Mortgage securitization for Dummies? Not exactly.

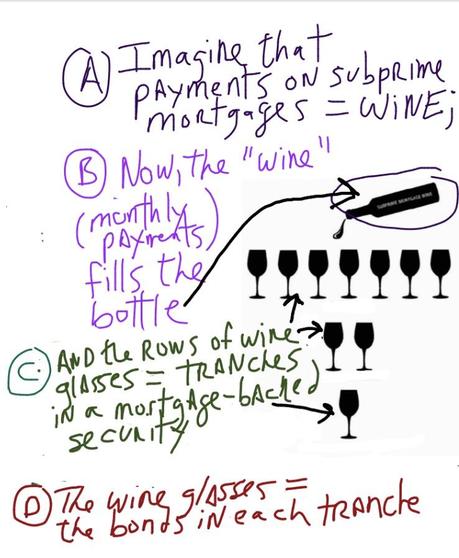

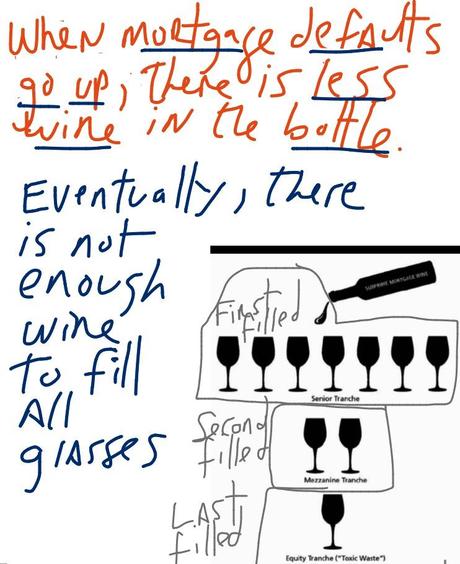

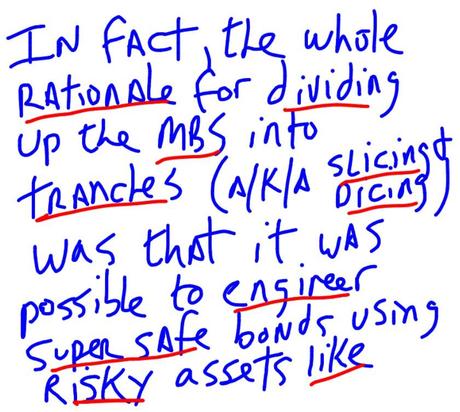

However, the diagram featured in this post - a tipped wine bottle floating above an inverted pyramid of wine glasses - really simplifies the migraine-inducing terminology and key concepts of mortgage securitization.

Note- This brilliant diagram was not conceived by Wall Street Law Blog.

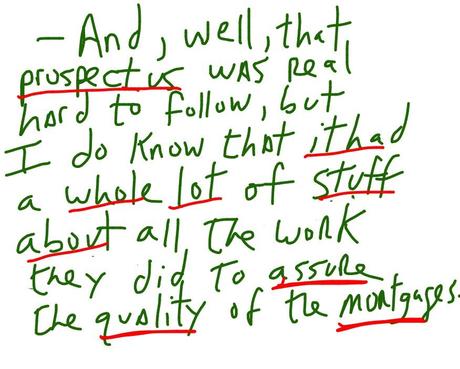

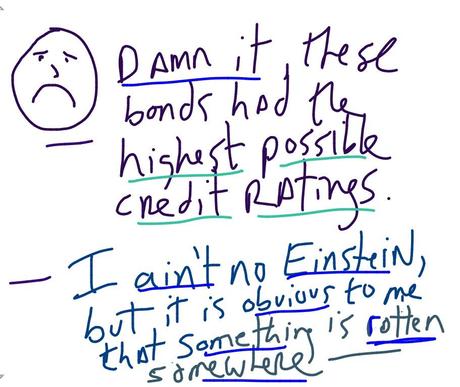

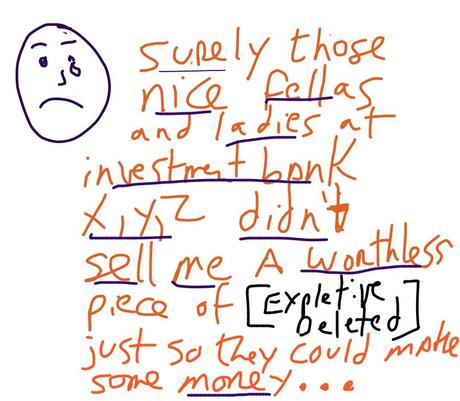

My goal in writing this post was to use this great visual aid to create a series of storyboards to describe the subprime debacle in a format that (a) is easy to understand, and (b) does not require readers to take any Advil, Tylenol, or Excedrin.

I know, I know - my chicken scratch handwriting is far from easy on the eyes. And you aren't sure you can go with the whole subprime wine thing. But hang in there. The post is pretty short.

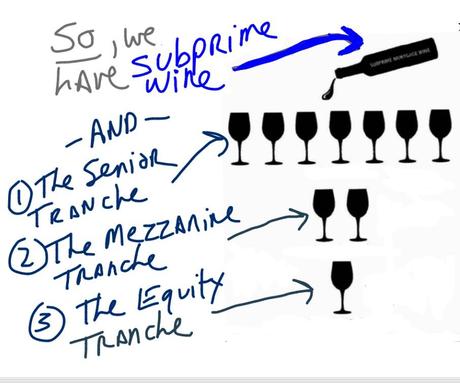

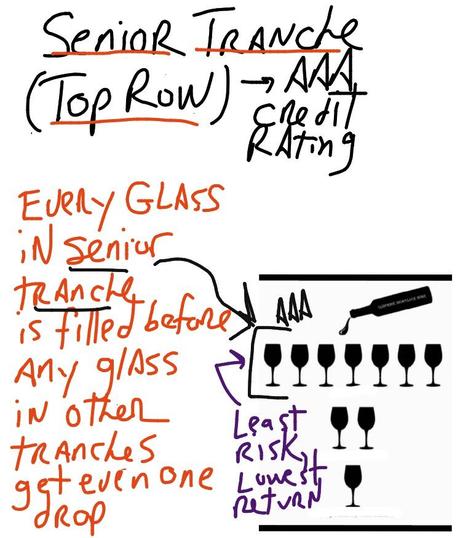

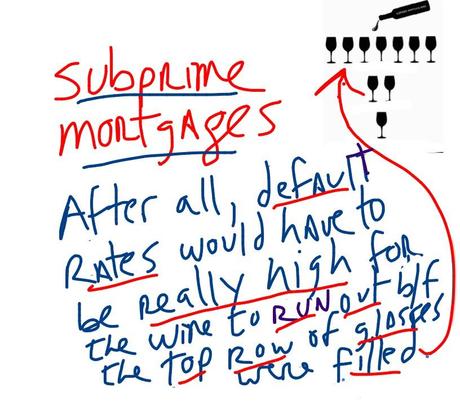

THE SENIOR TRANCHE (lowest risk, lowest return)

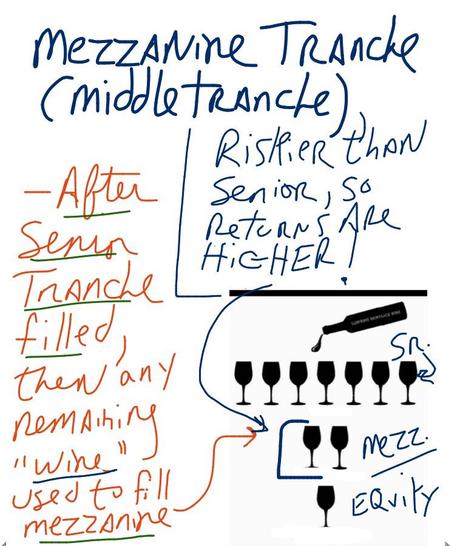

THE MEZZANINE TRANCHE (Middle Tranche / Riskier than senior tranche, but still low risk/low return)

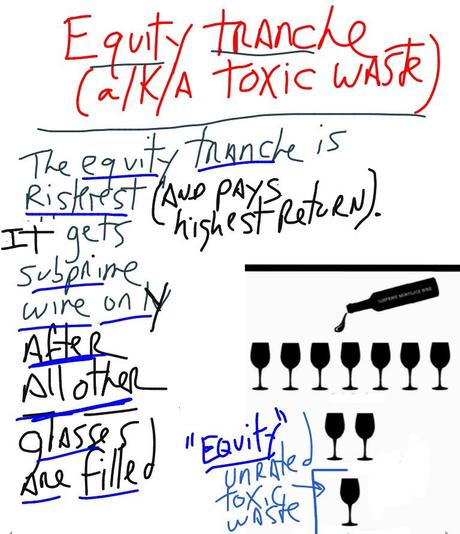

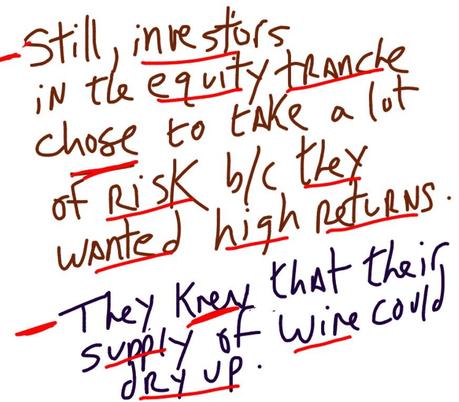

EQUITY TRANCHE (High Risk, High Return)

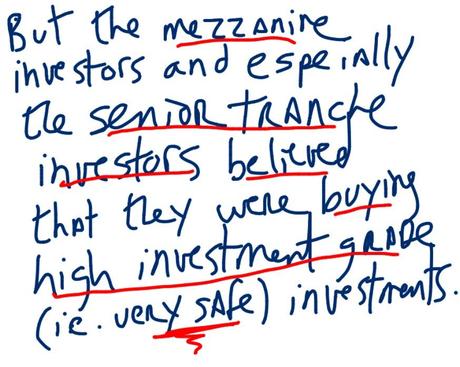

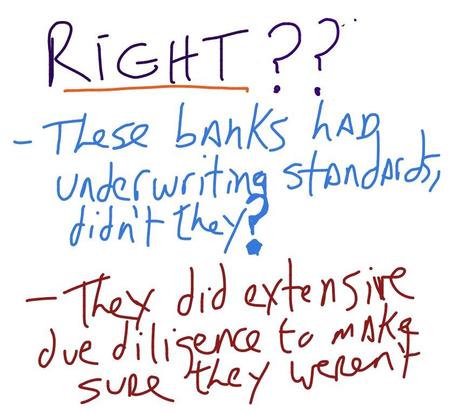

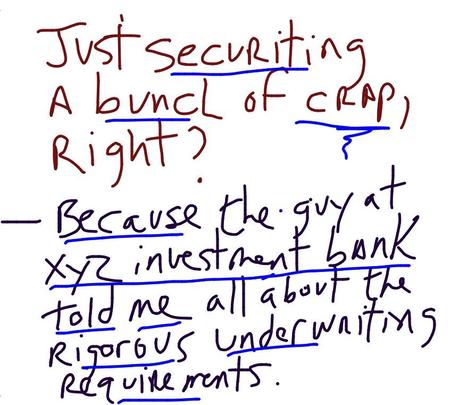

THE SUBPRIME DEBACLE

As long as favorable economic conditions keep default rates on subprime mortgages low, there is plenty of wine and all glasses are filled.

HOWEVER...

Actually, the truth is that the bankers coud -- and did -- sell investors trillions in fraudulent subprime bonds. And now, we hope, it is a little bit easier to understand how they did it.

By Brett Sherman