Whilst most of Europe were recovering from overindulgence over the Christmas period the US was dealing with a different type of hangover. December the 27th marked the release of the US Conference Board consumer confidence figures which didn’t make for comfortable reading.

The previous day had seen US stock markets rally at record levels, with tech stocks enjoying notable gains across many indexes. This day many will treat as an exception with many believing that markets will conclude this year and begin next year in the bear market territory. While the latest consumer confidence figures won’t have been the sole cause the timing was poignant. Analysts anticipate more choppy waters ahead believing key issues include a slowdown in China, potential of a no-deal Brexit and the FED’s decision to continue with interest rate rises despite the possibility of a trade war with China.

Investors are seeing the financial markets react to the President’s volatility, the US is getting closer to a government shutdown and Trump government officials appear to enter and exit via a revolving door currently. Trump is also believed to have requested a meeting with the FED chair Jerome Powell having recently discovered he is unable to fire him.

US consumer confidence

Consumer confidence fell dramatically in December tumbling to a reading of 128.1 against Novembers revised down 136.4. Analysts had expected the reading to drop to 134.0 but markets were left stunned by the reading which marked the largest consumer confidence drop in over three years. The data sparked a significant sell-off in stock markets, the S&P falling 1.8% by the afternoon trading session and provoking a weakening in the US Dollar, which fell against a basket of currencies.

Beginning of global economic slowdown?

The latest US consumer confidence will only add to the rhetoric that the US and potentially the globe may be approaching a slowdown or recession. Globally trade has slowed which can easily be explained by the tariff increases between the US, China and Europe. Despite a recent truce, a long-term solution doesn’t appear to be imminent.

International consumer confidence has also fallen prompted by falls in global stock markets. As an indicator of prosperity tumbles in stock markets tend to correlate into less spending. Currently despite the recent drop in confidence other fundamentals remain encouraging; the labor market remains strong with US employment growing by 155,000 in November and the unemployment rate falling to just 3.7%.

Manufacturing in the US also remains buoyant with the latest ISM manufacturing data showing growth of 1.6% compared with the previous month. New orders made for very encouraging reading, up 4.7% from the previous month. The panel at the ISM reflecting the continued confidence in the sector with employment also increasing with demand.

US GDP although recently missing the forecast levels is holding strong, highlighting a 3.4% growth over the year.

Despite the encouraging economic data, JP Morgan reported early on in December that they believed they had detected hallmarks that a recession could be looming. JP Morgan stated previously that they believed there was a 35% chance of a recession in 2019. Coincidentally, weaker consumer confidence was one of their key indicators of early stage recession.

US Dollar drops as consumer confidence falls

The fall in US consumer confidence prompted the US Dollar to fall against a host of currencies. The largest USD devaluations were seen against safe haven currencies including the Japanese Yen and Swiss Franc.

The US Dollar falling to 0.9806 against the Swiss Franc, a level last seen in October. Losses continued in the last trading week in 2018 with the pair closing at 0.9845 with the USD clawing back some of its losses.

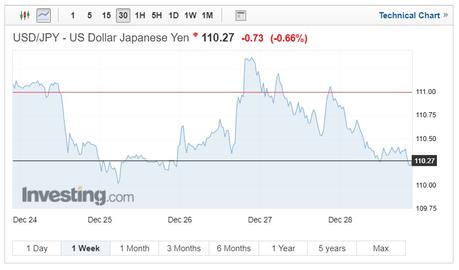

The US Dollar Yen chart depicted a similar story with the USD/JPY pair approaching 4-month lows, touching a week low of 110.02 prior to the US consumer confidence data. Despite a small recover from the Dollar trading on Friday wasn’t kind and saw the US Dollar slip a further 0.66%.

The US Dollar price against the Yen was also harmed by this week’s Chinese data which showed China’s industrial profit dropped for the first time in 2015. Prompting a decline in the USD index.

January is a key acid test

Whilst global economies are currently experiencing a decline much is due to political scenarios rather than hard economic data. Uncertainty provoked by global heads has equated to investors putting their activity on ice. Confidence can be improved especially if the leaders of the two superpowers can ensure the upcoming talks in Beijing on January 7th conclude positively. The 90-day truce reached last time they met showed great resolve and with the two nations seeing corrections in confidence and profits both sides could come together to mutually resolve the current uncertainty they have created. An agreement or genuinely positive rhetoric could work wonders for markets and stocks could rally if both parties suggested the talks were successful.

Now that the Democrats have won back the house political policy should become much more balanced and whilst it appears that Trump remains resolute over his plans for the wall with the government shutdown likely to extend into the new year.