ATCOR is an acronym for "all taxes come out of rent". This means that apart from a poll tax, all other taxes are incident to some degree or another on land rental incomes and thus selling prices. It doesn't mean that every penny of every tax is incident upon land.

To illustrate, consider the simplified example of a hypothetical country called SmallLand.

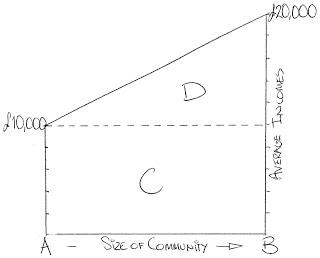

SmallLand has a population of 1 million. They all rent their immovable property from a landlord called Mr Monopoly. Total incomes are £15bn per year. Due to agglomeration effects there is a linear relation between the size of a locations population and its average income. Average incomes are lowest in the smallest town (A) Poorville at £10,000 pa rising to £20,000pa in the biggest town (B) StreetsofgoldCity.

Ricardos Law of Rent tell us that Mr Monopoly can extract the difference between the averages. Leaving the average discretionary incomes in SmallLand before taxes are applied at £10,000 pa(C), while Mr Monopoly gets a yearly income of £5bn(D) from land (leaving out income from bricks and mortar)

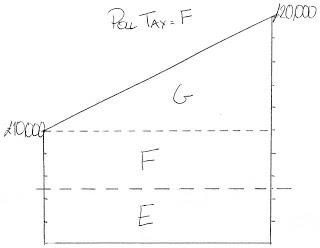

SmallLand's government needs to raise £5bn a year in taxes. It can do so by either a poll tax, a flat income tax, or a land value tax. The graphs below show how each of the taxes effect the incomes of the population.

To raise £5bn from a poll tax(F), everyone would pay £5000 pounds each, leaving total discretionary incomes at £5bn(E) for all those paying rent. Mr Monopoly's income becomes £5bn -£5000(G)

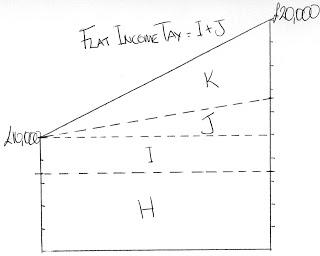

To raise £5bn from a flat income tax, it would be set a 33.3...%. For that part of incomes at £10,000 pa and under it would raise £3.33..bn(I). As incomes rise over £10,000pa the amount raised goes up in proportion to incomes, totaling £1.66..bn(J). This leaves total discretionary incomes £6.66..bn(h), leaving £6,666.66 for each renter. Mr Monopoly's income falls from £5bn-£1.66...bn, totaling £3.33..bn pa(K).

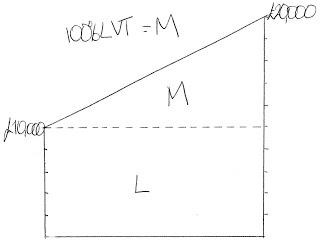

To raise £5bn from a flat income tax, it would be set a 33.3...%. For that part of incomes at £10,000 pa and under it would raise £3.33..bn(I). As incomes rise over £10,000pa the amount raised goes up in proportion to incomes, totaling £1.66..bn(J). This leaves total discretionary incomes £6.66..bn(h), leaving £6,666.66 for each renter. Mr Monopoly's income falls from £5bn-£1.66...bn, totaling £3.33..bn pa(K). To raise £5bn from a LVT it would be set at 100%, so that the total income of Mr Monopoly (D) is converted into tax revenue (M). Therefore, in essence, those living in SmallLand who all rent become tax free so their discretionary incomes (L) is the same as (C). The rent they pay is in effect rebated aback to them as State spending.

To raise £5bn from a LVT it would be set at 100%, so that the total income of Mr Monopoly (D) is converted into tax revenue (M). Therefore, in essence, those living in SmallLand who all rent become tax free so their discretionary incomes (L) is the same as (C). The rent they pay is in effect rebated aback to them as State spending.In conclusion, the incidence of a LVT and Poll Tax on land are at the opposite ends of the spectrum. Because incomes are dependent upon location, taxes upon output share their incidence between land, labor and capital in proportion to their "progressiveness".

In my example above, a flat 33% income tax is shared 1/3 land to 2/3 incomes. As the UK tax system is only mildly progressive in total, this this probably a good guesstimate of how much revenue a tax shift to LVT would raise.