Round 2 - The Naive Fighter – La La La (when is X factor on?)

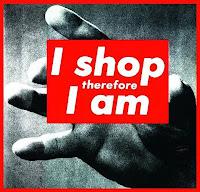

You have been taught how to look, talk and act the right way to get ahead in life. You get a good degree, a corporate job, expensive car, mortgage, go on expensive holidays, get married have kids etc. This is the good life…… unfortunately all of a sudden you are seriously in debt unless you are fortunate enough to earn mega $$$$$.

MUFF went down the generally accepted route "to get ahead in life". MUFF had student loans and a brand new car (investments in my future). A significant daily commute burning through my pay checks. I was "entitled" to expensive gadgets, movies, games and exotic holidays. At the end of each month I had no savings, just debt repayments. Pressure to conform continued - you must get on the housing ladder. How could I? Debt payment was a large chunk of my salary and taking years to pay off (5). Did I really want mortgage payments on top - it was supposedly good debt?

MUFF needed to excel at his corporate job - work harder and climb the corporate ladder. Surely the salary would sky rocket and a MVP (MUFF Vice President) in 20 years! So next steps:

- Make sure MUFF looked the part - expensive suits, shoes, leather designer computer case, flash mobile - MUFF was going places (factories)

- Study - buy all of the latest books on professionalism and business management - why can't it be simple and in one book or in 5 page books?

- Go beyond the call of duty in work - work on additional or suggest new projects whilst putting in all of those extra unpaid hours

- Go to a bigger company for more opportunities

Life was still good. MUFF was working hard and slowly progressing his career, as was his wife. Frequent holidays were a must to unwind and relax. We needed those breaks as work was becoming harder and more time consuming. Downsizing the workplace resulted in greater and greater workload. 9-5 working hours seemed like a pipe dream.

Life was still good. MUFF was working hard and slowly progressing his career, as was his wife. Frequent holidays were a must to unwind and relax. We needed those breaks as work was becoming harder and more time consuming. Downsizing the workplace resulted in greater and greater workload. 9-5 working hours seemed like a pipe dream.Our always "on" connected culture left little time to turn off from work. Weekends turned into recovery time from the increasing hours and stress levels. As high skilled individuals with good jobs we were not being significantly rewarded for these sacrifices. The idea that good job = good stress somehow introduced itself in the workplace - what rubbish is that - and who in their right mind thinks continuous stress is a good thing? In our opinion work life balance was going in the wrong direction

How could we possibly keep this up for at least another 30 or 40 years without developing health complications?

This is where we stopped and started to question our lifestyle. At that point we decided we did not want to spend all our time at work just to pay off the next piece of debt. Work did not really care about us. Why should all our effort and time be spent on it - did WORK=HAPPINESS? Retirement at 67 seemed a long way off.

Please read on for the two hottest topics we had: Debt versus Saving and getting on the housing ladder.

Debt and Spending versus Savings

Historically debt was always seen as bad (Consider the Merchant of Venice and the pound of flesh for the loan). In modern society debt has been transformed into a God send. Have it all now on credit. We are bombarded with "cheap" credit options, credit cards, car loans, bank loans, reward cards....

We are told there is "good" debt such as a mortgage - secured against "real" estate (house prices always go up you know). Go out and get some today as you MUST get on the housing ladder. Secondly there is unsecured debt which exploded with the introduction of the credit card. These allow you to get into debt extra fast for what are generally immediate wants and desires. This is generally a bad thing to do. In the past you would have had to save to get your want. Saving makes you think more carefully about your purchase as you have the discipline of earning the money first (all that time worked = a bigger TV is it worth it compared to I have a credit card I want it now give it to me).

Today we are introduced to debt at an early age (earlier the better). This really gets going with College and University. This is where it all started for MUFF as well. On moving away from home bed and board had to be paid for. MUFF needed the latest Pentium 400MHz computer with 32MB of memory and money to go out and chase girls.

You have to be free of debt to be really free. Debt is at the detriment to savings and SAVINGS= FINANCIAL FREEDOM. Debt just reduces your options. Consider interest on the debt as your productive time being given to the lender. Savings on the other hand give you choice - what shall I do with the time \ money I have?

If the life we were following (debt and work till I drop \ retire at 65) was actually to keep us in debt hence working and paying taxes it was not allowing us to reach our dreams as well. Happy family, friends, community, good food and a healthy life do not necessarily cost the earth. We needed an alternative path. Here are some of the debts MUFF built up:

- £6,000 in student loans

- £2,000 on bank balance

- £12,000 on graduate loan for a new car

- All of the business related costs detailed earlier

- Very expensive nights out £100 for travel food and drinks was a regular occurrence

- Expensive computers and games

- Maintaining the car

- Frequent exotic foreign holidays (Africa and Asia)

- Nice designer clothes

Moving from live for today (using debt) to consume at a later date required a whole new mindset. MUFF need to start saving. MUFF was then able to learn the positives of saving:

- You do not have to pay anyone else to do it.

- You generally get paid (interest or dividends)

- Investing the savings can help a company grow and you will take a share of the profits.

- You are investing in the future which means owning a constant value generating asset instead of a depreciating asset such as a car.

- Saving will mean less stress as you will not worry about servicing debt \ maintaining a job you hate.

- Saving will mean security for the future

MUFF Must Buy a House

Housing is a very emotional subject and one I would like to briefly touch on in this particular post. MUFF would argue that the general consensus in the UK is to buy. If you get a 25 year mortgage, with the interest payments you will actually pay for twice the house. Yes there is inflation that will erode the value of the initial loan but you are still on the hook for 25 years. There are risks, in the UK for example the interest rate can be fixed at most for 5 years. A 4% rate may be good now but what if it goes to 15%. At the same time don't worry and take as big a mortgage as possible again inflation will erode it.When we had the opportunity to buy we thought is there a different way to do this. Would it be possible to not pay double the value of the property over 25 years because of the interest payments - could we buy outright? How long would it take and what would be the long run benefits. We decided we would continue to rent and save like mad here is some of the reasoning:

One thing was clear to us housing is a COST. If we owned the property or rented it either way it was going to be an outgoing. So why was all of the peer pressure to buy. Our short term costs would be significantly be higher than renting. Here is a video from the Khan Academy on some of the maths:

For more information please see the post Early Retirement With a Mortgage.

Key Concepts:

- Conformity, same as the herd, work to retirement age in the same job you don't necessarily love.

- Society conditions us to get into debt and be good worker bees for 40+ years. Saving and investing are the key to brake these chains early in life.

1. What should you look for and

2. How to find it and make sure it is unbiased and true?

Yours Faithfully,

MUFF says BLUEBERRY MUFFINS ARE GREATNEXT UP – ROUND 3 AWAKENING THROUGH THE FREEDOM OF THE WEB

Welcome New MUFF Readers! Take a look around. Start at the first article, browse the all posts or just go for a Random Post

Keep in Touch: RSS Feed, follow MUFF on Twitter or subscribe to posts by email: