It has been rumoured over the last few days that the US might be considering stopping their tariffs. The rumours which were publicised in the Wall Street Journal sent the Dow skywards with the average stock rising nearly 0.7%.

The WSJ reported that the US Treasury Secretary Steven Mnuchin is considering reducing or lifting the current tariffs in order to gain more meaningful concessions and reforms for the future trade deal.

Whilst the WSJ’s article conflicts with comments from the US trade representative Robert Lightizer who believes this stance could show weakness and potentially jeopardise or weaken the USA’s stance on the new trade deal.

Markets have experienced significant volatility following Trump’s implementation of tariffs and many hope to see more stability if the tariffs are reduced or lifted. Whilst investors will require more than rumours and hearsay, if accurate the reduced tariffs could assist tech stocks and ensure that the US and Chinese economy gets back on track. Apple reported that it anticipates its earnings to drop at the beginning of the first quarter with earnings predicted to fall by $5 Billion. This follows slowing demand and supply chain issues.

Can the global uncertainty caused by the tariffs be reversed?

Whether a solution to the global slowdown would rest solely on a potential trade deal with the US and China would be hard to say. It clearly, however, has a profound effect on global sentiment and whilst traders will always find angles to trade, an agreement could see US markets enjoy more stability and provoke a risk of mentality.

The Chinese slowdown is clearly starting to unfold and has been highlighted in the latest industrial profit numbers which weakened by 1.8%. These figures were accompanied by weaker Chinese retails sales and industrial production. The aforementioned contributing significantly to Apple’s profit warning.

If the superpower was to start to see a continual recession in its growth the effects on other countries in Asia would be profound. Commodity exporters and emerging economies would just be a few of the causalities. Europe would also be affected, Germany who many believe is poised for recession would also be dramatically affected by a prolonged slowdown in the Chinese economy.

When are the superpowers meeting again?

The chief trade negotiator Liu He will head to Washington in the coming weeks to continue talks with US trade representatives. Accompanied by the Chinese Commerce Ministry spokesman Gao Feng the planned trip is mooted to take place week commencing January 30th.

As yet the talks haven’t been confirmed by the Trump administration. The planned talks follow last weeks dialog in Beijing which is believed formed great foundations for the next round of discussions. The previous talks are believed to have centred around US agriculture, manufactured goods, energy and products and services.

Both parties are trying to secure a palatable deal before March 2nd when Trump’s government plans to increase tariffs on £200 Billion of Chinese goods from 10% to 25% if a deal isn’t agreed. An increase which will almost certainly provoke further adversity in stock markets.

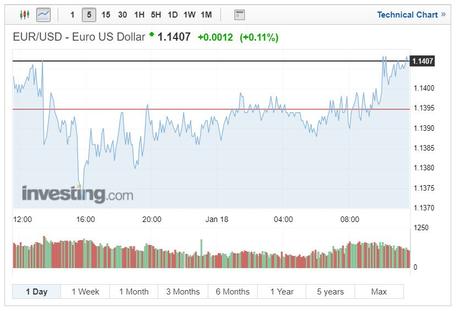

Dollar performance against the JPY and EUR

The USD/JPY climbed to over a two-week high as the WSJ reported the potential of the US reducing or lifting its tariffs on China. The pair climbed from 108.97 to 109.24 as the pair has sustained its strength. The JPY was abandoned as investor adopted a risk on attitude, leaving the haven of the JPY.

The USD was also able to capitalise against the JPY following softer than expected National Core CPI which came in 0.7% year-on-year lower than the predicted 0.8% and 0.9% last month.

The last few days have seen the EUR/USD pair rise slightly as the single block currency profited from the possibility of the reduced of lifted US and China trade tariffs. The last day has seen the pair strengthen from 1.1373 to its current level of 1.1406.

Investors believe the worst of the Euro data has now been released and has got behind the currency. This last few weeks have seen manufacturing and export tail off and the largest economy in the zone Germany has revised down growth expectations. The ECB confirmed recently that it is unlikely to raise interest rate until after the 3rd quarter, later than expected just a few months ago.