We thought we'd dig into whether leasing an apartment in a brand new condo represents a good deal for tenants, and at the same time verify whether a value investor is going to get good rental returns in the early years of their condo.

On one hand, we hear stories all the time of people getting a bargain when renting in a new development, and that seems to make sense considering there will be a flood of supply on the market (many near-identical apartments all available in a short period) and there may be inconveniences too (e.g. Ongoing construction, facilities not complete yet, etc). On the other hand - everyone loves shiny and new, right? We know in general that condos rent for less as they get older, but then where is the peak? Day 1, Year 2? Let's look into the data to find out!

Dark Condos

We noticed recently that the Business Times updated their " Dark Condos" infographic feature with " Still Dark Condos " These photo essays involved taking photos of new condos at night as a way to determine approximate occupancy rates.

An accompanying article in the Straits Times attempted to "shine some light" on the situation, which seemed strange considering that the condos had all and their Temporary Occupation Permit (TOP) issued for more than 18 months. Suggestions in the article include: - Today's expats are overseas more often - Apartments might be purchased by wealthy foreigners as holiday homes - Owners choose not to lease out as rents are too low and could attract unsavoury tenants (!) - Owners prefer to keep the unit empty for an easier sale - HDB upgraders staying on to wait for better price for their flat

We don't find any of these particularly convincing, but it's interesting nonetheless! This gave us the idea though to dig deeper into the rental data of some slightly older condos to see if we can spot any trends once they are more than 2+ years old and lease renewals come up.

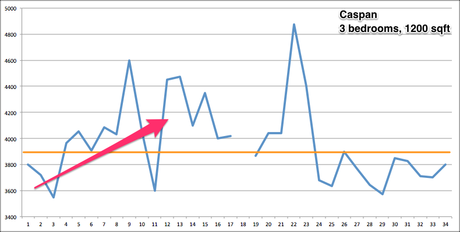

Here are some well known condos we picked to see what trends can be found with initial leases versus renewals.

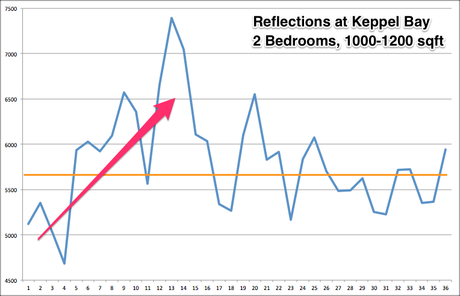

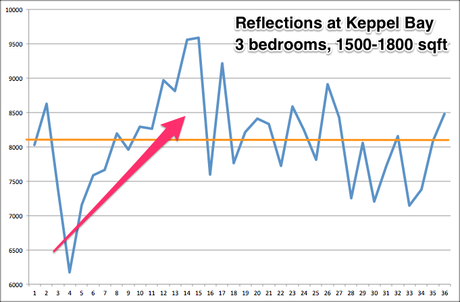

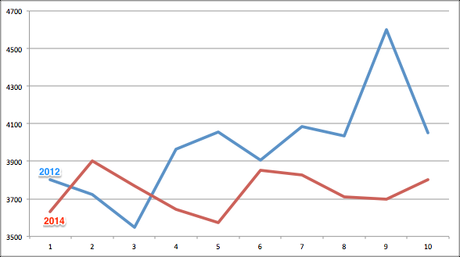

Reflections at Keppel Bay

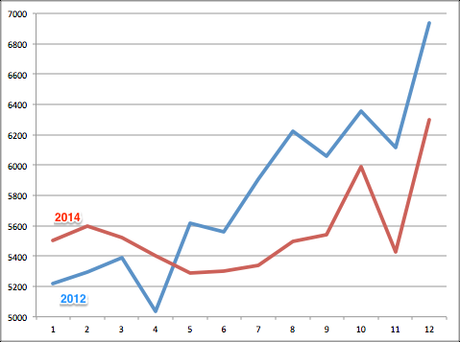

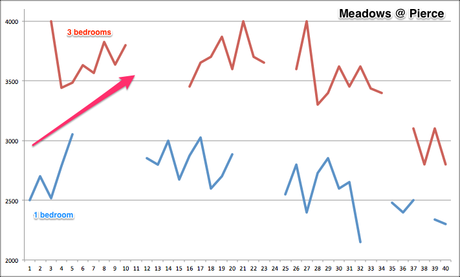

For our final analysis, we looked for another from early 2012, so it would be less impacted by the rental downturn in 2014-2015. For Meadows, we looked at both their 1 bedroom apartments - which leased first - as well as their 1100-1300 square feet apartments that sometimes get classified in URA data as 2 bedrooms and sometimes 3 (we just use label of 3 on our graph):

What's interesting here is to see how the supply of apartments actually stopped after a few months. Still, the same pattern emerged where apartments are priced under average in the first few months before shooting up as availability decreases.

We've only looked in to three condos here, but it seems that the data backs up anecdotes that you really can get a bargain on rent if you move into a new condo in the earliest few months. But also beware - it seems that these new condos may become overpriced for rent once supply decreases. More good news for tenants in both cases though - it would seem that when leases are renewed, the earliest ones did not completely shoot up, meanwhile the most expensive ones did seem to come back down.

If you've already bought a new condo off the plan, or considering it, then this data is very important for you too. It seems clear that a new landlord has a choice: either race against the clock to fill your apartment early for a cheaper price, or hold out longer with no tenant until you can get a better price. In the case of Reflections at Keppel Bay, we saw leases for the same size apartments increase on average by hundreds of dollars a month for the first few months, which would really add up for a 24 month lease - let alone if the tenant stays longer and you don't have to negotiate so much again.

Also, the price at which you rent your condo out can also play an important psychological part if you're actually planning to sell within the first two years - obviously it's easier to get a good sale price for your condo if you can show that you're also getting a good monthly rental. Another factor is that the extra months at the start could give you time to make capital improvements to the apartment that allow both a better rental as well as better sale price in future.

What do you think - have we missed anything?

Rhys Arkins is the founder of Key Location, a website dedicating to giving people better data about renting Singapore condos