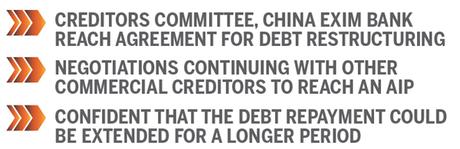

An Agreement in Principle (AIP) was reached with the Official Creditors Committee (OCC) and with the EXIM Bank of China for debt restructuring, while good faith negotiations are continuing with other commercial creditors to reach an AIP at the earliest. We hope this can be done in the next two months,” Central Bank Governor Dr. Nandalal Weerasinghe releasing the “Annual Policy Statement – 2024” at the CBSL Head Office said yesterday.

“We are confident that the debt repayment could be extended for a longer period.” He recalled that as part of the effort to bring down the debt trajectory to a sustainable level, the Government successfully completed the Domestic Debt Optimisation (DDO) operation.

The recovery of the Sri Lankan economy in the near to medium term hinges on the successful continuation of the reform agenda as underpinned by the Extended Fund Facility (EFF) arrangement obtained from the International Monetary Fund (IMF).

Sri Lanka has made notable progress in carrying out reforms that have helped turnaround the negative effects seen in the wake of the economic crisis. He said that an election would be held this year and whoever is elected to lead the country will have to continue with the IMF reform agenda.

Dr.Weerasinghe said that though some say that the COVID impact and lowering of taxes were some of the main reasons for the economic crisis, it was the lack of financial buffers that aggravated the situation last year.”

“Without sufficient financial buffers the country did not have sufficient finances to make essential purchases and provide welfare and to avoid a repeat of this we are now building strong buffers.”

The country now has over US$ 4.4 billion reserves and we are now taking more steps to further increase it, to face any ‘situation’ in the future.”

Such rapid buildup of GOR was primarily due to sizable net forex purchases by the Central Bank, receipt of two tranches under the IMF-EFF arrangement and further financing support extended to the Government by the World Bank and the Asian Development Bank (ADB).

The external current account is expected to record a surplus in 2023, reflecting the impact of a notable improvement in workers’ remittances, the sharp rebound in earnings from tourism and other inflows to the services account, amidst a relatively modest trade deficit due to compressed import activity. The Sri Lankan economy started showing signs of gradual recovery during the latter part of 2023 and he said that this healthy trend would continue.