This week has proved a challenging one for the USD with a basket of currencies capitalising on a combination of weak US data and the uncertainty perpetuated by the numerous scandals surrounding President Trump with AUD to USD exchange rates being one of the benefactors. However, the Australian dollar also posted encouraging data this week which also had a hand in its strength against the US Dollar.

Australian retail sales triumph

Wednesday saw the release of Decembers’ Australian retail sales. For many months the reserve bank of Australia has deliberated on ways to encourage its people to spend. Inflation has systematically fallen short of sort of the central bank expectations.

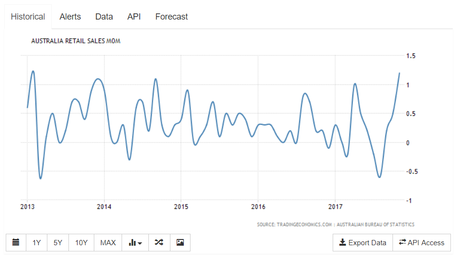

However, the bank will, without doubt, be encouraged by December’s retails which demonstrated impressive growth where retail sales were forecast to show growth of 0.4% and retail figures spiked significantly with the economic data showing 1.2% growth.

The significant upturn was fueled by black Friday and Christmas sales plus the release of the latest iPhone. In total, the upturn highlighted sales totalling in excess of AU$26 Billion. The performance marked the best monthly increase since 2013.

Weekly overview: AUD to USD exchange rates performance

The significant Australian retails sales increase allowed AUD to USD exchange rates to capitalise on a significantly weakened US Dollar. The US Dollar has found itself under pressure from a variety of major currencies in the last few weeks.

This week saw AUD to USD Exchange rates rise from week lows of 0.7808 and strengthen to the pairs current price of 0.7917. The surge marks roughly a 3-month high for AUD to USD exchange rates.

Upcoming Chinese economic data could influence AUD to USD exchange rates

The week ahead also has a raft of Chinese economic data releases. These include gross domestic production figures. Following the quarterly GDP data is the release of the Chinese fixed asset investment data which illustrates investments in factories, roads, electrical supplies and property; the majority of which raw products required will be sourced from Australia. Concluding this week’s key Chinese economic data is the quarterly assessment of the National Bureau of statistics. The conference typically provides a statement on the economy followed by an in-depth overview of China’s economic figures.

China’s quarterly GDP figures tend to remain between 6.7-6.9% and markets anticipate a reading of 6.7%; this quarter anything higher combined with positive fixed asset investment data should potentially bode well for commodity currencies and therefore the Australian dollar.

Do analysts believe the AUD to USD Exchange rates rally will continue?

Banking analysts have been quick to air on the side of caution following last week’s positive retail sales figures. Indeed, the improvement in Australian consumer spending should be celebrated. Yet issues surrounding wage growth remain. Australian wage growth has been extremely modest improving only 0.5% in the final quarter of 2017, the same as the previous quarter. With the uplift in the retail sales figures being attributed to the release of the latest iPhone and goods purchased in end of year sales and over Christmas sales may be somewhat short-lived, however the true sustainable support for AUD exchange rates will be through the supply of iron ore, gas and coal whose prices have risen in 2017 due to increased global demand. In world, economies remain on track so should AUD exchange rates.