The Australian Dollar is closing in on a 3 month high this week following a dovish tone from the FED and encouraging if not perfect inflation data. The combination of the Jerome Powell’s recent FED statement and the Aussie inflation data propelling the Australian Dollar to a two-month high against the US Dollar.

Whilst the AUD did lose some ground following the release of January’s Caixin manufacturing PMI overall the AUD has held on to the majority of the gains provided by the FED’s more downbeat outlook.

Australian Inflation below par

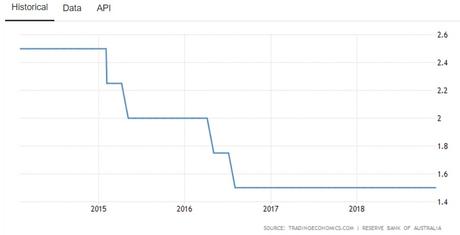

January saw Australian inflation grow by 0.5% exceeding estimates of 0.4% equating to an annualised growth of 1.8%. The number although encouraging sit far behind the Reserve bank of Australia’s target of between 2-3%. Whilst overall inflationary pressures remained passive, the current inflation growth remains ahead of financial markets forecasts of 0.4%, quarterly and 1.7% annual growth and contributed to the Australian Dollars gain with some believe that the currency is reversing some of its longer-term losses against the US Dollar.

Regardless of this this, inflation remains below the minimum standards set by the RBA with inflation currently sat at the lowest leaves since Q4 2016.

Prices rise in products such as tobacco, domestic travel and fruit supporting the slight inflationary gains. Falls were seen in audio and visual equipment, motor fuel and telecommunications equipment and services.

Experts believe the chances of the RBA achieving its CPI rate of 2% remain remote following the latest quarterly figures. The RBA needing to see inflation increase at a rate of 0.6% in the next two quarters. The weaker numbers have led investor to believe that the RBA will revise down their GDP forecast of 3% in their next quarterly statement; which if accurate could see a sell of in the Australian Dollar, in the same way as we are seeing now in the USD.

FED Dovish Statement

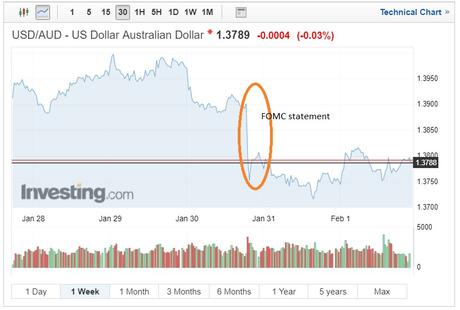

Whilst the inflation figures would have arguably assisted the AUD the data was hardly a show stopper. AUD gains were mostly due to US Dollar weakness this month with Jerome Powell putting hopes on further interest rate rises on ice. The statement was interpreted by as a complete 360 on rate hikes with analyst interpreting that the FED could be coming to the end of its tightening policy. Delivering a much more cautious outlook on the economy a clearly different outlook from its previously patient and measured rhetoric to future rate rises.

The two months haven’t been kind to the Dollar with the USD index highlighting a depreciation of over nearly 2% against 6 other currencies; the poorest 2-month performance in 12 months.

Outlining their stance, the FED said they would be remaining patient in raising US interest rates due to more uncertainty surrounding the US economy and refused to rule out monetary tools and policy change. Both rate cuts and altering its balance sheet feasible options if needed.

Although following the recent non-farms jobs growth the scenario remains less bleak than potentially the FED would let us believe the effects of the global slowdown are clearly being felt.

Reserve Bank of Australia to hold rates well into 2021

This week’s tepid Australian inflation figure will almost certainly see Aussie interest rate remain at 1.5% the 28th consecutive month they have remained at this level. Economists anticipate that this rate will be held well into 2021, with many thinking the RBA won’t move for a rate rise until Q3 2021.

Australia’s economic outlook was caused by a terrible Q3 economic data run which saw disappointing GDP figures and retails sales falter, indication low consumer confidence levels.

Whilst many don’t envisage an interest rate rise until 2021, markets believe a rate cut is might be inevitable with an 80% probability of a rate cut to 1.25 by spring 2020.

AUD holds on to the week’s gains

Despite the blight being experienced in the Chinese economy AUD managed to hold on to its gains against the US Dollar. USD/AUD falling from 1.3901 to 1.3753 following the FOMC announcement. Whilst the encouraging tone of the US Chinese meetings has stabilised confidence the USD hasn’t regained much ground in the final days of trading. Indicating that risk on sentiment might be coming back in to focus.

The final days of January saw the Australian gain further with the USD/AUD pair touching 1.3717; its lowest point since 5th December.

AUD forecast – AUD/USD to Extend gains?

Whilst sentiment surround the trade talks appears positive investor could consider consolidating the recent gains. The weekend prompted the release of the Caixin Services PMI showed a small decline from 53.9 to 53.6. The figure which surpassed market expectations will by no mean offset concerns around the Chinese economy cooling.

Upcoming Australian data includes the TD securities inflation report and December building permits. More important data is also announced next week with Retail sales, RBA Rate statement and speech from RBA Governor Lowe. Subject to the outcome of the aforementioned data we anticipate that AUD will retain the majority of its gains.