%%bloglink%%

In May 2009 PIMCO’s Bill Gross first used the term the “New Normal” to describe an investment future filled with more regulations, less borrowing, slower growth and below average returns. In his latest letter to shareholders, (January 2013) he now says we may be leaving the “New Normal”.

So how did investors do following his advice…well not too shabby.

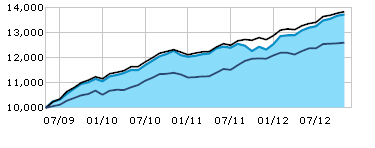

This graph shows how $10,000 invested in the PIMCO Total Return grew by about 9% per year from May 2009 (when he first mentioned New Normal) to Dec 2012 (the end of the New Normal).

PTTRX

Peer Index (Lipper Intmdt Inv Grd IX)

Market Index (Barclays US Agg TRIX)

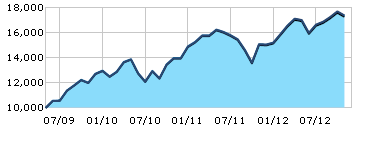

This graph shows how $10,000 invested in the Vanguard S&P 500 Index grew by about 15% a year during the same time frame.

VFINX

Peer Index (Lipper S&P 500 Fund IX)

Market Index (S&P 500 Daily Reinv IX)

So by following his advice and owning bonds, your money grew by 9% a year with just a few months of mild price swings.

This sounds to me like what owning a bond should be like.

If you owned the S&P 500 Index during the same time frame you had a higher ending value but that is only if you never sold out during the multiple double digit declines.

Just another example of the differences between the two.

graphs source: Finra.org