From a swing trade perspective, I am primarily interested in trading impulsive moves rather than chop. Here are the recent equities posts in reverse chronological order: Correction Scenario,1986 Support,Deep Pullback Scenario, and The Next Dip Buy. As for the analog scenarios, I am not a big fan of guessing corrective structure. It can present as rolling upwards, sharp/deep, sideways. We still do carry that bearish analog I have mentioned in the posts, but I have no reason yet to consider trading it.

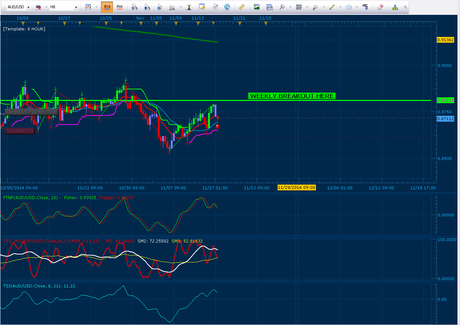

This current post is an add on to the Dollar Weakness. I am tacking on an AUDUSD long here. I am front running the dollar weakness a bit but last week went so well in the NZDUSD and EURUSD that I am going to add the AUDUSD long. Here is the chart with the stop level:

The goal would be to find support on the 8 hour chart here and then rally through the green line and hold it. At that point, I will probably add into the position.

There is always a bull path and a bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester

The goal would be to find support on the 8 hour chart here and then rally through the green line and hold it. At that point, I will probably add into the position.

There is always a bull path and a bear path. We cannot know which path our future will choose. As always, do your own due diligence, read the disclaimer, and make your own investment decisions.

Peace, Om,

SoulJester