Amidst volatile markets, Bitcoin’s recent bull market surge commands attention. This article probes the expert investor’s bold prediction, scrutinizing on-chain metrics and historical trends.

We dissect the significance of the 200-week moving average and the halving cycles that inform Bitcoin’s valuation.

As we navigate through analytical insights, we aim to elucidate the strategic foresight driving the cryptocurrency’s potential long-term growth, offering a nuanced understanding of its ascent in the financial ecosystem.

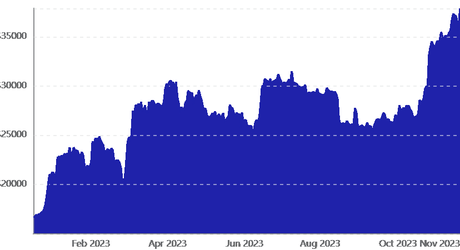

Analyzing Bitcoin’s Recent Surge

In analyzing Bitcoin’s recent surge, it is essential to consider the synergistic impact of historical trends, on-chain metrics, and market psychology on its market performance.

Notably, Cathie Wood’s investment strategy, which integrates a deep understanding of technology’s exponential growth, is indicative of a broader embrace by institutional investors. This cohort’s growing participation is a fundamental driver of Bitcoin’s price dynamics. As institutions allocate portions of their portfolios to digital assets, their substantial capital inflows amplify Bitcoin’s market movements.

Furthermore, Ark Invest’s analysis, leveraging intricate on-chain metrics, provides a granular view of Bitcoin’s network health, underscoring the asset’s robustness and validating its upward trajectory.

Collectively, these elements forge a compelling narrative for Bitcoin’s performance, aligning with Wood’s optimistic prognosis for the cryptocurrency’s bull market potential.

The Significance of On-Chain Metrics

Several on-chain metrics provide critical insights into the underlying strength and potential future performance of Bitcoin’s market. Analyzing Bitcoin’s on-chain indicators, such as transaction volume, active addresses, and the hash rate, can offer a more nuanced view of market sentiment than price movements alone.

These metrics aid in market sentiment analysis, allowing investors to gauge the level of user adoption and network security. Furthermore, the correlation with other cryptocurrencies often mirrors shifts detected by Bitcoin’s on-chain activities, as Bitcoin typically leads the sentiment in the crypto market.

Future price predictions increasingly rely on these metrics to forecast market trends. As such, on-chain data is an indispensable tool for investors seeking to understand and anticipate the dynamics of Bitcoin’s market trajectory.

Historical Patterns and Halving Cycles

Bitcoin’s market behavior is strongly influenced by its halving cycles, events that have historically preceded significant bull runs. By analyzing market trends, we can discern that these halving events, which occur approximately every four years, play a pivotal role in shaping Bitcoin’s value trajectory.

The impact of halving cycles is measurable; they reduce the rate at which new Bitcoins are created, thereby constricting supply and often leading to upward price pressure. Observing historical data, analysts note that Bitcoin typically enters a period of gradual appreciation leading up to the halving, with more pronounced gains materializing in the aftermath.

The current market cycle appears to be adhering to this established pattern, suggesting that understanding these halving events is crucial for forecasting Bitcoin’s long-term market performance.

Entry Points and Growth Potential

Assessing the current market landscape, disciplined investors may find the present Bitcoin valuation to be an attractive entry point, given its growth potential and historical cyclical patterns.

The recent price appreciation, following a notable 28% increase in October, aligns with the asset’s tendency for pre-halving momentum.

While the current price of Bitcoin at $37,179.45 reflects a modest retreat, the proximity to the 200-week moving average suggests underlying strength. This positioning, coupled with Cathie Wood’s analysis of on-chain metrics, indicates robust health and an upward trajectory.

The ideal buying opportunity may well be at hand, as Bitcoin’s cyclical nature and the anticipation of post-halving gains offer a compelling case for potential long-term price appreciation.