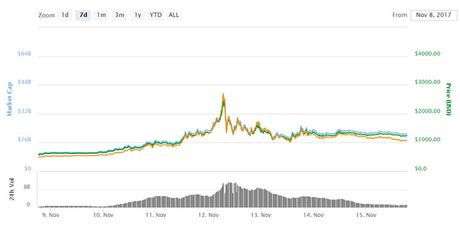

Bitcoin Cash (BCH), Bitcoin’s younger brother has surged 112% at the time of writing in the last 7 days, nearly doubled since its inception on August 1, 2017, and grown 6 times from its lowest trough. It peaked on Sunday to a high of $2,500 before crashing down to earth by 60%. So, is this the new “get rich quick scheme” of 2018 and can it surge pass Bitcoin (BTC) in terms of value, adaption and application?

So, what is Bitcoin Cash (roughly)?

Without wanting to get technical nor boring, Bitcoin cash spawned in what is known as a “hard fork” whereby bitcoin miners voted overwhelming to separate the original or “real” Bitcoin to favour those who wanted to treat the cryptocurrency as a digital investment as opposed to a pure transactional currency as before. To keep things simple, the two are more similar than they are different. BCH’s main aim is to be faster and cheaper at making payments or transactions whilst upholding Bitcoin’s main characteristics of a public, decentralized network without the requirement of a central “bank”; A type of Paypal to credit card payment if you will.

Bitcoin, however, is the reverse, prioritizing anonymity and widening peer to peer adoption of its decentralized network over speed and usage. There’s a degree of rebel and defiance behind Bitcoins design and creation whereas Bitcoin cash seems more useful and sensible. Both have no inherent value per se. Unlike a traditional equity stock there are no debt, liabilities, sales, growth and earnings projections or market fundamentals to peg value to it; In many ways, all part of its allure.

Why the sudden growth?

Several factors have affected the surge in value the last 3 months, mirroring the reasons many other cryptocurrencies have boomed. First, is adoption from the exchange platforms. Originally, Coinbase, one of the main players, refused to acknowledge BCH but caved days later approving restricted trading from January 1, 2018, causing a spike. Then later, Kraken and China Based Via BTC joined the party and allowed the trading of BCH approving deposits and withdrawals of Bitcoin Cash. As its exposure grew to be exchanged around the globe, market cap and 24hr trading volume swelled.

The second is not as clear. Some argue the boom to a peak $2,500 valuation per coin was due to a strategic infight by techy insiders on Bitcoin’s core design, others claim merely a fundamental acceptance of its statue in the cryptocurrency sphere and some, a classic “pump and dump” trading pattern maneuver by Chinese miners usually reserved for volatile, African Mining penny stocks listed on the AIM. All bold, romantic claims but as is common with cryptocurrency, impossible to prove.

So what now for Bitcoin Cash?

The easy answer is “who knows.” For now, this spin-off currency will continue its bullish volatility with global savvy day traders profiting daily and large exchanges and platforms gaining from the fees for transactions from hopeful average joe’s dreaming to be another “Bitcoin Millionaire”. The technical analysis shows a sell-off correction, a short-term cooling of the buoyant growth fueled by Korean Exchanges offering BCH/KRW pairings in recent days.

It’s always a bold ask to predict a cryptocurrencies’ future but some things are for sure – the boom-bust nature will continue more so than ever just like the other 1250 + currencies, mainstream media outlets and financial institutions will continue to report, monitor and comment on it, even if they still don’t respect it. But more importantly than all driving its intoxicating evolution, Bitcoin and Bitcoin cash will be like Crossfit, if you do it (or have bought it) you won’t be able to shut up about it and as any great marketer or salesman will tell you, that’s almost invaluable.