What's going on here? Read this post to find out. All charts below are clickable to enlarge.

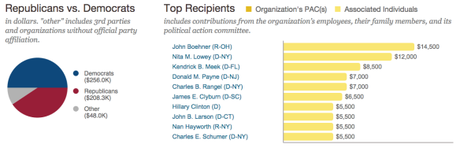

What's going on here? Read this post to find out. All charts below are clickable to enlarge. Campaign finance, from 1989 through Q2 2014: $512,365

Lobbying:

- All time: $1,740,000

- 2013-2014: $760,000

- 2013-14 spending represented 43.7 percent of all time amount

Source

2013-2014 Cycle

Individual contributions:

Political Action Committee contributions:

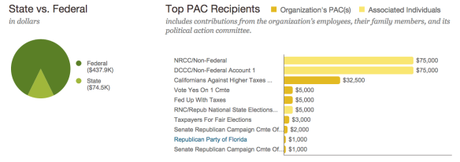

Individual contributions:

Political Action Committee contributions:

Over last 15 years, top party committees have been:

- Florida Republican Party: $7,500

- New York Senate Republican Campaign Committee: $3,000

- Florida Democratic Party: $1,000

Source

2014 Election Cycle

- Total Raised: $84,567

- Total Spent: $33,843

- Contributions to federal candidates: $27,840 (66% to Democrats, 34% to Republicans)

Source

Of note, many top recipients of donations from Heineken USA were New York representatives or from neighboring states. Heineken USA's headquarters in White Plains, NY. Whether that's a worthwhile connection or not may be up for debate.

Legislation of Interest

As you would expect for a large company such as Heineken USA, attention is focused on taxes, including general stake in corporate taxes and offsets as well as LIFO, known as the " last in, first out" method of inventory. Repealing this program would increase tax liability for distribution companies.

Of more interest for everyday consumers would be Heineken USA's support for the CIDER Act, which would adjust tax code related to cider. This is of particular use for Heineken, given increasing attention to their Strongbow brands, especially in the US. Strongbow released two new brands last year and will do so again in 2015 with a bigger push.

Under current federal tax law, the definition of hard cider only allows for up to 7% alcohol by volume before it is taxed at the more expensive rate for wine only a certain level of carbonation before it is subject to the extremely expensive champagne tax ($3.30 or $3.40/gallon).

If you're curious, here are details about the carbonation issue and more about the CIDER Act.

Beer Money series:

Bryan Roth

"Don't drink to get drunk. Drink to enjoy life." - Jack Kerouac