Current time in Silicon Valley

California Mortgage Rates Dip, But Remain Higher Than National Average

California’s mortgage rates have seen a slight decline in recent weeks, offering a glimmer of hope to prospective homebuyers in the Golden State.

However, the average rates for various loan terms remain higher than the national average, underscoring the ongoing affordability challenges in California’s competitive housing market. Despite this dip, the state’s persistently high housing costs and lingering inflation continue to pose significant hurdles for those seeking to purchase a home. As the Federal Reserve contemplates future interest rate adjustments, the trajectory of both national and California mortgage rates remains uncertain, leaving potential buyers and homeowners eagerly watching for further developments.

Mortgage Rate Comparison (National vs. California)

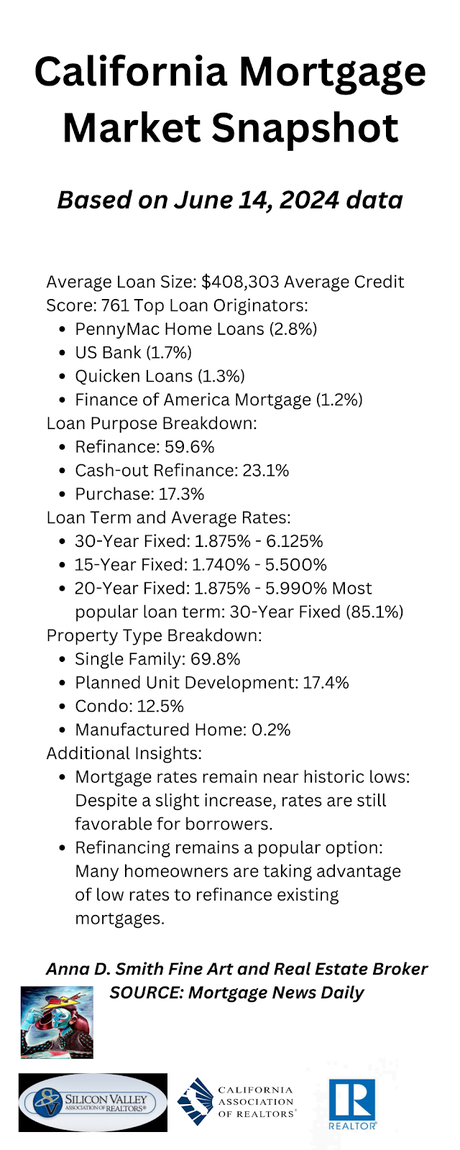

As of June 14, 2024, the national average for a 30-year fixed-rate mortgage stands at 6.95%, according to Freddie Mac. While California has seen its rates dip slightly, they are still notably higher than the national average. The average rate for a 30-year fixed mortgage in California ranges from 1.875% to 6.125%, depending on individual circumstances and lender. For 15-year fixed mortgages, the average California rate is between 1.740% and 5.500%. Those seeking a 20-year fixed mortgage in California can expect rates ranging from 1.875% to 5.990%.

Factors Influencing California Rates

Several factors contribute to the higher mortgage rates observed in California compared to the national average. The state’s robust economy and thriving job market often drive up demand for housing, leading to increased competition and subsequently higher prices. Additionally, California’s higher cost of living, driven by factors like housing expenses, taxes, and regulatory costs, can influence mortgage rates. The specific lending landscape in the state, including the number and types of lenders operating in the market, can also play a role in shaping interest rates.

Despite the higher interest rates, the California mortgage market remains active. The average loan size in the state is a substantial $408,303, indicating a strong demand for larger loan amounts. Additionally, the average credit score for borrowers in California stands at 761, reflecting a relatively creditworthy pool of applicants.

Within the state, several key players dominate the mortgage origination landscape. PennyMac Home Loans leads the pack with a 2.8% share of originations, followed by US Bank at 1.7%, Quicken Loans at 1.3%, and Finance of America Mortgage at 1.2%. These lenders, along with numerous others, play a crucial role in facilitating homeownership for Californians.

The data also reveals interesting trends in loan purposes and property types. Refinancing remains the most popular option, accounting for 59.6% of originations, followed by cash-out refinancing at 23.1%. Purchases make up 17.3% of the market, indicating a steady demand for new homes despite the affordability challenges.

In terms of property types, single-family homes are the most sought-after, making up 69.8% of originations. Planned unit developments (PUDs) constitute 17.4% of the market, while condos account for 12.5%. Manufactured homes make up a small portion at 0.2%.

Affordability Challenges

While the recent dip in mortgage rates offers a glimmer of hope, affordability remains a significant challenge for many Californians. The state’s high cost of living, coupled with the relatively elevated mortgage rates, creates a difficult landscape for potential buyers. The persistently high inflation, particularly in the housing sector, further exacerbates this issue.

The shelter component of the Consumer Price Index (CPI), which measures rent and homeownership costs, has seen a 5.4% increase, contributing to the overall inflation rate. This rise in shelter costs makes it increasingly difficult for individuals and families to save for a down payment or manage monthly mortgage payments.

However, there is some optimism that the situation may improve. Lawrence Yun, the chief economist for the National Association of Realtors (NAR), suggests that the official CPI, which tends to lag behind real-time data, may have room to slow down. He points to rising apartment vacancy rates and stagnant rent prices as potential indicators of a cooling housing market.

Future Outlook

The future trajectory of California’s mortgage rates hinges largely on the actions of the Federal Reserve. Economists predict that the Fed may implement multiple interest rate cuts by the end of next year, a move that could potentially alleviate some of the affordability pressures facing homebuyers in the state. If mortgage rates follow suit and decline alongside the Fed’s benchmark rate, it could stimulate increased home sales, especially in regions where housing inventory is on the rise.

However, the exact timing and magnitude of these rate cuts remain uncertain. The Federal Reserve’s decisions will be heavily influenced by the evolving economic landscape, particularly the trajectory of inflation. While there are signs of a potential slowdown in inflation, ongoing monitoring of economic indicators will be crucial in determining the Fed’s next steps.

Conclusion

The California mortgage market presents a mixed bag for those seeking homeownership. While recent dips in mortgage rates offer some encouragement, the state’s persistently higher rates compared to the national average underscore the ongoing affordability challenges. The interplay of factors like high housing costs, inflation, and potential changes in Federal Reserve policy further complicate the outlook. However, with careful monitoring of market trends and diligent rate comparisons, potential buyers may find opportunities to navigate this complex landscape and achieve their homeownership goals.

We’d love to hear your thoughts! Have you recently navigated the California housing market as a buyer or seller? Are you considering refinancing your current mortgage? Share your experiences and questions in the comments below – let’s explore the evolving landscape of California real estate together!