a financial interest (and also if I get comments and feedback since sometimes it seems like I’m talking to myself). The publishers also don’t like having material on the web and sometimes fuss when they check and see the material on my blog that I have in the book, so you may see some of the material in the archives of the blog disappear with time.

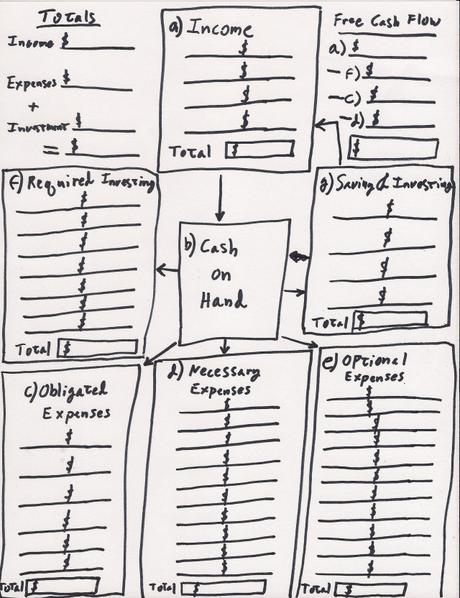

At this time there has also been another diversion. In looking at the first book, I realized a lot more needed to be said about the topic of managing your cash flow, since that is really the key to it all. I’ve therefore started a new book specifically devoted to handling cash flow that will be released before the book on stock picking. This one is coming along really well and should be out in a few months if not sooner.

So what is cash flow and why should you be interested? Cash flow is how your money comes into your household and then how it either stays or flows out. People who become wealthy find ways to make more of the cash they earn stay in their household and even use their cash flow to create more income. The average family has a straight cash flow where every dollar that comes into their bank account flows right back out again. Not only do they not build wealth, meaning that they are looking at a retirement in poverty, but they also face the risk of racking up debt when there is an event that causes their expenses to spike in a given month, causing them to take on debt. This then adds to their expenses and they start to sink into the abyss.

So, I’m working my way through the cash flow book, going deep into everything from income (how to increase yours) to managing expenses (where you find the money to invest) and even investments you really need to be making that few people do. Hopefully, it will be out before Christmas because it would be a great book to read with your graduating senior this spring. While it has some powerful material for those already working, someone who is just starting out and who gets his cash flow right from the start could really do things with financial security and wealth building. Please forgive me for this diversion.

Have a question about investing? Please send to [email protected] or leave a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.