Share prices of various stocks have come down significantly in the past few weeks and this include Ascendas Hospitality Trust (AHT). This has been one of my favourite hospitality trust investment which I bought back in 2014. It has been a 4 years investment now. AHT made some significant developments in the past 1 year which they have summarised in their recent AGM last friday. I wanted to make a trip down but was too busy at work so I couldn't take time off for this AGM. Nevertheless, I managed to get the slides presented during the AGM which gives quite good information on the developments over the past 1 year.

I believe AHT share price of below $0.80 presents a good opportunity to invest in a hospitality trust with stable dividend yield of more than 7%. Let's discuss in detail on why is this so.

Brief introduction to AHT

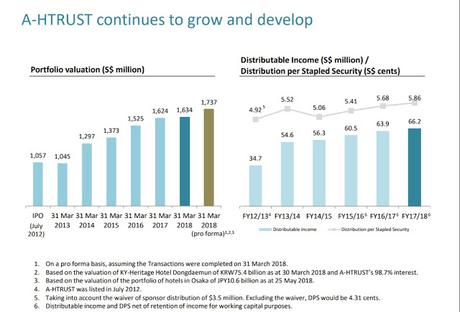

AHT has 10 hotels located in Australia, Japan, Korea and Singapore. In terms of portfolio valuation, Australia makes up 38.7%, Japan at 38%, Singapore at 18.1% and South Korea at 5.3%. In its opening address during the AGM, they mention specifically 3 highlights:

- Divested Beijing Hotels for 2.0x valuation

- Effective interest rate significantly lower at 2.7%

- 3.2% DPS y-0-y improvement

Earlier this year, AHT did divest away their 2 Beijing hotels at much higher valuation. It was the talk of the town as its share price shot up because investors believed that its Net Asset Value is much higher than what they have put in their balance sheet. However, this was short lived when its Australia properties did not do as well and what made it worse was Australia hotels collectively made up the largest contribution to its DPU. Its Australia net property income declined -6.4% in FY2017/18 as compared to FY2016/17.

Its other hotels in Singapore and China did relatively well and Japan 's hotel was unchanged with a slight decrease. Overall, DPU increased 3.2% mainly due to savings in finance cost and look fee received in connection to the divestment of Beijing hotels.

One thing to note is that I can see REVPAR is increasing for all its hotels in all countries including Australia. This is an encouraging sign. Its Australia's hotel in Sydney still performed well. One of its Sydney's hotel was also undergoing renovation so this affected DPU in the past 1 year. Moving forward, DPU should continue to be good as the renovation is already done.

*To understand why REVPAR is important, you can read this article here

AHT's gearing is at 30.8% which is a decrease from the previous 32.2% after it divested its Beijing hotels. One significant thing to note is that its effective interest rate came down to 2.7% from the previous 3.1%. This is an important factor in this rising interest rate environment which I wrote in another article here.

Net Asset Value remains stable at $0.92. This means that the current price of AHT at $0.79 is trading at a discount. For its debt profile, 77.2% is on fixed rate while 22.8% is on floating rate. Most of its debt are in AUD and JPY which is not that affected by interest rate movement so far. Japan still has one of the lowest interest rates in the world currently. It might be interesting to note that Japan's key short term interest rate is actually at -0.1% as at June 2018.

Hotel Acquisition for Growth

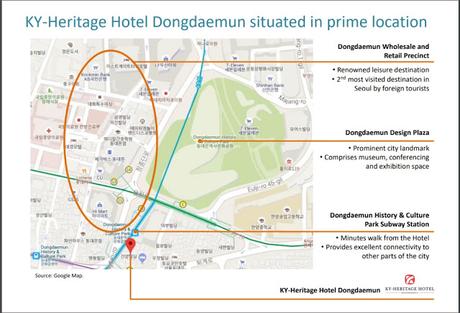

After its divestment of its Beijing hotels, AHT continues to pursue growth opportunities by acquiring DPU accretive hotels. It made its maiden entry into Seoul, South Korea by acquiring a hotel that is strategically located in the prominent Dongdaemun area. The acquisition is DPS accretive by 1.7% on pro forma FY2017/18 basis. This is a midscale hotel which was completed in 2015 and it is freehold.

Separately, it also purchased 3 other hotels in Osaka which is DPS accretive by 4.3% on pro forma FY2017/18 basis. Osaka is a key financial centre both in Japan and globally and also a popular leisure destination. International visitors arrivals in Osaka reached 11.1 million in 2017 and has a CAGR of 43% over the past 5 years. Overnight stays in Osaka also grew by 8% on average, every year for the past 5 years.

I believe Ascendas Hospitality Trust will continue to grow both in terms of portfolio valuation and also in terms of DPU. A stock price of below $0.80 represents a good 7%+ yield as well as trading below its book value. I will be looking to add more to this investment if it comes down to below $0.75. My last purchase price was at $0.72 and this represents a 8.1% yield which I have been getting for the past 4 years.