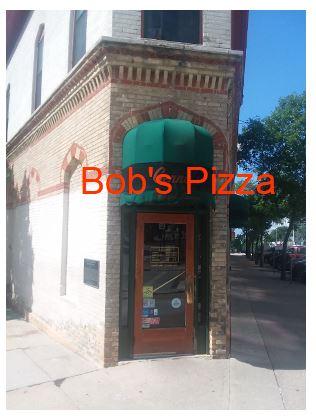

Once upon a time, in a small American town, there was a restaurant called Bob’s Pizza. Bob had opened the restaurant almost two decades before and his whole family were involved from the start. His wife, Freda, would greet people at the door and watch over the front of the house. His sons both worked in the restaurant as waiters and busboys. Bob would spend days and nights in the back, making the pizzas and other Italian food.

(Note, this site contains affiliate links. As an Amazon Associate I earn from qualifying purchases. When you click on an affiliate link and buy something, The Small Investor will get a small commission for the referral. You are charged nothing extra for the purchase. This helps keep The Small Investor going and free. I don’t recommend any products I do not fully support. If you would like to help but don’t see anything you need, feel free to visit Amazon through this link and buy whatever you wish. The Small Investor will get a small commission when you do, again at no cost to you.)

If you do use mutual funds and are looking for ways to choose types of funds, check out my new mini-book, Sample Mutual Fund Portfolios. It goes through fund allocations for different types of accounts, from 401ks and IRAs to college accounts, saving up for things and accounts for spending during your retirement years or other times where you’re using money from a portfolio to fund your lifestyle.

Opening the restaurant and getting it going was not easy. To gain the money needed, Bob and his with had to get a second mortgage on their home. They maxed out all of their credit cards to buy furniture and food for the business. For the first three years they didn’t take home a salary at all and needed to get loans from their parents and other family members to pay their mortgage and buy the things needed for their families. Finally, by the forth year, they were starting to make enough from the business to take home some money. By the fifth they were actually able to start paying back some of the loans that family members had made. Finally, after ten years, they were able to repay all of the personal loans and the credit cards, leaving only the second mortgage to pay plus the business loan they had taken out.

Long hours

Running a restaurant was not easy. From the start Bob was there at 8 AM each morning to prep the ingredients, balance the books, do the ordering, and take care of anything else needed. Freda would join him by 10 AM after getting the kids to school and help everything get ready for the start of the lunch service at 11 AM. From there they would work tirelessly, serving customers until they closed at 9 PM weekdays and 10 PM weekends. They would eat most meals in the back during slower times, often getting interrupted by the odd customer who would come between normal meal times. After closing they would clean for an hour or two, then take care of other business aspects such as filing the needed paperwork for taxes and licenses.

By the third year they were finally able to start hiring help, putting a couple of people on the wait staff and hiring another hand in the kitchen. This relieved the burden of serving customers a little but added the extra burden of filling out paperwork for the city, state, and federal government and sending in payroll taxes to the IRS. They also found that they still needed to be at the business most of the time since they could not hire anyone who would take the care that they would with the customers and the food. If they left for the evening, they would often find out the next day that the food quality and service suffered as some of the employees goofed off.

It was also not unusual to have employees not show up for their shift or quit suddenly, so taking a vacation might mean losing a night of income when a key employee failed to show. Over the years they even had a few that were stealing money from them or giving friends free food and drinks when they were not there to watch over things. Even when they were able to hire staff, they were still chained to the restaurant most of the time.

Starting to see some rewards

After about 15 years of hard work and feeding thousands of people each year, Bob and Freda had paid off the second mortgage and had actually built up enough regular business to make the place valuable. They actually had a couple of offers to buy the place, one of which was $750,000. They were generating about $200,000 in income from the business, which allowed them to buy nicer cars and move to a larger home, rolling the mortgage from their first home into the second. Things were starting to look up for Bob and Freda.

They were quite generous with their wealth. They sponsored three local sports teams, buying the uniforms and providing other support in exchange for having “Bob’s Pizza” on the back of the jerseys. They gave the teams free pizzas and drinks each year for a celebratory dinner at the end of the season. They were also devout Catholics, giving 10% of their earnings to their church each year as they had always done. Finally, they could always be counted upon to give out free dinner coupons for local charity auctions, even giving out a “free pizza per week for a year” coupon to one charity for their auction.

They still were both at the restaurant at least 40 hours per week, but were able to take a couple of days off per week most weeks and get in a vacation now and again. One of their sons was starting to become effective as a manager, so they knew they could take the weekend off if their son was there to cover things. All in all, it was shaping out the be a good life.

Want all the details on using Investing to grow financially Independent? Try The SmallIvy Book of Investing

The virus comes

One day in early March Bob was listening to the radio while he was prepping for the day. The announcer came on to say the March Madness, the college basketball tournament, had been cancelled for the year. He was shocked, not only sad to miss out on the entertainment, but also thinking about the business he was going to lose. They always had big groups come in to watch the games with pizza and beer on the big screens that they had. They got a lot of their weeknight business during times when the college basketball tournament was on. Without just that business, they would lose 5% of their sales for the year.

But things only got worse. One-by-one he listened throughout the day as each of the sports cancelled their seasons. Without any sports, they were looking at a drop in sales of about 30%. Given that their profit margin was about 25%, that wasn’t good. They had some savings that would let them keep things going for a month or two, but if things stayed like this for long, they would need to start cutting staff just to keep from losing money each month. Because each of their employees had become like part of the family, this was not a choice they would want to make.

A week later, however, they got even worse news. While they had seen a little less business without sports and because some people chose to stay home to avoid the risk of getting the virus, things were still going along at a manageable pace. But now the governor of their state had issued an order to close down all restaurants, only allowing carry-out service. This would be devastating to Bob and Freda. While they had a good carry-out business and pizzas can easily be made “to go,” about 40% of their sales were non-pizza dinners. People carrying out rarely ordered these higher-margin dinners and added things like salads and desserts onto their meals. The governor also provided a special exemption to sell alcohol for take-out, but who would pay them $5 for a beer that they could get for $1 at the grocery store?

Tough times

The next two months were rough for the restaurant. Bob and Freda did what they could to keep things going and keep their staff paid. Revenues dropped 80%. Bob and Frida stopped taking home any salary, choosing instead to give out all of the hours they could to their staff even though they were losing money every hour. Because most of the food they had bought was going to go bad anyway, they decided to make and deliver meals to emergency room staff and elderly shut-ins around the neighborhood. They lost several thousands of dollars in food alone during the first month.

Even though business was down, they still owed rent on their building. They also had a loan for a renovation they did about five years in the past to expand the restaurant that they needed to continue to pay. Bob and Freda dipped into their savings, including money they had put into an IRA for retirement and money they had put away for their kids’ college. As the months dragged on they saw most of the money they had saved vanish.

(If you enjoy The Small Investor and want to support the cause, or you just want to learn how to become financially independent, please consider picking up a copy of my new book, FIREd by Fifty: How to Create the Cash Flow You Need to Retire Early This is the instruction manual on how to become financially independent.)

Reopening

Finally, after two and a half months, they were given the word that they could reopen to sit-down guests, but that they would be restricted to 50% capacity. At that rate, they would be losing money every hour that they were open even if they laid off half of their staff. They would make enough money to cover the rent and the loan, but they would need to put money in from their own pockets to cover food and staff.

Bob started to try to figure out where they could get a bridge loan to cover them until they were able to open up fully again, not knowing how long that would take. He also pulled his credit cards out of his pocket, trying to decide which one he was going to use to buy food for the restaurant for the week. Freda saw him in the office and came in to talk.

She talked about how basically everything they had built over the last fifteen years was gone and they had nothing to show for their work. Business was forced to be down by the capacity restrictions and even though they were allowed to have people dine-in, many people were still staying away for fear of getting the virus. In fact, people had now become paranoid to the point where they were sacred to be in crowds ever just for fear of getting the normal flu. Things were also uncertain since it was expected that the virus could come back at any time. If that happened, they could be shut down again and lose all of their food again. This would mean going further into debt and perhaps being bankrupted within a year or two. They could lose their home and be unable to pay for their children to go to college at all.

A sad decision

Bob and Freda decided to close down and not reopen, even though the state allowed them to do so. There was just too much risk that the virus would be back and cause them to lose all that they had worked so hard to build again. At this point they were walking away with a small profit, but the next time they would likely not be so lucky. They might lose their home and they would need to put all of their savings into the place to get things going again. So, they broke the news to their staff, sold off the furniture and the fixtures, and closed the doors.

A week after they had closed, a family that had been working from home and eating in decided that it was time to venture out and go to their favorite pizza place. They were lucky, in that they each had jobs with the state and their income was not affected. In fact, they had been able to save up several thousand dollars during the shutdown because they were eating in and not driving their cars much. They had been diligent in staying home to “flatten the curve,” but felt that the time was finally right to start getting back into life.

They loaded up the car and drove over to Bob’s pizza, ready to have Freda greet them and sit down for their a slice of their favorite pie. As they approached, they saw the familiar sign and green awnings, but the place was dark. The wife got out of the car and walked over to the front door. There she found a hand-written note that read:

To all of our loyal customers: We have decided to close rather than work to build it all again. Thank you for 15 great years.

-Bob and Freda

Have a burning investing question you’d like answered? Please send to [email protected] or leave in a comment.

Follow on Twitter to get news about new articles. @SmallIvy_SI

Disclaimer: This blog is not meant to give financial planning or tax advice. It gives general information on investment strategy, picking stocks, and generally managing money to build wealth. It is not a solicitation to buy or sell stocks or any security. Financial planning advice should be sought from a certified financial planner, which the author is not. Tax advice should be sought from a CPA. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.